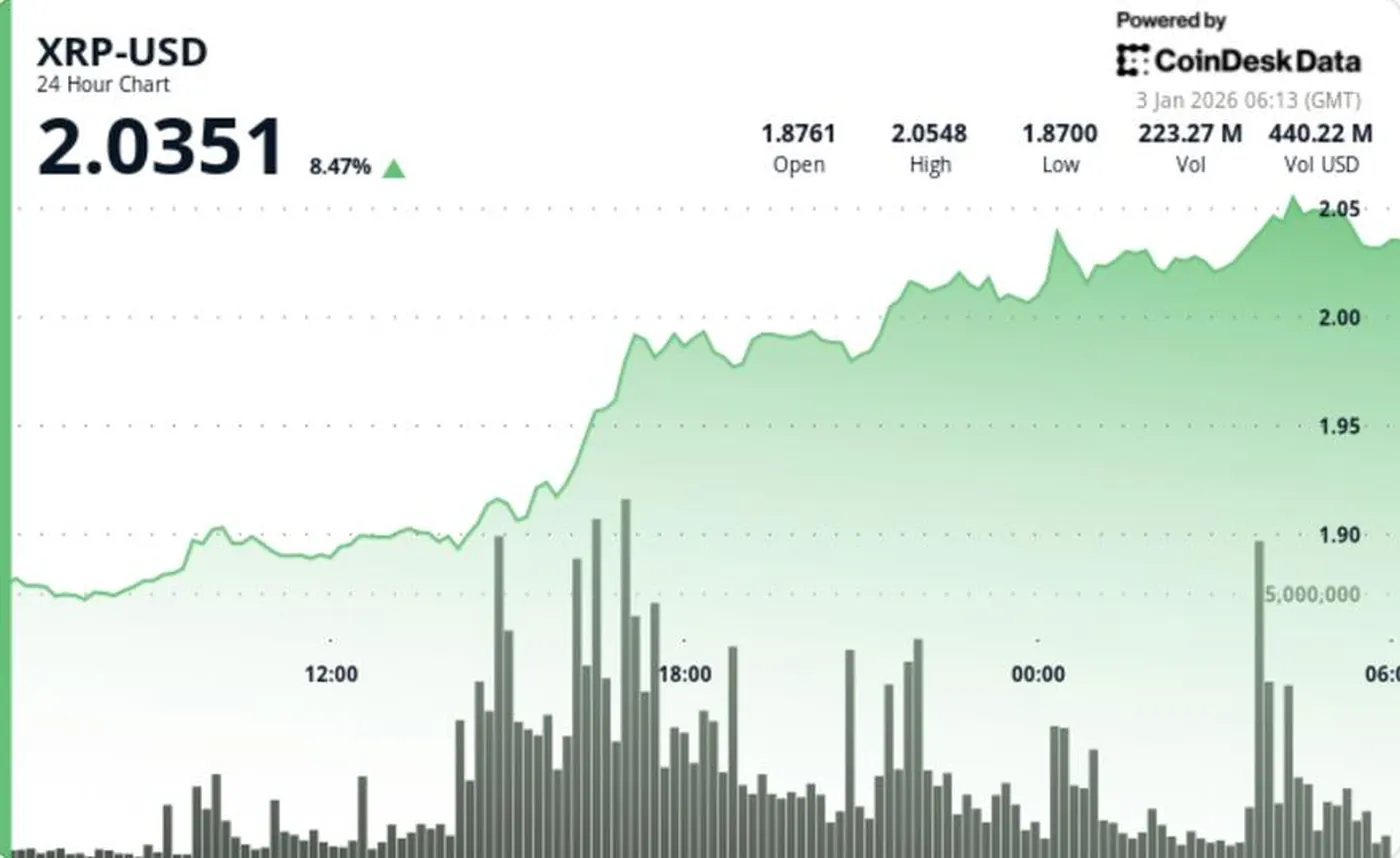

XRP climbed to $2.02 after buyers drove a clean break above the $1.96 level on strong volume, turning that prior ceiling into short-term support. The token gained 8.7%, moving from $1.8766 to $2.0227 over the 24-hour session ending Jan. 3, and traders are watching whether the move can hold above $2.00 long enough to attract further buying. The quality of the breakout — backed by a large volume burst — is the key element market participants will assess in the near term.

XRP Price Surge Overview

The decisive action came as XRP cleared the recurrent $1.96 inflection point and advanced into the $2.00–$2.03 band rather than immediately falling back. The breakout reached $2.02 and was accompanied by sustained participation, which contrasts with prior brief, stop-driven pops around this handle. That sustained activity is why the market is focused on whether the $2.00 level will remain intact after the initial move.

Key Technical Levels

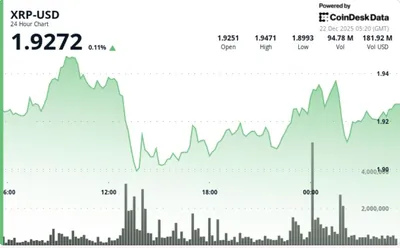

$1.96 stands out as the critical inflection line: clearing it converted the prior resistance into a potential floor and allowed price to push into a higher band. After the advance, XRP established a support pocket near $2.01–$2.03 that traders now treat as the must-hold zone for the breakout to remain credible. For related context on nearby support behavior, see the support $1.87 analysis, which examines how nearby levels have acted in past sessions.

Volume and Market Reaction

The breakout gained traction at 17:00 UTC when volume surged to 154.4M, a sharp increase versus the session average and a key reason the move is viewed as more than a thin spike. Following the high at $2.031, XRP pulled back modestly to about $2.023 on 1.59M in volume; that dip represented a controlled retracement of roughly 0.4% and did not cascade through $2.00. That digestion after the spike is the type of action traders prefer to see after a breakout, as it preserves the structure rather than invalidating it.

Next Steps for XRP

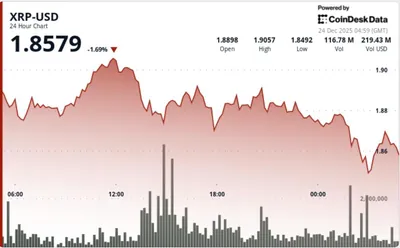

The immediate checklist is straightforward: if the $2.01–$2.03 pocket holds and $2.00 remains intact, the breakout stays valid and the tape can look to build on the move above recent consolidation. Conversely, if $2.00 is lost and price slips under $2.01, the market would likely refocus on $1.96 as the next critical line between a bullish continuation and a return to the prior range. For a broader view of recent trends and technical context, consider the December 2025 overview that reviews preceding consolidation and resistance behavior.

Почему это важно

Для майнера в РФ это движение вряд ли изменит технические параметры майнинга — энергию, оборудование или доходность в хешах это напрямую не затрагивает. При этом рост и формирование поддержки у $2.01–$2.03 влияет на цену активов, которые вы держите, и на вашу готовность фиксировать прибыль или удерживать позицию.

Что делать?

Если у вас есть XRP в портфеле, следите за удержанием зоны $2.01–$2.03 и за сохранением $2.00: удержание этих уровней говорит о вменяемом профиле пробоя и снижает риск быстрой распродажи. Планируйте действия заранее — например, определить уровни фиксации прибыли и стопов относительно $2.00 и $1.96, а также не поддаваться на импульсное усреднение без чёткой точки выхода.