Forecasting XRP’s value from 2026 to 2030 requires a clear baseline and a structured analytical approach. Market data from Q1 2025 shows consolidation among major cryptocurrencies, which many analysts use as the starting point for medium-term scenarios. This review examines the drivers, valuation frameworks and the specific conditions that would be necessary for XRP to reach the widely discussed $5 level.

Introduction to XRP Price Prediction

XRP is positioned as a settlement and bridge asset within several payments-focused use cases, and that role shapes how analysts value it. Price predictions matter to investors and operators because they translate network adoption, regulatory events and liquidity into potential market capitalization outcomes. This piece focuses on the 2026–2030 horizon and the concrete implications of the $5 target given XRP’s current supply dynamics.

Analytical Framework for XRP Price Prediction

A robust forecast combines multiple perspectives: past price behavior, regulatory progress, measurable adoption of settlement products, and broader liquidity conditions. The 2024 resolution of Ripple’s dispute with the U.S. Securities and Exchange Commission is a central input here because it changed the project’s regulatory risk profile and therefore factors into probability-weighted scenarios. In addition, adoption of Ripple’s On-Demand Liquidity (ODL) and institutional partnerships provide observable utility metrics that feed into demand-side estimates; for related discussion on regulatory and market structure, see the ETF regulatory clarity analysis.

Critical Market Drivers and Valuation Models

Several quantitative approaches help convert network effects and utility into price ranges. Metcalfe’s Law-style models tie network value to user or participant counts, while adapted discounted cash flow methods attempt to capture the present value of future settlement savings and fees. Market sentiment and global liquidity conditions also shift valuations, and potential interoperability with central bank digital currencies is often cited as a structural demand multiplier.

The Bank for International Settlements projects growth in the total addressable market for cross-border settlements by the decade’s end, which underpins many bullish scenarios without guaranteeing them. At the same time, competition from alternative settlement rails and changing monetary conditions represent plausible headwinds that must be included in risk scenarios.

Year-by-Year XRP Forecast Analysis: 2026 to 2030

Analysts generally present a range of scenarios rather than single-point forecasts, and those scenarios are conditional on a few core assumptions. These include no major adverse regulatory reversals in primary markets, continued technical reliability and incremental adoption of XRPL-based settlement corridors, and steady global liquidity conditions. Under those assumptions, model outputs for each year differ primarily by adoption pace and macro risk premia.

The Path to $5: Scrutinizing the Milestone

Reaching and sustaining a $5 price requires a market capitalization on the order of $260 billion given XRP’s approximate circulating supply of 52 billion tokens. Achieving that level would imply significant capital inflows and a material share of settlement flows or tokenized asset activity being routed via XRPL. Practical determinants include the proportion of escrowed supply released or retained and the pace at which institutional corridors adopt XRP for settlement; see the escrow update for related supply discussions.

Historical Precedents and Volatility Considerations

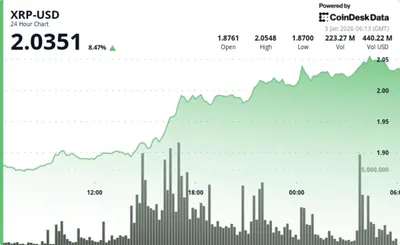

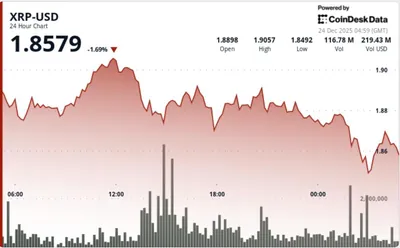

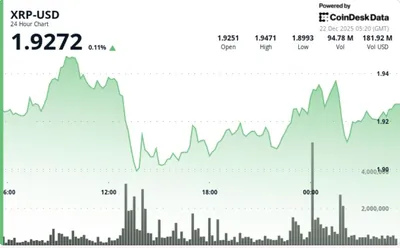

XRP’s all-time high near $3.84 in January 2018 is an important reference point but occurred in a different market environment with distinct liquidity and regulatory expectations. Since then, markets have become more institutionalized and periodic consolidations, such as those reflected in Q1 2025, show that price discovery often occurs in multi-year cycles rather than as smooth growth. Risk models should therefore account for non-linear revaluation phases and potential long consolidations.

Expert Perspectives and Contrasting Viewpoints

Viewpoints diverge on how much of the correspondent-banking and cross-border payments market XRP can capture. Some proponents emphasize XRP’s utility as a bridge currency and potential efficiency gains, while critics point to ongoing pressure from operational sales and competition. Recent industry discussions also highlight tokenization of real-world assets on XRPL as an additional, though uncertain, source of long-term demand; for a broader forecast context see the XRP 2025–2030 forecast.

Почему это важно

Если вы майните в РФ и у вас от одного до тысячи устройств, изменения в цене XRP напрямую не меняют эксплуатационные параметры вашей фермы, однако они влияют на доходность и решения по удержанию или продаже добытого актива. Снижение регуляторной неопределённости после разрешения спора с SEC в 2024 году уменьшает один из главных рисков, который мог бы резко снизить ликвидность и спрос на токен.

При этом период консолидации рынков, зафиксированный в Q1 2025, показывает, что ценовые движения могут быть замедленными и нестабильными одновременно. Это означает, что краткосрочная выручка от майнинга может колебаться независимо от долгосрочных моделей, и операционные решения следует принимать, учитывая как текущую цену, так и потенциальную деноминацию капитала.

Что делать?

- Контролируйте операционные расходы: регулярно сверяйте тарифы на электричество и энергоэффективность оборудования, чтобы сохранять положительный маржинальный доход при волатильности цен.

- Следите за метриками сети: наблюдайте on-chain показатели и реальные внедрения ODL или других решений, которые влияют на утилитарный спрос на XRP.

- Планируйте ликвидность: держите резерв средств на покрытие затрат в периоды консолидации и определите правила фиксации прибыли для разных ценовых сценариев.

- Изучайте вопросы предложения: учитывайте влияние выпуска из escrow и операционных продаж на рыночную ликвидность и принимайте решения с учётом этих факторов.

В заключение, путь XRP к $5 возможен при сочетании регуляторной ясности, увеличения реального применения в расчетах и благоприятных рыночных условиях, но он требует значительной доли рынка расчетов и крупных притоков капитала. Инвесторы и операторы должны опираться на измеримые показатели сети и базовые сценарии, а не на однократные прогнозы.