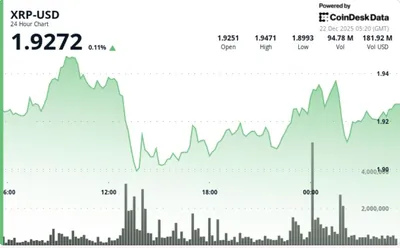

XRP rose above $2 on Friday for the first time since mid-December, extending a strong start to 2026 as traders pointed to steady spot ETF inflows and improving U.S. regulatory sentiment. Data cited by SoSoValue showed U.S. spot XRP ETFs took in $13.59 million on Jan. 2, pushing total inflows since launch to $1.18 billion. The token was last trading just over $2, up around 8%, reflecting rallies driven by ETF demand and policy-related reassessments.

XRP Price Surge Overview

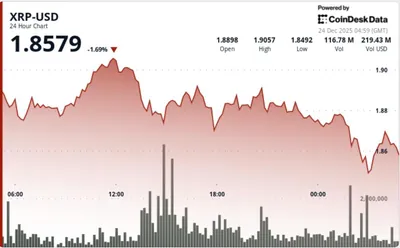

The recent move lifted XRP above the $2 mark and represented an approximately 8% gain on the session, with the token outperforming some peers on the day. That strength stood out while broader crypto benchmarks were relatively muted: bitcoin hovered just over $90,000 and ether traded around $3,000, both only modestly higher. Traders described the rally as being driven more by token-specific catalysts than a broad market risk-on shift.

ETF Inflows and Market Dynamics

According to data cited by SoSoValue, U.S. spot XRP ETFs took in $13.59 million on Jan. 2, bringing total inflows since launch to $1.18 billion. This steady demand has helped tilt near-term supply and demand dynamics in XRP’s favor, providing a tangible liquidity tailwind for the token. For more background on ETF asset trends and how they relate to XRP’s price, see XRP ETF assets in our related coverage.

Regulatory Developments

Market participants also referenced changes at the U.S. Securities and Exchange Commission as a factor in sentiment; the move came after SEC Commissioner Caroline Crenshaw’s departure. Traders pointed to a possible Market Structure Bill markup on Jan. 15, a development that has kept policy expectations elevated into the first quarter. These regulatory shifts contributed to the reassessment of the oversight backdrop and were cited alongside ETF flows as reasons for XRP’s outperformance.

Market Sentiment and Future Outlook

Analysts noted that XRP’s strength came amid mixed flows in other major crypto ETFs, reinforcing the view that its rally was driven by token-specific demand. The combination of steady ETF inflows and a perceived easing of regulatory headwinds helped push XRP higher while broader crypto benchmarks moved only modestly. Traders continue to watch both fund flows and policy signals for clues about near-term momentum.

Why this matters (for a miner in Russia with 1–1000 devices)

If you run mining equipment, the direct impact of an XRP price move is limited unless you hold or trade XRP itself. Still, XRP’s rally signals that ETF demand and regulatory developments can shift sentiment quickly, which in turn can influence liquidity and trading volumes across the crypto market. For miners who price electricity, sell mined coins, or maintain fiat cashflows, episodes of heightened demand or policy-driven rallies can change exchange rates and short-term market conditions.

What to do?

- Monitor core price drivers: keep an eye on ETF inflows and official regulatory updates, since both were cited as drivers of the recent XRP move.

- Watch major coin prices: track bitcoin and ether levels as they influence liquidity and exchange rates for mined coins, given their role as market benchmarks.

- Manage cashflow and sell strategy: consider a staged sell approach or small hedges if sudden token-specific rallies affect your revenue conversion timing.

- Keep operations efficient: audit power costs and equipment uptime, because mining margins depend first on production costs and then on market prices.

- Stay informed on policy dates: note that traders have referenced a possible Market Structure Bill markup on Jan. 15 as relevant to sentiment; follow official sources for confirmations.