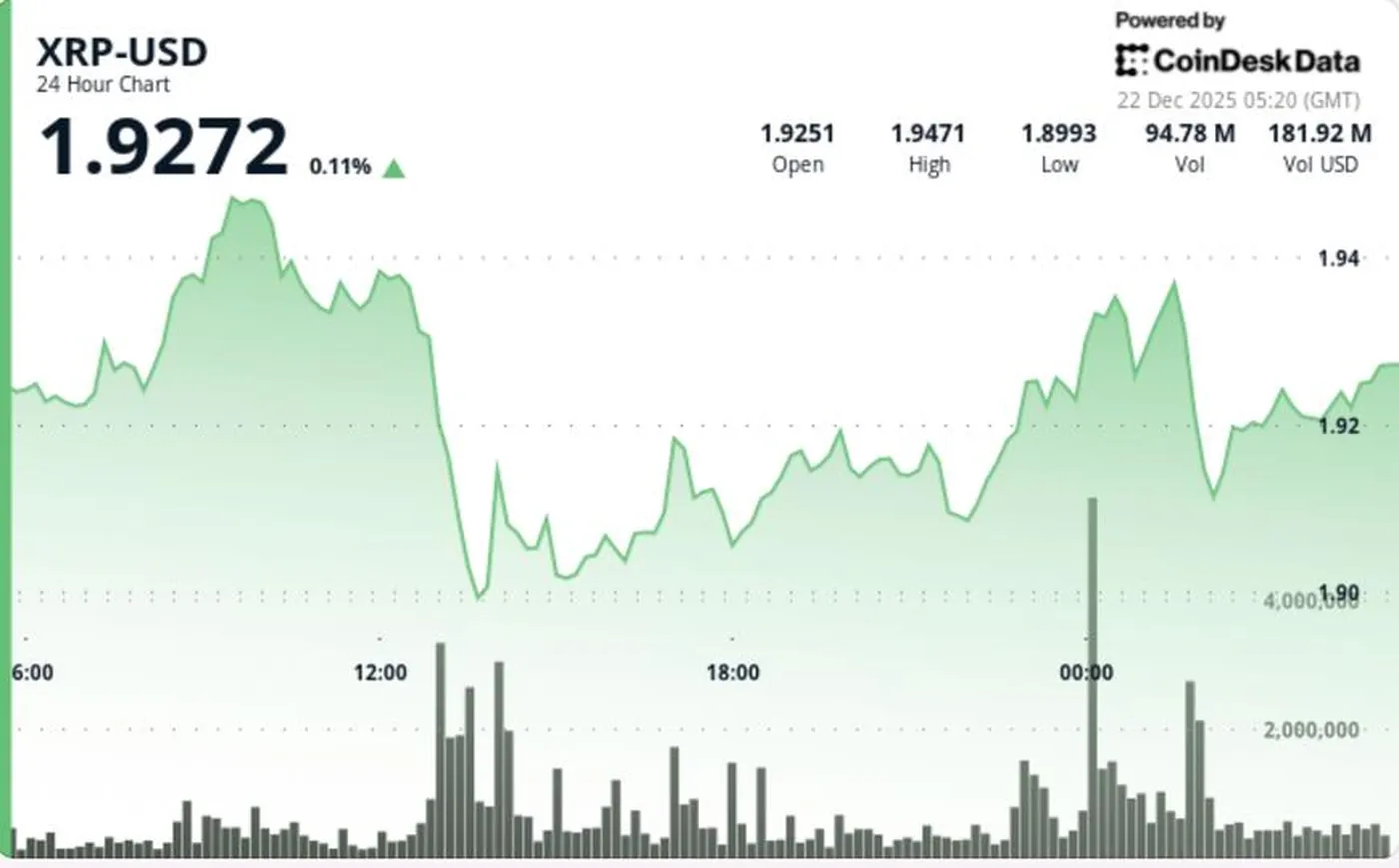

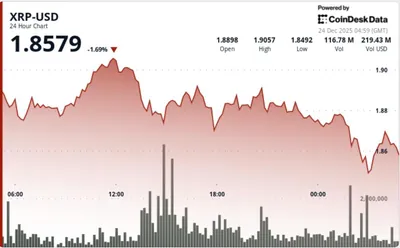

XRP broke down from a multi-day consolidation late Saturday, slipping below the $1.93 support zone as elevated volume confirmed sellers were in control. The most decisive move occurred around 13:00 UTC, when price slid to $1.897 on volume of roughly 93.8 million tokens, a volume spike that reinforced selling pressure. Over the 24-hour period ending Dec. 22 at 02:00 UTC, XRP fell from $1.926 to $1.915, and the failed rebounds left the prior range vulnerable.

XRP Price Breakdown Overview

Through much of the session XRP traded inside a roughly $1.90–$1.95 range before sellers forced a breakdown through the lower bound. The $1.93 area, which had held through multiple tests, gave way during U.S. hours as volume climbed well above recent averages, flipping the zone into resistance. Although broader crypto markets were mixed, repeated attempts to reclaim the $2.00 handle failed to produce sustained follow-through, leaving XRP technically fragile.

Technical Analysis of XRP's Decline

Price momentum deteriorated after the breakdown, with intraday charts showing failure to stay above the short-term moving averages and indicators rolling over. The most decisive intraday move hit $1.897 on roughly 93.8 million tokens traded, about 78% above the 24-hour average, which confirmed active selling rather than thin liquidity. For a fuller technical context, see a related technical overview of XRP's December structure.

Key Price Levels and On-Chain Data

The price action has shifted the immediate landscape: former support near $1.93–$1.95 now acts as a resistance band, while $1.90 is the first level bulls need to hold to prevent further downside. On-chain data from Glassnode highlights that below $1.77 realized supply thins significantly until the $0.80 area, which had previously been a heavy accumulation zone. These levels define where buying interest has concentrated and where demand becomes sparse.

- $1.93–$1.95: now resistance after the breakdown.

- $1.90: first level for bulls to defend to limit follow-through selling.

- $1.77: critical intermediate support; a clean loss would expose thinner demand.

- $0.80: longer-term demand area per Glassnode's realized-supply profile.

Trader Insights and Next Steps

Current setup favors sellers, with rebounds failing to gather momentum and rallies met by increased volume on the sell side. Recovery would require a quick reclaim of $1.93 on rising volume to neutralize the near-term bearish tilt, while failure to defend $1.90 would leave lower supports vulnerable. Traders should also be mindful of concentrated selling dynamics; for context on how large holders can affect price, review coverage of whale pressure on XRP.

Почему это важно

Для майнера в России эта новость прежде всего меняет степень ценовой волатильности, с которой придётся работать: потеря промежуточной поддержки повысила чувствительность цены к продолжению снижения. При этом сообщение не говорит о прямом влиянии на добычу или энергопотребление оборудования, но указывает на повышенный риск снижения цены в кратком сроке. Если вы получаете доход в XRP или храните его, понимание ключевых уровней поможет принять решения по продажам или хеджированию.

Что делать?

Короткие и понятные шаги помогут снизить риски при текущей цене action. Ниже — практические рекомендации, которые можно применить сразу, независимо от размера фермы или числа устройств.

- Установите оповещения на пробой и удержание $1.90 и $1.93, чтобы быстро реагировать на движение цены.

- Следите за объёмом: рост торгового объёма при падении подтверждает активные продажи, а не просто низкую ликвидность.

- Если вы используете стоп-ордеры или планируете продажу, учтите возможную слабую покупательскую базу ниже $1.77 до $0.80.

- Пересмотрите риск-параметры и размеры позиций, особенно если часть затрат на майнинг номинирована в XRP.