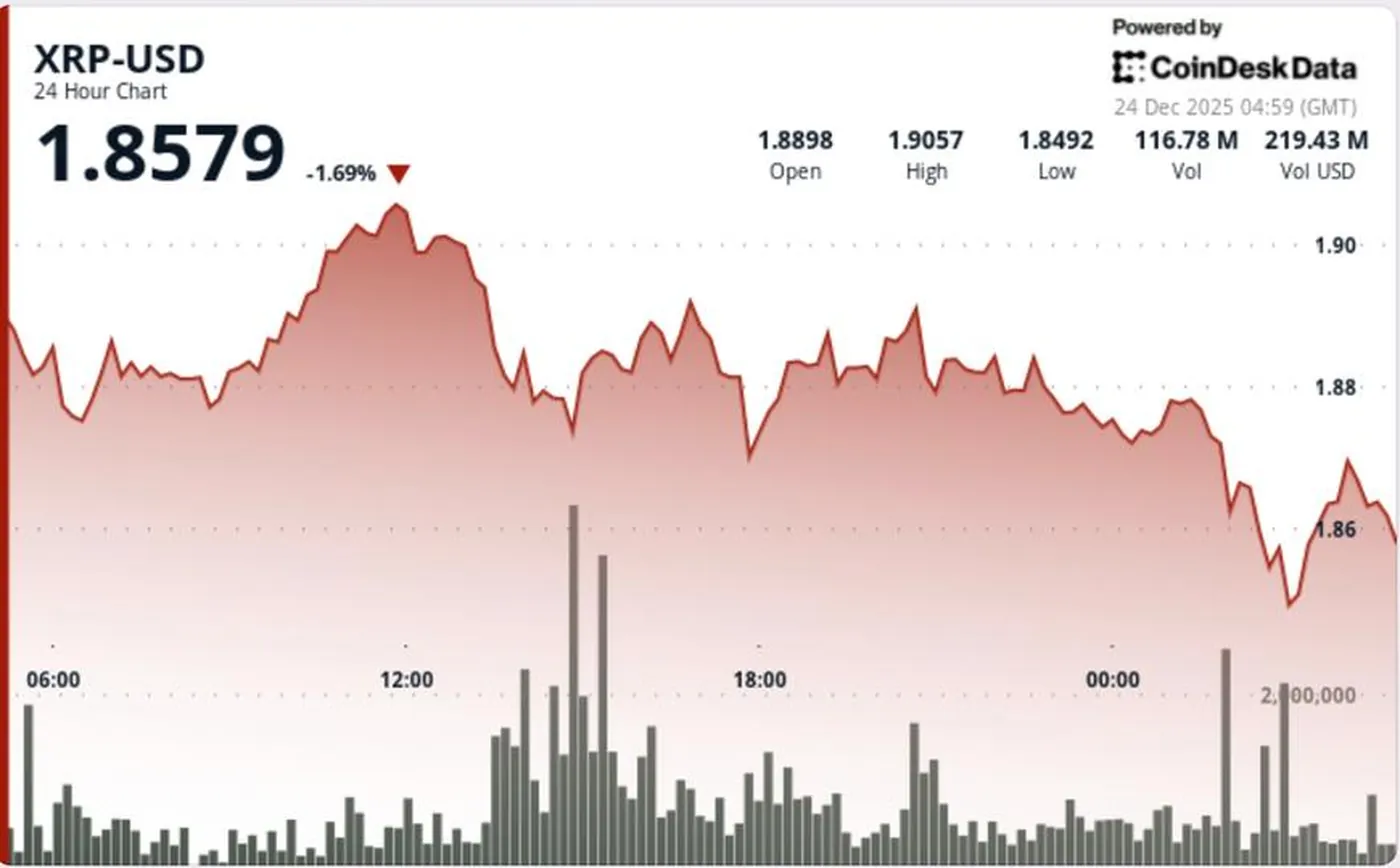

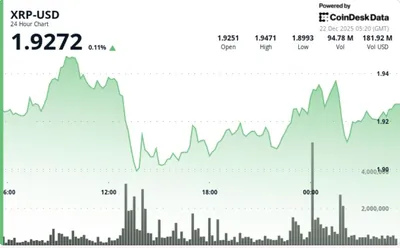

XRP broke short-term support on Wednesday and declined again after bouncing off $1.90, shifting traders' attention to the $1.85 area. Over the past 24 hours, the price fell from $1.8942 to $1.8635, with trading remaining within a narrow $0.0395 range. Volumes indicated that the sell-off was driven by concentrated seller participation, with key levels shaping price behavior.

News Overview

Markets remain volatile and prone to short-term positional decisions, so XRP's movement reflects a general cautious sentiment among participants. Frequent rebounds and returns within the range maintain low conviction in direction, increasing the market's tendency to sell off near obvious resistance. For a more detailed technical breakdown, see the XRP technical review for December.

Technical Analysis

During the session, the $1.8615–$1.8700 zone acted as a working support area, but late selling broke this range and pushed the price into a lower distribution corridor. Local resistance near $1.9061 held at the day's highest volume, indicating seller activity during the rally. The breakdown from about $1.878 to mid-$1.86 was accompanied by repeated volume spikes, including a single impulse of 2.7 million tokens, confirming that the move was driven by flows rather than simple drift.

Key Levels

- Resistance: around $1.9061, where the session's highest volume was recorded.

- Working support: $1.8615–$1.8700 — this band cracked late in the session.

- Near-term decision level: $1.87 — became the pivot between ranges.

Price Movement Summary

Over 24 hours, XRP dropped from $1.8942 to $1.8635, while the trading range remained limited to $0.0395, about 2.1% of the price. Trading volume peaked around 75.3 million tokens during the pullback at $1.9061, nearly double the 24-hour average, indicating active large sellers. A detailed analysis of the causes and context of the decline is available in the article XRP price falls to $1.85, which discusses the nature of the correction.

Why It Matters

For miners, not only prices but also volume characteristics and support level stability are important, as they affect profitability when selling mined coins. Concentrated volumes during pullbacks and breaking of working support suggest that short-term selling pressure may weigh on the price, worsening monetization conditions during periods of high seller activity. Meanwhile, the shift of $1.87 into a decision level shows where to assess the potential for price holding before the next recovery attempt.

What to Do?

- Watch for holding of the $1.87 level: if the price returns and stabilizes above it, this signals reduced pressure on market liquidity.

- Monitor volumes during breakouts: volume spikes on declines confirm large sales, impacting timing and price for selling mined coins.

- Set selling rules and cash reserves: with high volatility, it’s useful to predefine thresholds for partial sales or holding coins.

- Don’t rely on a single scenario: current dynamics support a "sell rallies, buy dips" strategy until volume indicates a sustained breakout.

For deeper insight into how whale pressure may have influenced recent moves, see the note on whale pressure, which discusses the role of large flows in sell-offs. In the short term, key levels remain $1.87 and the $1.8615–$1.8700 range.