XRP exchange reserves on centralized platforms have fallen to their lowest point since 2018, according to the on-chain metrics cited in the source report. Between October 8 and the end of December, balances on exchange wallets declined from roughly 3.76 billion tokens to about 1.6 billion, a drop of over 57% in less than three months. This reduction leaves exchange-held XRP at an eight-year low and has become central to narratives about a potential supply shock.

XRP Exchange Reserves Hit 8-Year Low

Glassnode data reported by Cointelegraph shows a rapid withdrawal of XRP from centralized exchanges over the cited period. Such a fast, large-scale movement away from exchange wallets suggests a shift in holder behavior toward longer-term custody rather than active trading. Historically, when exchange reserves fall to levels not seen in years, market observers treat it as a signal of lower immediate selling pressure.

Implications of the Supply Shock

A supply shock describes a situation where liquid supply tightens while demand remains steady or grows, so the basic scarcity principle may apply to price discovery. For XRP, the change in exchange reserves matters because most of the token’s total supply was created at inception and a large portion is controlled by Ripple in escrow, released on a predictable schedule. The current withdrawal from exchanges therefore changes the short-term liquidity profile without altering the protocol’s issuance mechanics.

Regulatory and Institutional Catalysts

The context around this reserve decline includes improved regulatory clarity after Ripple’s partial legal victory against the SEC, which the source links to reduced institutional overhang. Market interest in a potential spot XRP ETF in the United States is also highlighted as a catalyst that could bring regulated, institutional capital into XRP markets. These factors together form the demand-side narrative paired with the supply-side shift.

2026 Bull Market Thesis

The idea of a structural bull market in 2026 presented in the source rests on a confluence of supply contraction on exchanges and possible demand surges from institutional products like an ETF. The argument combines the exchange-reserve drawdown with the prospect of new, regulated inflows to form a thesis for stronger price performance if those demand catalysts materialize. This is a conditional, multi-factor view rather than a single-data-point prediction.

Risks and Considerations

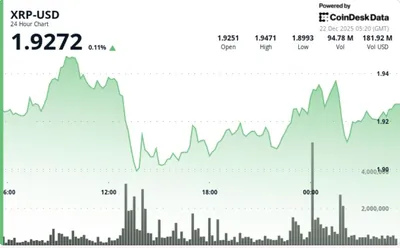

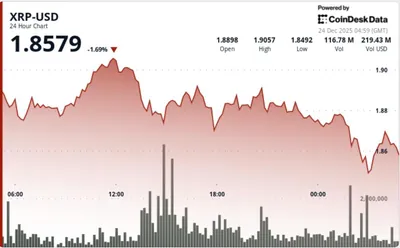

Despite the optimistic narrative, the source notes several caveats. The bullish case depends materially on external developments such as ETF approval and sustained regulatory clarity, and markets remain volatile and sensitive to broader conditions. Technical analysts cited a $1.78 support level as a key area to monitor; holding above that level is presented as one indicator of a firm market structure, while failing it could imply renewed weakness.

Why this matters

For a miner operating in Russia with between one and a thousand devices, the direct operational impact of lower XRP exchange reserves is limited: mining hardware and energy costs are unchanged, and XRP is not mined. However, market dynamics that reduce liquid supply can change token volatility and trading behavior, which may affect liquidity if you accept XRP as payment or trade mined proceeds. If institutional demand increases as the source suggests, that can affect on-ramps and exchange liquidity over time, indirectly influencing how easily you convert holdings to fiat.

What to do?

If you mine or receive crypto in Russia and follow XRP developments, consider simple, practical steps to manage risk and liquidity. First, keep liquidity needs separate from long-term holdings: decide what portion of any XRP you hold should remain available for operational costs versus longer-term storage. Second, review custody and withdrawal processes so you can move assets off exchanges if you prefer self-custody and want to reduce counterparty exposure. Third, monitor technical levels and regulatory news to time conversions or sales in line with your cash-flow needs.

Concrete actions to consider:

- Set a clear liquidity buffer in fiat or stablecoins to cover short-term expenses and avoid forced sales during volatile periods.

- Use secure personal or institutional custody solutions if you plan to hold XRP long term rather than leaving funds on exchanges.

- Follow key technical levels and regulatory updates — they can inform whether to convert mined proceeds now or hold for potential market changes.

For broader context on market forces and forecasts, see the XRP 2026 forecast, and related discussions of how whale activity affects price in whale selling. For technical price levels and nearer-term outlook, consult the price and forecast coverage.