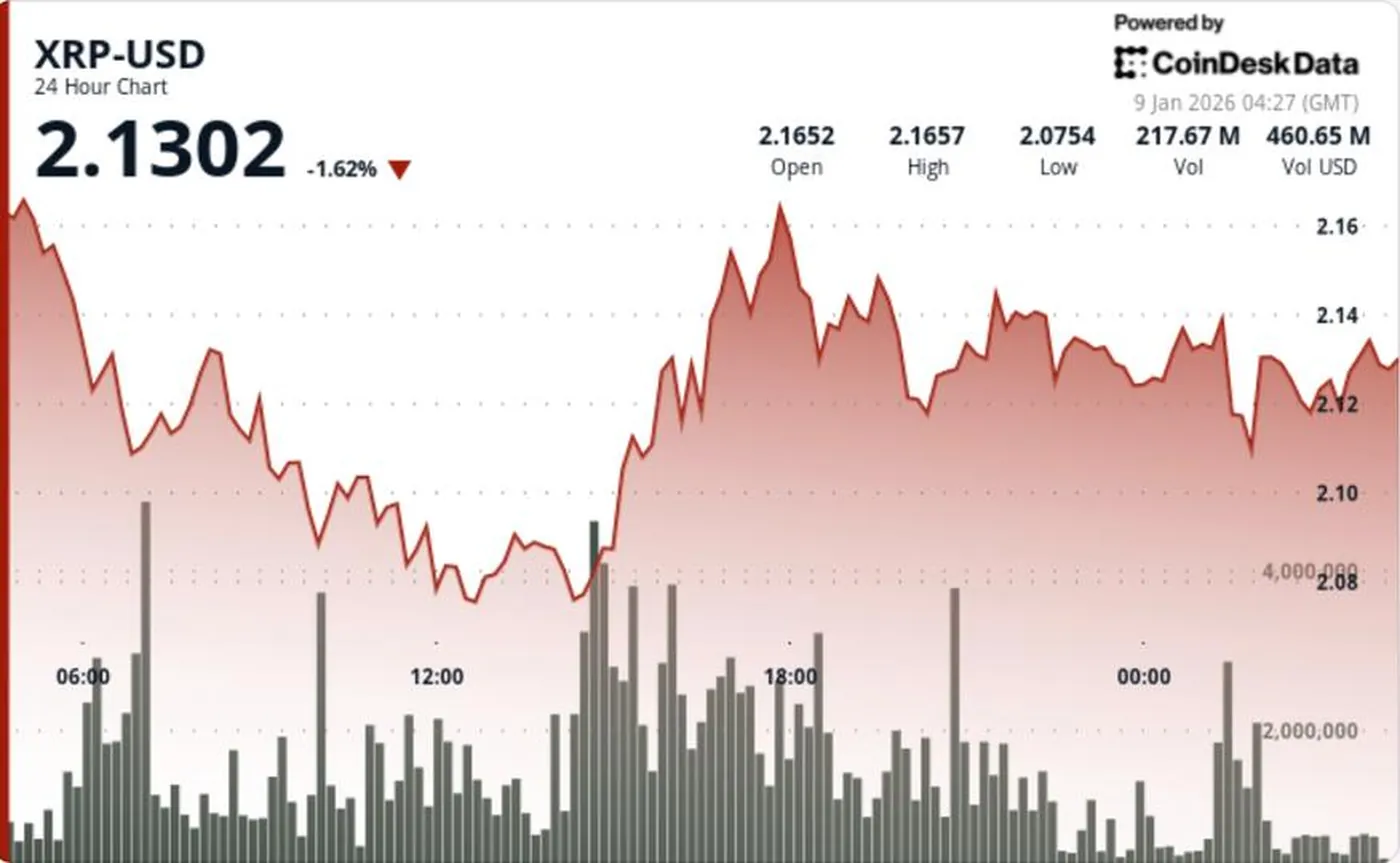

XRP eased to $2.12 after a rare two-sided liquidation sequence on Binance Futures that removed leverage from both directions. The move left the spot price confined to a $2.07–$2.17 range as traders waited for a fresh catalyst to break consolidation. Over the 24-hour period ending Jan. 9 at 02:00, XRP fell 2.3%, sliding from $2.17 to $2.12.

XRP Price Movement Overview

The recent price action was driven by a rapid reset of leverage, which pushed XRP back toward the middle of its range. Spot traded between $2.07 and $2.17 as participants absorbed the liquidation-driven flow and held off on directional bets. For background on the earlier upside move and its implications, see the breakout above $2.12 coverage that tracked the run toward higher levels.

Liquidations Impact on XRP

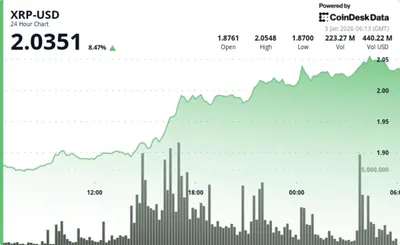

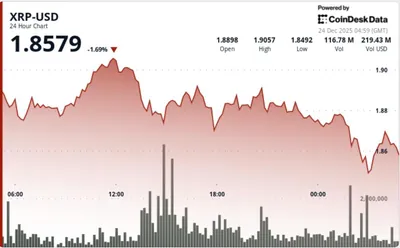

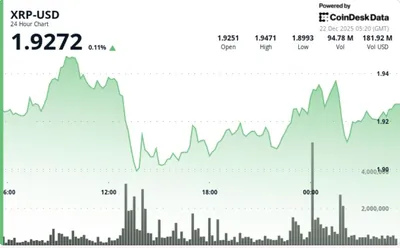

Binance Futures recorded roughly $4.4 million in short liquidations on Jan. 5, when XRP spiked toward higher intraday levels and forced late sellers to cover. The next day the market reversed and triggered about $5.5 million in long liquidations, including roughly $1 million see-through on Binance, which pressured breakout chasers and pulled price back into the center of the range. That two-sided cascade removed excess leverage but also signalled market uncertainty rather than a clean directional conviction.

Institutional Interest in XRP

Separately from short-term price moves, Evernorth — an XRP digital asset treasury company supported by Ripple and SBI Holdings — said it has entered a strategic collaboration with Doppler Finance to explore institutional liquidity and treasury use cases on the XRP Ledger (XRPL). The initiative is described as an exploratory phase focused on frameworks for structured liquidity and treasury management rather than a product launch. These infrastructure developments add a longer-term context, even while near-term trading remains derivatives-led.

Technical Analysis Insights

The clearest technical outline is a defended demand band around $2.07–$2.08 and supply near $2.17, keeping price trapped inside the stated range. Volume spiked sharply at 14:00 on Jan. 8, with 154.85 million XRP changing hands, which coincided with a move to the lower bound and a quick rebound on sustained activity. Overall the tape looks like a post-liquidation reset: reactive, mean-reverting and awaiting a fresh impulse to break the range.

Why this matters

For market participants, the recent liquidation sequences mean a lot of leverage was removed in a short period, which can reduce the chance of immediate cascading moves driven by futures stops. At the same time, two-sided liquidations reflect uncertainty: the market is searching for direction and is likely to remain sensitive to leverage flows and short-term impulses. Institutional moves on the XRPL provide a separate, longer-horizon narrative, but they do not change the current derivatives-driven character of price action.

What to do?

If you run mining equipment or manage a small to mid-size operation, focus on short, practical steps that suit your risk tolerance and scale of operations. Keep actions simple, prioritizing capital and operational stability while the market consolidates.

- Monitor the $2.07–$2.17 range and set automatic sell or stop thresholds aligned with your risk rules to avoid forced exits during sudden liquidations.

- Track Binance Futures liquidation events and intraday volume spikes as indicators of leverage-driven moves that can affect short-term price swings.

- Adjust power usage and batch mining schedules when volatility spikes to control operating costs without making reactive market-timing decisions.

- Follow institutional developments such as the Evernorth–Doppler collaboration to gauge longer-term liquidity and infrastructure trends on the XRPL.

For a broader view of current market indicators and near-term conclusions, see our update on current indicators. Staying disciplined on risk and costs is the most reliable approach while XRP remains in a post-liquidation consolidation.