The launch of U.S. spot XRP ETFs has brought roughly $1.2 billion of net inflows since they debuted on November 13, signalling notable institutional demand for regulated exposure to XRP. Despite this capital, XRP’s market price has not followed suit, creating a gap between fund flows and token performance that market participants are still unpacking.

Introduction to XRP Spot ETFs and Their Impact

Spot ETFs that hold XRP offer investors a way to track the token’s price without direct custody, and the initial capital moving into these funds underlines institutional interest in the asset class. Still, inflows into ETFs are only one part of the picture; prices in the spot market reflect many other forces that can offset fund demand.

Driving Forces Behind XRP ETF Inflows

Institutional confidence and the appeal of regulated products appear to be primary reasons for the rapid inflows into XRP spot ETFs. Investors seeking exposure beyond Bitcoin and Ethereum are using these ETFs to gain access to XRP within familiar fund structures, which helps explain the concentrated capital movement into the new products.

Leading XRP ETF Providers

The ETF market for XRP is competitive, with several issuers attracting assets under management and investor attention. As of the latest reports, the Canary spot XRP ETF is the largest player, holding around $335 million in AUM, a sign of its early traction among issuers and institutional buyers.

Why XRP Price Remains Below $2

The most immediate reasons cited for the token’s muted price action are selling pressure from large holders and broader volatility across cryptocurrency markets. In practice, ETF purchases can be partially counterbalanced by outsized sell orders or swings in sentiment that affect all digital assets, limiting a clear price response to inflows.

The Need for XRP’s Unique Narrative

Observers argue that for XRP to sustain long-term price gains it needs a stronger, distinct narrative tied to real-world utility rather than merely moving with Bitcoin. Emphasizing XRP’s role in payments and banking solutions would help differentiate it and potentially support more durable investor conviction over time.

Future Outlook for XRP and Its Spot ETFs

The $1.2 billion in ETF inflows establishes a foundation of institutional interest, but the disconnect between those flows and retail market prices suggests further dynamics will determine the next phase. Continued growth in ETFs will likely depend on adoption, demonstrable utility, and how selling pressure and market volatility evolve.

Why this matters

For miners and small operators in Russia managing between one and a thousand devices, ETF inflows can signal institutional confidence that may support broader infrastructure and service development. However, because ETF activity does not automatically raise spot prices, your immediate mining revenue and decision-making are more directly affected by selling pressure and market swings than by fund flows alone.

What to do?

If you run mining equipment, focus first on cost control and risk management rather than expecting ETF inflows to lift prices in the short term. Keep an eye on buying and selling patterns in the spot market and consider diversifying exposure or hedging if you rely on XRP price levels for operational decisions.

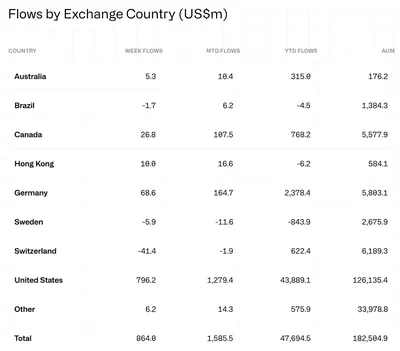

For context on institutional flows in related products, compare developments in the Bitcoin ETF space, for example Spot Bitcoin ETF inflows, and how ETFs for other major coins have experienced changing flows over time, such as trends across Bitcoin and Ether ETFs. These comparisons help frame why ETF inflows do not always translate directly into higher spot prices.