New analysis shows an increase in sales from large XRP holders, hindering a short-term price recovery. Data indicates that the majority of tokens flowing into major exchanges come from large wallets, which increases market supply. At the same time, the analyst highlights a critical support zone, and amid massive whale transfers, any positive news may be insufficient to trigger a price rebound.

What Is Whale Selling Pressure on XRP?

Whale selling pressure refers to situations where large holders transfer coins en masse to exchanges intending to sell. In XRP's case, such transfers raise the available supply on trading platforms, creating an imbalance between sales and demand. Regular large inflows to exchanges often signal to market participants that sellers are ready to liquidate positions.

Data Analysis: XRP Flows to Exchanges

According to data cited in the CryptoQuant analysis and shared by PelinayPA, most XRP entering Binance and similar platforms originates from massive wallets. These holders range from 100,000 to one million XRP, as well as those holding over one million tokens. This pattern confirms that current flows are driven by large holders rather than retail investors.

Such large transfers typically increase supply liquidity and exert downward pressure on price if demand does not rise correspondingly. For more detailed technical context and support levels, see our XRP price technical review, which explores possible price movement scenarios.

Potential Price Impact and Support Levels

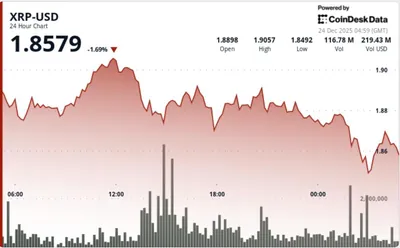

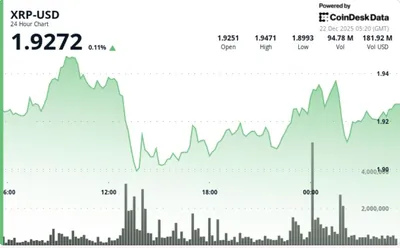

The analysis identifies a primary support zone between $1.82 and $1.87 and warns that if mass transfers continue, this area may fail to hold the price. Should selling pressure persist, the next likely target range is $1.50–$1.66. These levels reflect the current demand and supply structure documented in the analysis.

As long as large coin inflows to exchanges persist, chances for a sustainable recovery remain limited: the market must either quickly find buyers or see selling decrease to restore bullish balance.

ETF and the Reality of Whale Selling

On one hand, approval of a US spot ETF is seen as a potential source of institutional capital and increased demand for XRP. On the other hand, the current fund distribution and massive large-wallet transfers exert opposing pressure. The key question remains timing — whether institutional investor inflows will coincide with a reduction in whale selling.

If you’re interested in institutional flows and their market impact, check out the article on ETFs and related dynamics discussing capital inflows and outflows in the crypto sector: ETF and Capital Inflows.

Why This Matters

For miners with 1–1000 devices living in Russia, direct impact from whale selling on mining is limited: XRP is not mined, and you don’t receive XRP as mining income. However, market volatility affects the value of crypto assets you handle when converting earnings to fiat or purchasing equipment. Sharp price swings worsen conditions for quick monetization and increase the risk of losses when selling at unfavorable times.

Additionally, intensified whale selling can reduce liquidity in trading pairs and increase slippage on large orders. This is important to consider when planning reward conversions or reinvestments in hardware and capacity.

What to Do?

Actions depend on your position and goals, but there are practical steps to reduce risk amid high whale pressure. First, closely monitor exchange inflows: a sustained decline in deposits will be the first sign of easing selling.

- Regularly check exchange flow data and incoming transfers from large wallets.

- Plan fiat conversions of earnings considering possible volatility and slippage — break large orders into smaller parts.

- Set risk management rules: stop orders, target sell levels, and reserves for unexpected expenses.

- Keep information on key support levels ($1.82–$1.87 and $1.50–$1.66) handy and update your action plan when these are tested.

FAQ

What is causing the current whale selling pressure on XRP? Pressure mainly comes from large wallets holding between 100,000 and over 1,000,000 XRP; these coins are transferred to exchanges like Binance, usually signaling an intent to sell.

Can approval of a spot ETF stop the price decline? ETF approval could attract institutional demand and capital, but if whale selling continues, the ETF’s effect may not offset the current supply increase until inflows materialize.

Which levels are important to watch? The analysis highlights support between $1.82 and $1.87 as primary, with $1.50–$1.66 as the next target range if selling persists.

How to track whale activity? It’s recommended to monitor on-chain data and exchange flows via platforms like CryptoQuant; a sustained decline in exchange deposits indicates easing pressure.

Is it a good time to buy XRP? The decision depends on your strategy and time horizon. The analysis advises caution short-term due to selling pressure, while long-term investors might view the dip as an opportunity if prepared for volatility.