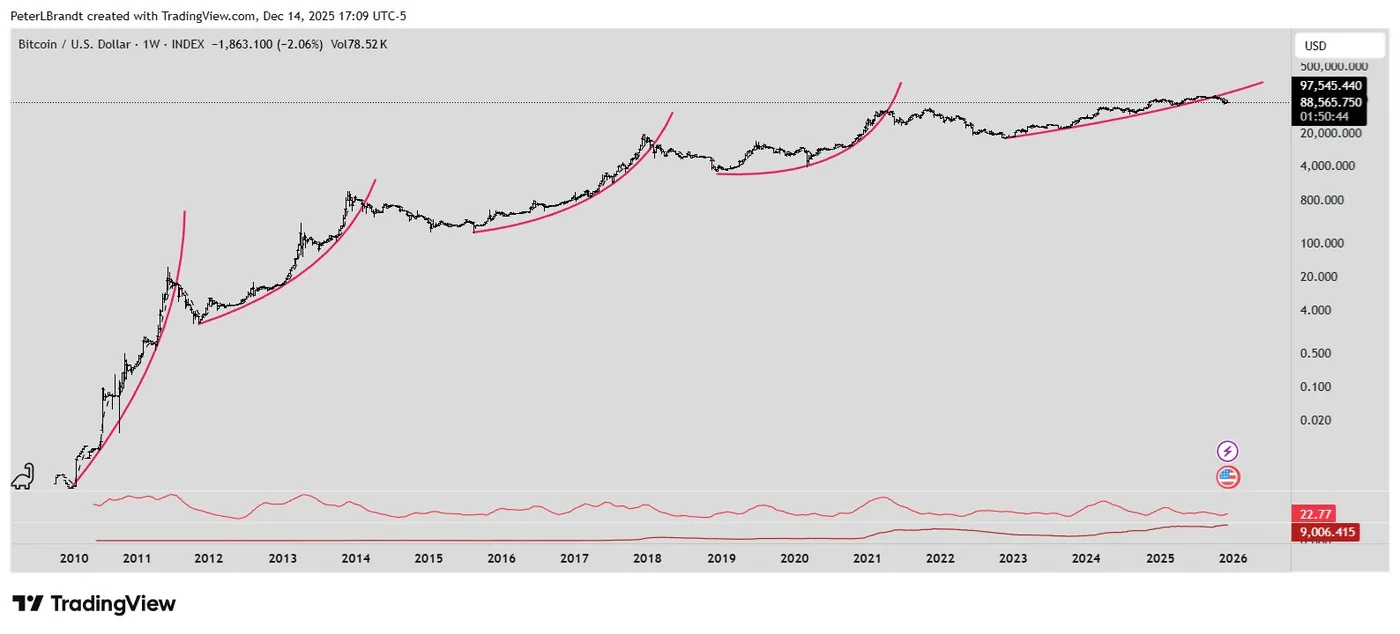

Bitcoin's price recently broke below its parabolic trendline, a technical indicator that veteran trader Peter Brandt identifies as a warning sign for substantial price corrections. This breakdown marks a departure from the previous upward trajectory and signals a period of increased downside volatility based on historical patterns.

Bitcoin's Parabolic Breakdown and Historical Context

The parabolic trendline represents an accelerating price increase often seen during Bitcoin bull markets. Peter Brandt highlights that in prior cycles, once Bitcoin violated this parabolic advance, it entered extended corrective phases with price declines reaching up to 80% from cycle highs. Currently, Bitcoin has already fallen about 20% from its all-time peak, indicating the parabolic structure has failed. If history repeats, this could lead to a further drop toward the $25,000 price range within the coming months. See also: Bank of Japan Rate Hike May Push Bitcoin Below $70,000, Say Analysts

Macroeconomic Factors Influencing Bitcoin Price

Alongside technical signals, macroeconomic conditions are exerting additional pressure on Bitcoin's price. Markets, including Polymarket, assign a 97% probability to a Bank of Japan interest rate hike of 0.25% scheduled for December 19, 2025. Historically, such rate increases by the BOJ have tightened global funding conditions, causing leveraged positions to unwind and negatively impacting risk assets like Bitcoin. Previous BOJ hikes corresponded with Bitcoin price drops of approximately 27% in March 2024, 30% in July 2024, and another 30% in January 2025, underscoring the potential for further downside volatility. See also: Luke Gromen Turns Bearish on Bitcoin: Warns of $40K Risk in 2026

Evolving Market Structure and Demand for Bitcoin

Despite these bearish technical and macroeconomic indicators, Bitcoin's market dynamics have evolved significantly. Data from Glassnode reveals that corporate Bitcoin treasuries have surged from about 197,000 BTC in January 2023 to over 1.08 million BTC currently, marking a 448% increase. This shift reflects Bitcoin's transition from a speculative asset to a strategic balance-sheet holding. Additionally, the supply held by long-term investors remains high, and the introduction of spot ETF products has brought more stable institutional inflows. These factors may help absorb future market shocks, potentially resulting in less severe drawdowns compared to past cycles. See also: Bitcoin Price Prediction: Analyst Warns of Possible $80K Retest Amid Market Turbulence

Summary and Market Outlook

While Bitcoin's breach of its parabolic trendline signals a heightened risk of a significant correction, the strengthened demand from corporate and institutional holders offers a counterbalance. The interplay between technical bearish signals and evolving market fundamentals suggests that upcoming price movements could be volatile but may not replicate the full extent of previous downturns. Miners and investors should approach the market with caution, considering both the potential for further declines and the mitigating effects of increased strategic adoption.

This article is for informational purposes only and does not constitute investment advice. All trading and investment decisions involve risk, and readers should conduct their own research before acting.