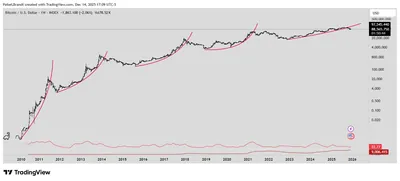

Bitcoin has historically followed a four-year cycle closely tied to its halving events, with prices typically reaching a peak 12 to 18 months after each halving before entering a prolonged bear market. In line with this pattern, Bitcoin reached a high near $126,200 in October 2025, exactly eighteen months after the April 2024 halving, before experiencing a decline exceeding 30%.

Overview of Bitcoin's Traditional Four-Year Cycle

This cyclical behavior has been a defining characteristic of Bitcoin's market dynamics. The October 2025 peak and subsequent price drop align with previous cycles where a bull market phase is followed by a bearish correction. Such patterns have historically provided a framework for anticipating market movements based on halving timelines.

Indicators Suggesting a Bearish Phase

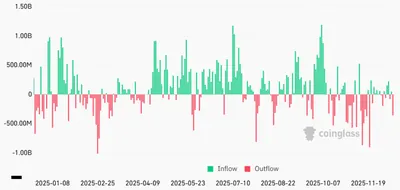

Supporting the notion of a bearish phase, veteran analyst Peter Brandt has forecasted that Bitcoin's price could fall toward $25,000 in the coming months. Additionally, the Spent Output Profit Ratio (SOPR), a metric that tracks whether Bitcoin is being sold at a profit or loss, has been trending lower as of December 2025. This trend indicates that Bitcoin holders are spending coins at smaller profits or even losses, a behavior typically observed near market bottoms and signaling increased selling pressure.

Arguments for a Changing Bitcoin Cycle

Despite these bearish signals, some experts argue that Bitcoin's traditional four-year cycle may be evolving. Grayscale Investments has predicted that Bitcoin's price could reach a new all-time high in the first half of 2026, citing growing macroeconomic demand driven by currency debasement and a supportive regulatory environment in the United States. Similarly, Fidelity has expressed optimism about Bitcoin entering a "supercycle" akin to the commodity supercycles of the 2000s, which lasted nearly a decade. This outlook is bolstered by the emergence of a new class of investors who may sustain longer market expansions.

Impact of ETFs and Corporate Treasuries on Bitcoin Market Dynamics

The dynamics of Bitcoin's market are also being influenced by substantial holdings from institutional investors. As of December 2025, US Bitcoin ETFs backed by firms such as BlackRock and Fidelity collectively held over 1.30 million BTC, valued at approximately $114.13 billion. At the same time, public companies maintained treasuries containing over 1.08 million BTC, worth about $100.42 billion. These significant reserves suggest that new investor classes and institutional demand are reshaping the traditional boom-and-bust cycles historically associated with Bitcoin.

Expert Opinions and Market Outlook

Chris Kuiper, Vice President of Research at Fidelity Digital Assets, highlighted the role of an "entirely new cohort and class of investors" in potentially supporting a longer market expansion than seen in previous cycles. While the market remains uncertain with possibilities for both bearish and bullish outcomes, these developments suggest that Bitcoin's price behavior may be entering a new phase. Investors are advised to conduct thorough research and consider market risks carefully when making decisions.

Why This Matters

For miners operating in Russia with up to a thousand devices, understanding these market shifts is crucial. The traditional four-year cycle has guided expectations for price movements and profitability. However, the growing influence of ETFs and corporate holdings may alter these patterns, affecting Bitcoin's price stability and mining returns. Awareness of bearish indicators like the SOPR metric can help miners anticipate potential downturns, while recognizing bullish forecasts may inform strategic planning.

What Should Miners Do?

- Monitor key metrics such as SOPR to gauge market sentiment and potential price trends.

- Stay informed about institutional movements and regulatory developments that could impact Bitcoin demand.

- Consider the possibility of extended market expansions or supercycles when planning mining operations and investments.

- Maintain flexibility to adjust strategies in response to both bearish and bullish market signals.