The CryptoQuant Bitcoin demand slowdown bear market signal appears in a new analysis from on-chain analytics firm CryptoQuant, published in CryptoQuant’s Friday report. The report highlights that the surge in spot Bitcoin demand "has fallen below its upward trendline since early October," a change the firm views as meaningful for market dynamics. CryptoQuant also states that "accumulation demand for the current cycle has likely been absorbed," which the report links to weakening institutional participation and softer derivatives sentiment. Below we summarise what CryptoQuant reported, why it matters, and what miners and investors can do next.

What CryptoQuant reported

CryptoQuant, an on-chain analytics firm, presented these findings in CryptoQuant’s Friday report and grounded them in several measurable on-chain signals. The core observation is that spot demand momentum "has fallen below its upward trendline since early October," which indicates the recent buying surge no longer follows its prior trajectory. The firm draws on exchange inflows and outflows, wallet movements of large holders, and accumulation patterns by institutions and companies to form this view.

Why slowing Bitcoin demand matters

According to CryptoQuant, when "accumulation demand for the current cycle has likely been absorbed," the implicit price support provided by buyers can weaken, removing a stabilising factor during sell-offs. The report also notes that demand from institutions and large-scale investors has entered a contraction phase, and this retreat by large holders can reduce liquidity and increase volatility. At the same time, CryptoQuant finds that risk appetite in the derivatives market is weakening, which often accompanies shorter-term cautiousness among traders and can amplify downward moves.

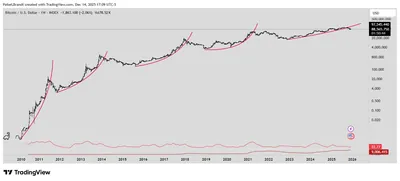

Historical patterns and bear-market signals

CryptoQuant points out a historical pattern where a bear market often follows when demand growth peaks and reverses, making demand-side indicators particularly relevant regardless of supply dynamics. Past cryptocurrency bear markets have varied from several months to over a year, and notably, "The 2018 bear market lasted approximately 12 months." These historical notes are presented as context rather than deterministic forecasts.

Practical takeaways for miners and small operators

For miners operating between one and a thousand devices inside Russia, the CryptoQuant findings are useful signals to monitor but not automatic triggers for a single action. Slower demand can mean wider price swings and potentially lower gross margins; therefore, understanding on-chain flows and large-holder behaviour helps you anticipate periods of greater price instability. Keep in mind that CryptoQuant provides data analysis rather than predictions, so combine these signals with your operational and cost considerations.

What to monitor right now

- Exchange inflows and outflows: watch for sustained net inflows to exchanges, which can precede selling pressure.

- Large-wallet movements and institutional accumulation: changes in large-holder balances often foreshadow shifts in market liquidity.

- Derivatives sentiment and funding rates: weakening risk appetite in derivatives can signal shorter-term caution among traders.

Also consider reading related coverage on broader market conditions, such as changes in spot trading volumes and pieces that place demand signals in a wider correction context like this market correction analysis. These linked reports can help connect CryptoQuant’s on-chain signals with observable market behaviour and liquidity shifts.

What to do?

If you run a small to mid-size mining setup, prioritise simple risk-management steps rather than attempting to time the market. Review your operating breakeven, ensure contingency for prolonged price pressure, and avoid concentrated exposure if you rely on coin sales to cover immediate costs. Diversify information sources and treat CryptoQuant’s data as one input among exchange metrics, price action, and your own cost model.

Practical steps include setting predefined sell rules based on your cost structure, keeping a short list of on-chain metrics to check regularly, and preparing for higher volatility in daily revenue. If you use automated sell or hedging strategies, test them against recent scenarios rather than changing them solely on one report. Finally, remember this is analysis, not financial advice: consider independent research or professional consultation before making major decisions.

FAQ

What does CryptoQuant measure to determine demand?

CryptoQuant analyses on-chain data including exchange inflows and outflows, wallet movements of large holders, and accumulation patterns by institutions and companies. These metrics are used to estimate buying pressure versus selling activity and to detect shifts in demand concentration.

How long do bear markets typically last?

Historical bear markets in cryptocurrency have varied from several months to over a year. For example, the report notes that "The 2018 bear market lasted approximately 12 months." Each cycle differs, so duration alone is not a reliable timing tool.

How reliable is CryptoQuant?

CryptoQuant provides data analysis rather than predictions. Its value comes from interpreting on-chain metrics that reflect actual market behaviour, but such analysis should be considered alongside other market factors and perspectives.

Should I sell based on this report?

Investment and operational decisions should depend on your individual financial situation, risk tolerance, and time horizon. The CryptoQuant report offers important signals but is one of many inputs; consider reviewing your cost structure and risk controls before altering a long-term plan.

Disclaimer: This content is not trading or financial advice. Conduct independent research or consult a qualified professional before making investment decisions.