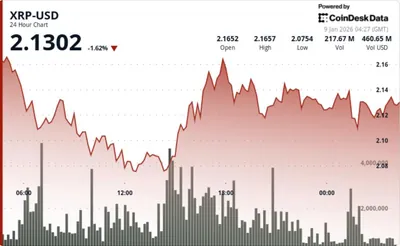

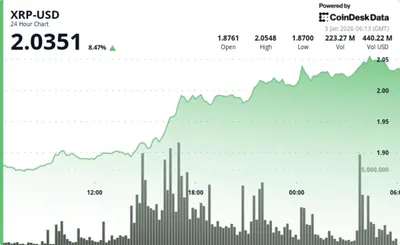

XRP’s derivatives markets showed a clear pickup in activity on January 13, 2026: aggregate futures open interest climbed to $4.08 billion while the token traded at $2.11 at 2:30 p.m. EST. That total represents roughly 1.93 billion XRP of futures exposure distributed across multiple venues, with the mix of exchanges shaping the leverage picture.

XRP Derivatives Market Overview

Futures open interest reached $4.08 billion, led by the CME, which held $909.75 million or 22.3% of the total. Other major venues such as Binance and Gate also contributed significant shares, showing that both institutional and retail venues are carrying notable portions of open interest. For readers wanting deeper context on recent price moves, see this price analysis on XRP.

Trading Activity and Trends

Short-term positioning showed steady growth rather than churn: aggregate open interest increased 0.63% over one hour, 0.96% over four hours, and 2.62% over 24 hours, suggesting new positions were being added. Funding rates stayed near 0.006% on average, a level described as mildly positive and indicating leverage exists but is not extreme, per cryptoquant.com statistics. Taker flow metrics were close to balanced, with aggressive sell-side flows holding a small edge over buys, which looks more like two-way trading than panic liquidation.

Options Market Insights

Options activity reinforced a bias toward upside exposure: on Binance, 58.92% of options open interest sat in calls versus 41.08% in puts, and calls made up more than 83% of options volume over the prior 24 hours. Contracts around strikes between $2.10 and $2.25 saw the heaviest flow, pointing to traders targeting modest continuation rather than extreme moves. This concentration in near strikes helps explain why implied volatility has been elevated but not disorderly.

Market Sentiment and Outlook

The distribution of futures activity—CME’s sizable share alongside large volumes on Binance, Bybit and Gate—suggests a mix of institutional and retail participation. That blend appears to keep funding and leverage relatively disciplined even as open interest rises, producing a market that looks busy but controlled. For a broader look at price drivers and longer-term context, see this analysis of XRP price drivers.

Why this matters

For a miner in Russia operating anywhere from one to a thousand devices, derivatives activity mainly signals how traders are positioning around XRP, which can affect short-term price swings. Higher open interest and call-heavy options do not change your mining output, but they can correlate with price moves that influence the value of freshly mined coins and the timing of sales. At the same time, the current funding and leverage profile—moderate and dispersed—reduces the immediate odds of sharp, exchange-driven liquidations that might cause abrupt price collapses.

What to do?

Keep monitoring spot price and exchange-specific funding rates, since funding can raise the cost of leverage-driven momentum that influences short-term prices. If you rely on mining revenue for operating costs, consider staggering coin sales rather than selling large blocks during volatile intraday moves, and watch open interest by exchange to understand where concentrated positions sit. Finally, maintain basic risk controls: set cost-based sell thresholds that cover power and maintenance, and avoid taking margin exposure tied directly to mined coins unless you have explicit hedging rules.

Quick checklist

- Track spot price versus your operating breakeven and plan staggered sales.

- Watch funding rates on exchanges you use; rising funding can increase short-term volatility.

- Monitor open interest leaders (CME, Binance, Gate) to see where positions concentrate.