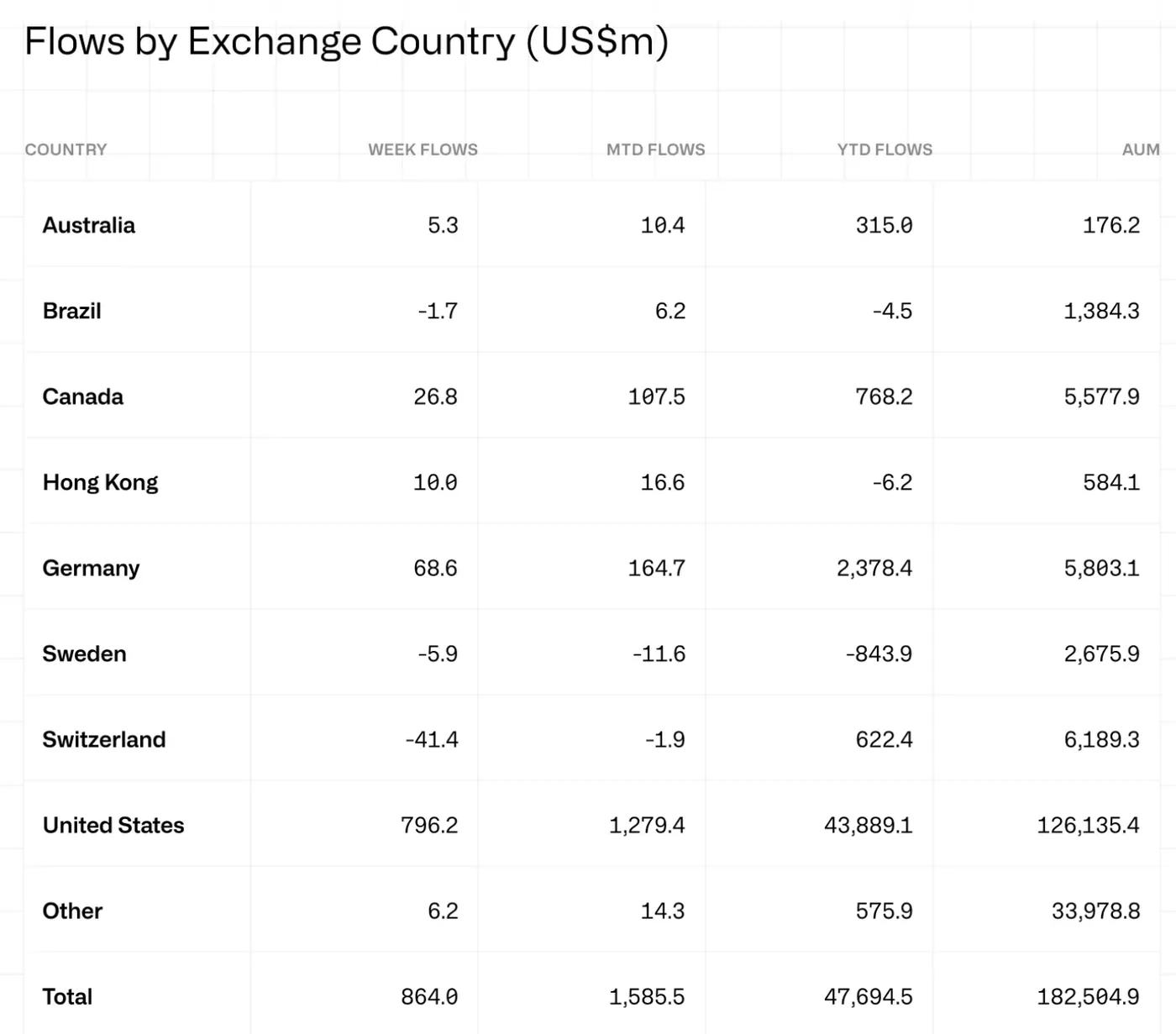

Crypto exchange-traded products (ETPs) recorded approximately $864 million in inflows last week, continuing a positive trend for the third consecutive week. The United States was the primary driver of this growth, contributing about $796 million to the inflows. Germany and Canada followed with roughly $68.6 million and $26.8 million respectively, together accounting for nearly 98.6% of year-to-date inflows into digital asset investment products. Meanwhile, Switzerland-listed crypto ETPs experienced outflows totaling around $41.4 million during the same period.

Overview of Weekly Crypto ETP Inflows

The inflows highlight strong regional interest, especially in the US market, which dominates the landscape. Germany and Canada also maintain notable positions in attracting investments into crypto ETPs. Despite these gains, some regions like Switzerland saw net outflows, reflecting mixed investor sentiment across different markets. See also: Spot Bitcoin ETFs Experience $351.7M Outflow Led by Fidelity

Top Performing Crypto Assets in ETPs

Bitcoin investment products led weekly inflows with about $522 million, signaling renewed investor confidence. Conversely, short-Bitcoin products posted net outflows of approximately $1.8 million, indicating a shift in market sentiment. Ether followed with around $338 million in inflows, lifting its year-to-date total to about $13.3 billion, which is a 148% increase compared to the previous year.

Other notable performers included Solana and XRP. Solana investment products attracted about $65 million in weekly inflows, bringing its year-to-date inflows to roughly $3.46 billion—a tenfold increase from last year. XRP products also saw fresh capital inflows of approximately $46.9 million during the week, accumulating about $3.18 billion year-to-date.

Smaller-Cap Crypto ETPs and Mixed Flows

Smaller-cap assets showed varied results. Aave-linked products recorded modest inflows of about $5.9 million, while Chainlink added roughly $4.1 million. In contrast, Hyperliquid products experienced net outflows of around $14.1 million. Despite these mixed flows, the overall trend for crypto ETPs remains positive with three consecutive weeks of inflows. See also: Bitcoin and Ether ETFs Experience Heavy Outflows While Solana and XRP ETFs Remain Positive

Assets Under Management and Fund Flows

Bitcoin investment products currently hold approximately $141.8 billion in assets under management, reflecting their dominant position in the market. Ether-linked products account for about $26 billion in assets under management. Multi-asset crypto ETPs, however, faced outflows of roughly $104.9 million last week, extending their year-to-date net redemptions to around $69.5 million, despite holding about $6.8 billion in assets. See also: Cryptocurrency ETF Weekly Recap: Bitcoin and Ether Rebound, Solana and XRP Extend Inflows

Among thematic funds, VanEck’s Digital Transformation fund posted the largest weekly inflow at approximately $45.8 million, followed by VanEck Crypto and Blockchain with about $20.5 million, and Schwab’s Crypto Thematic ETF with around $7.2 million. Other funds like Invesco CoinShares’ Global Blockchain and Bitwise Crypto Industry Innovators ETPs recorded modest net outflows during the week.

Why This Matters

For miners operating in Russia with up to 1,000 devices, understanding these inflow trends is important as they reflect broader investor confidence and liquidity in the crypto market. Strong inflows into Bitcoin and Ether ETPs suggest sustained interest and potential stability in these assets, which can influence mining profitability and market dynamics. Regional dominance by the US highlights where institutional and retail demand is concentrated, potentially impacting global price movements.

Conversely, outflows in multi-asset and certain smaller-cap products indicate selective investor caution, which may affect the valuation and demand for less prominent cryptocurrencies. Keeping track of these trends helps miners anticipate market shifts and adjust their strategies accordingly.

What Should Miners Do?

- Monitor inflow and outflow data regularly to gauge market sentiment and potential price movements for mined assets.

- Focus on mining cryptocurrencies with strong institutional support, such as Bitcoin and Ether, as indicated by significant ETP inflows.

- Stay informed about regional market developments, especially in dominant markets like the US, to understand demand drivers.

- Be cautious with smaller-cap assets showing mixed flows, and consider diversifying mining operations accordingly.

- Follow updates on assets under management and fund flows to anticipate shifts in investment trends that could impact mining profitability.