In 2025, Bitcoin and Ether exchange-traded funds (ETFs) have been facing significant outflows, marking a notable shift in investor sentiment within the cryptocurrency market. Meanwhile, ETFs linked to Solana and XRP continue to show positive performance, highlighting a divergence in market trends among major cryptocurrencies.

Overview of Bitcoin and Ether ETFs Performance

Recent data reveals that Bitcoin and Ether ETFs are experiencing heavy withdrawals, indicating reduced investor interest or profit-taking in these assets. This contrasts with the flows seen in Solana and XRP ETFs, which have managed to sustain inflows and maintain a positive trajectory. The difference in ETF flows underscores varying investor confidence levels across different cryptocurrency assets. See also: Spot Bitcoin ETFs Experience $351.7M Outflow Led by Fidelity

Performance of Solana and XRP in the ETF Market

Solana and XRP ETFs have demonstrated resilience amid the outflows affecting Bitcoin and Ether. Factors contributing to their relative strength include investor perception of growth potential and market positioning. This sustained positive performance suggests that some investors are reallocating capital towards these alternative cryptocurrencies, seeking diversification within the ETF space. See also: Cryptocurrency ETF Weekly Recap: Bitcoin and Ether Rebound, Solana and XRP Extend Inflows

Reasons Behind Heavy Outflows in Bitcoin and Ether ETFs

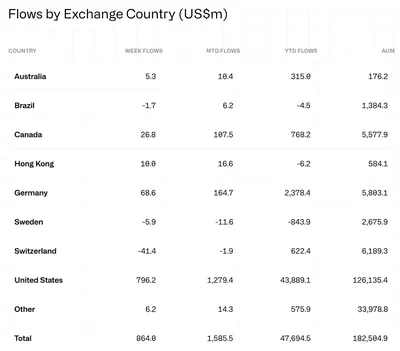

The heavy outflows from Bitcoin and Ether ETFs can be attributed to several market dynamics. These include shifts in investor risk appetite, profit-taking after previous gains, and broader trends within the cryptocurrency market that influence asset allocation decisions. Such movements reflect the complex interplay of market sentiment and strategic portfolio management among investors. See also: Crypto ETPs See $864M Weekly Inflows Led by US Demand in December 2025

Implications for Investors and Market Outlook

For investors holding Bitcoin and Ether ETFs, the current outflows may signal a period of increased volatility and reassessment of positions. Conversely, the steady gains in Solana and XRP ETFs could present opportunities for diversification and potential growth. Understanding these trends is crucial for making informed investment decisions in the evolving cryptocurrency ETF landscape of 2025.