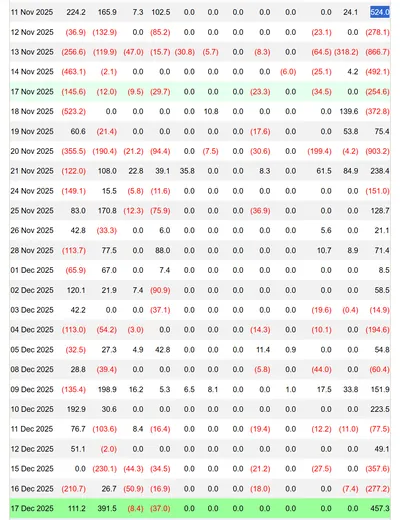

Spot Bitcoin exchange-traded funds recorded $1.42 billion in net inflows over the past week, marking their strongest weekly performance since early October. The surge was concentrated midweek, with Wednesday posting the largest single-day net inflow of roughly $844 million, while late-week pullbacks included a $395 million outflow on Friday.

Spot Bitcoin ETFs See Strongest Weekly Inflows Since October

The weekly total of $1.42 billion was driven by large midweek purchases, including a strong Tuesday session that preceded Wednesday’s peak. Despite the Friday outflow, the sequence of midweek inflows pushed the week to its best level since early October, highlighting a renewed return of institutional demand through regulated products.

Ether ETFs Also Experience Significant Inflows

Inflows into Ether (ETH) ETFs were front-loaded earlier in the same week, producing meaningful single-day gains before later weakness trimmed returns. The pattern for ETH ETFs shows concentrated demand at the start of the week, followed by a weaker session toward the end.

- Largest single-day ETH inflow: roughly $290 million on Tuesday.

- Secondary inflow: about $215 million on Wednesday.

- End-of-week weakness included net outflows of roughly $180 million on Friday.

Institutional Demand Returns Amid Reduced Whale Selling

Market commentators linked the inflows to a return of long-only institutional allocators buying via ETFs, which has coincided with a reduction in large-holder selling. Vincent Liu, chief investment officer at Kronos Research, said ETF absorption alongside whale stabilization implies tightening effective supply and a more risk-on market environment, while noting the shift remains at an early stage.

The renewed institutional bid and lower net selling from large holders together can make dips easier to absorb, even if volatility persists. For context on how inflows have developed earlier in the year, see the earlier inflows report, which covers initial heavy flows in recent sessions.

Sustained ETF Demand Needed for Lasting Bitcoin Rally

Not all observers see short-term inflows as sufficient to change the broader trend. The Bitcoin macro newsletter Ecoinometrics cautions that spikes in spot Bitcoin ETF inflows have often produced brief price rebounds that faded once demand cooled, arguing that several consecutive weeks of strong inflows are required to sustain a lasting uptrend.

Without a steady, multiweek flow into ETFs, isolated positive days may help stabilise prices temporarily but are unlikely to support a prolonged rally. For related coverage of recent flow patterns and pauses in outflows, see the article on how a seven-day series was halted: seven-day outflows stopped.

Почему это важно

Если вы майните в России с одним или несколькими установками, поток $1.42 млрд в спотовые Bitcoin ETF сам по себе не меняет условия добычи и тарифы. При этом снижение продаж крупных держателей и институциональные покупки означают, что резкие просадки могут быть легче поглощены рынком, а это снижает вероятность коротких импульсных падений, которые напрямую влияют на выручку майнера при продаже добытых монет.

Но помните: до устойчивого роста рынка ещё далеко — отдельные крупные вливания не гарантируют длительного подъёма цен. Это значит, что текущее событие важно прежде всего как сигнал улучшения спроса, а не как повод для экстренных изменений в операциях.

Что делать?

Если ваша ферма небольшой или средней мощности, держите фокус на рутинных операциях и контроле затрат. Резкие колебания цены могут происходить, поэтому стабильность работы оборудования и учёт электроэнергии остаются ключевыми факторами доходности.

- Не меняйте стратегию майнинга из‑за одной недели inflows — оцените ситуацию по нескольким неделям подряд.

- Контролируйте расходы на электроэнергию и техобслуживание, чтобы выдержать период волатильности.

- Если планируете продавать заработанные BTC, распределяйте продажи по времени, чтобы не попадать под сиюминутные откаты.