In December 2025, the cryptocurrency ETF market demonstrated significant activity, with Bitcoin and Ether ETFs experiencing a price rebound that positively affected investor sentiment. Alongside this, Solana and XRP ETFs maintained their momentum by extending their streaks of inflows, highlighting sustained investor interest in these assets.

Overview of Cryptocurrency ETF Market in December 2025

The market trends for Bitcoin and Ether ETFs showed a recovery in prices, which contributed to renewed optimism among investors. At the same time, Solana and XRP ETFs continued to attract capital, sustaining their inflow streaks and underscoring their appeal within the cryptocurrency ETF space. See also: Bitcoin and Ether ETFs Experience Heavy Outflows While Solana and XRP ETFs Remain Positive

Bitcoin and Ether ETF Performance

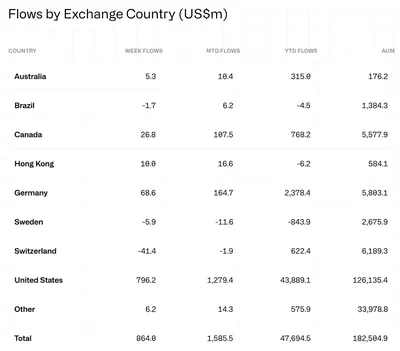

Bitcoin and Ether prices rebounded during this period, which had a direct impact on ETF inflows. This recovery helped improve investor confidence, leading to increased participation in these ETFs. The price movement served as a catalyst for renewed interest and investment activity. See also: Crypto ETPs See $864M Weekly Inflows Led by US Demand in December 2025

Solana and XRP ETF Inflow Streaks

Solana and XRP ETFs continued to see consistent inflows, extending their streaks from previous weeks. This trend indicates persistent demand and confidence from investors in these particular cryptocurrency ETFs. The inflow patterns suggest a stable appetite for Solana and XRP within the ETF market. See also: Cryptocurrency and Market Price Predictions for December 15, 2025

Implications for Investors and Market Outlook

The ongoing inflow trends into Solana and XRP ETFs, combined with the rebound in Bitcoin and Ether prices, reflect underlying investor confidence in these digital assets. For miners and investors managing portfolios with up to 1000 devices in Russia, these movements suggest a potentially favorable environment for cryptocurrency ETFs. Staying informed about such trends can help in making timely decisions regarding investment allocations and risk management.

To navigate this market effectively, investors should monitor ETF inflow data regularly and consider how price movements in major cryptocurrencies like Bitcoin and Ether influence overall market sentiment. Maintaining awareness of these dynamics supports better strategic planning in the evolving cryptocurrency landscape.