Digital asset investment products recorded a net inflow of $2.17 billion, a figure CoinShares reported on April 14, 2025. This weekly total is the largest since October of the previous year and reverses the brief outflows seen the week before. The inflow was concentrated in a few major assets and in one principal market, shaping the week's flow dynamics.

Record-Breaking Influx into Digital Asset Investment Products

The $2.17 billion net inflow covers regulated vehicles such as exchange-traded products and institutional funds, and it marks a notable weekly shift back into the space. CoinShares presented the figure as part of its regular flow reporting, highlighting that last week’s performance stands out relative to recent weeks. While weekly totals can fluctuate, this particular inflow is the largest observed since October of the previous year.

Bitcoin and Ethereum Lead Investor Allocations

Breaking down the total, Bitcoin investment products captured $1.55 billion of new capital, taking the majority share of the week’s inflows. Ethereum products secured $496 million, making it the second-largest recipient during the same period. Other assets moved with much smaller amounts, leaving Bitcoin and Ethereum clearly dominant in the allocation mix; for related coverage of Bitcoin-focused flows see Bitcoin ETF flows.

Geographic Distribution of Crypto Investment Flows

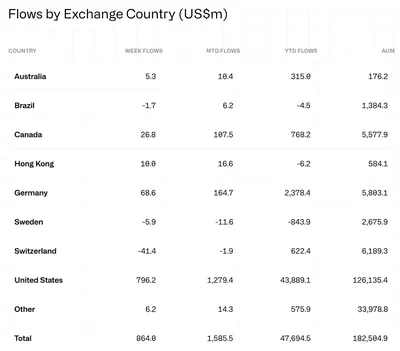

The United States accounted for $2.053 billion of the total weekly inflow, forming the bulk of the reported $2.17 billion. Other regions contributed at a smaller scale, leaving the US as the primary source of last week’s capital movement. For more on how weekly fund movements have varied recently, compare this report with other weekly inflow summaries such as weekly fund inflows and pieces noting renewed optimism in fund flows like optimism returns.

Shift in Investor Sentiment

CoinShares also noted that investor sentiment weakened from Friday onward during the reported week. The firm pointed to a combination of geopolitical and macroeconomic pressures as correlates for that deterioration in sentiment. As a result, some of the inflows recorded earlier in the week may have been followed by more cautious positioning as the week closed.

Why this matters

For miners operating in Russia with anywhere from a single rig to a few hundred or a thousand devices, the report matters primarily because large inflows concentrate attention on major assets. When institutional products attract significant capital to Bitcoin and Ethereum, it can increase demand pressure on spot markets, which in turn affects liquidity and potential selling dynamics. At the same time, the noted late-week sentiment weakening shows that flows can reverse quickly when global geopolitical or macro risks rise, so miners should expect short-term swings.

What to do?

If you run mining hardware in Russia, focus on practical risk management rather than trying to time flows. Keep your operating costs and power efficiency under control, since sustained price moves driven by institutional demand are uncertain and can be followed by quick sentiment shifts. Also maintain basic liquidity planning: avoid committing the entire run of mined coins to immediate sale during volatile days, and consider staggering conversions to fiat to smooth price risk.

Quick checklist for miners

- Monitor exchange order books and liquidity for Bitcoin and Ethereum before large sales.

- Track headlines on geopolitical and macro news late in the trading week, as sentiment can change quickly.

- Keep reserves to cover several weeks of power and maintenance costs to withstand short-term market drops.