Bitwise Asset Management has introduced the Bitwise Proficio Currency Debasement ETF, which trades on the NYSE under the ticker BPRO. The fund is actively managed and combines Bitcoin with precious metals and mining equities to address concerns about the erosion of fiat purchasing power. Rather than targeting pure upside, the vehicle is positioned with capital preservation in mind and allows managers to allocate across crypto and commodity-linked assets.

Overview of the Bitwise Proficio Currency Debasement ETF

BPRO is presented as a hedge against currency debasement through a blended portfolio that includes Bitcoin (BTC), gold and mining stocks. A notable rule in the fund’s design is a minimum allocation of 25% to gold, intended to keep a material exposure to the precious metal at all times. The fund’s cost is reflected in an expense ratio of 0.96%, and its active management differentiates it from single‑asset spot Bitcoin ETFs.

Structure and Strategy of BPRO

Unlike spot Bitcoin ETFs that track a single asset, BPRO permits discretionary shifts between crypto and commodity-linked holdings, giving managers flexibility to reposition the mix. The fund is framed around capital preservation rather than purely chasing returns, which may appeal to wealth managers seeking diversified exposure to stores of value. Trading on the NYSE under the ticker BPRO, the fund’s fee structure includes the 0.96% expense ratio disclosed by Bitwise.

Market Context and Institutional Interest

Asset managers are increasingly fitting crypto into broader macro strategies, using combined products to offer exposure without relying on single-asset funds. Bob Haber of Proficio Capital Partners pointed out that gold remains underrepresented in many modern portfolios, a view he supported with research cited from Goldman Sachs. For background reading on how gold and Bitcoin have compared recently, see the gold vs bitcoin 2025 review.

Bitcoin vs. Gold as Hedges Against Debasement

Bitcoin has often been discussed as a long-term hedge because of its fixed supply, but recent episodes have raised questions about its near-term effectiveness. Analysis cited in coverage shows Bitcoin underperformed gold during a period when political pressure on the central bank was prominent, a point used to argue limits to Bitcoin’s reliability as a debasement hedge. For a focused look at this divergence, consult our Bitcoin underperformance review.

Expert Opinions and Analysis

Bob Haber noted that, despite gold’s long-term record, it plays a relatively small role in many private portfolios, which is one rationale for a mandated gold allocation in BPRO. Conversely, Karel Mercx argued that Bitcoin has not consistently behaved as a dependable hedge against currency debasement, citing episodes where gold reacted to monetary credibility concerns while Bitcoin did not. These contrasting views frame why Bitwise combined both assets and added mining equities to the mix.

Why this matters

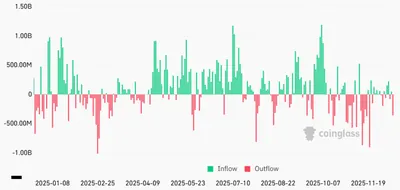

If you operate mining hardware in Russia — whether a handful of rigs or up to a thousand machines — BPRO does not change how your equipment runs or your immediate operating costs. However, the fund creates another institutional channel for Bitcoin exposure that can influence demand dynamics over time, and its explicit gold allocation signals renewed interest in mixed hedging strategies. In practice, the announcement is more relevant to market structure and capital flows than to day‑to‑day mining operations.

What to do?

Track market demand and liquidity rather than react to the product launch itself: monitor price moves and where institutional flows go, since those can affect BTC realizations when you sell mined coins. Keep operational focus on efficiency — cooling, power costs and uptime — because your margins depend primarily on those factors. Finally, if you manage proceeds or savings from mining, consider whether diversified hedge exposure fits your risk profile and consult a tax or investment advisor about using funds versus holding assets directly.