The 21Shares Bitcoin Gold ETP (BOLD) began trading on the London Stock Exchange on Tuesday. The fund offers combined exposure to Bitcoin and gold, allocating roughly two-thirds of its assets to gold and one-third to Bitcoin. It is listed in British pounds under the ticker "BOLD" and in US dollars under "BOLU," providing investors with two currency trading options on the LSE.

Introduction to 21Shares BOLD ETP

21Shares expanded access to its Bitcoin–gold product by listing BOLD on the LSE, adding a UK venue where the fund is now tradable. The ETP was developed as a regulated, exchange-traded vehicle that bundles both assets into a single instrument, aiming to simplify exposure for investors who want both gold and Bitcoin in one product.

Asset Allocation and Backing

BOLD’s official allocation is 65.85% in gold and 34.15% in Bitcoin, reflecting a tilt toward precious metal weight within the portfolio. The fund is 100% physically backed by its underlying assets and was developed in partnership with investment research platform ByteTree Asset Management, which is noted in the fund’s documentation. For a direct comparison of the two assets, see Золото vs биткоин, which examines their roles as stores of value.

Trading Details

BOLD trades on the London Stock Exchange under ticker symbols 'BOLD' for British pounds and 'BOLU' for US dollars, giving market participants the choice of currency exposure. The fund reports a net asset value of $50.30 and total assets under management of $40.2 million, and it charges an annual management fee of 0.65% that covers custody, administration and ongoing operation.

Market Context and Impact

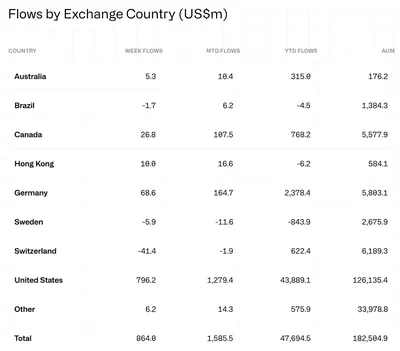

BOLD joins a wider suite of crypto ETPs from 21Shares and sits alongside the firm’s European listings. At the end of last week 21Shares held about $4 billion in assets under management for European crypto ETPs, a figure reported alongside global ETP data. For more on how gold and Bitcoin have behaved relative to one another, consider the analysis in Золото против биткоина, which reviews their performance and the role of ETFs.

Why this matters

For miners operating anywhere, including Russia, the LSE listing does not change how mining hardware functions or how blocks are produced. The announcement is primarily a market-level development that makes a combined gold–Bitcoin exposure available to investors through a regulated exchange product.

That said, products like BOLD can affect investor options and demand for on- and off-chain exposures. If more investors choose regulated ETPs for combined allocations, that can influence where capital flows, but it does not directly alter day-to-day mining operations such as equipment maintenance, power management or payout procedures.

What to do?

If you run from one device up to a small farm, focus on the things you control rather than product listings. Below are practical steps to stay prepared and informed without changing your mining routine unnecessarily.

- Keep operations efficient: monitor uptime, cooling and power costs to protect margins regardless of market products.

- Track settlement options: if you plan to sell mined coins, check brokers and exchanges that list ETPs like BOLD to understand liquidity and currency options.

- Watch fees and NAVs: if you consider exposure via an ETP, compare the fund’s management fee and net asset value to other ways of holding assets.

- Secure your holdings: continue using reliable custody and backup practices for both private keys and documentation about any fund investments.

These steps help keep your mining business resilient while you monitor how market products such as BOLD evolve and whether they become relevant to your wider portfolio decisions.