Bitwise published an analysis on X on January 10, 2026, arguing that spot Bitcoin ETFs have reached institutional adoption far faster than gold’s early ETF era. The firm notes that spot Bitcoin ETFs, launched Jan. 11, 2024, accumulated about $57 billion in net inflows over two years, and it compares that figure with roughly $8 billion in inflation-adjusted early gold ETF inflows from 2004–2006.

Bitcoin ETFs Surpass Gold Adoption by 600%

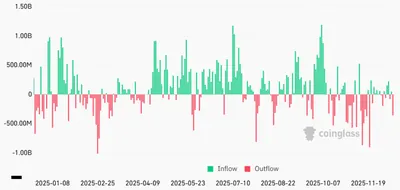

Bitwise’s post frames the comparison as evidence that Bitcoin’s entry into traditional finance has been unusually rapid, estimating adoption at about 600% of gold’s early pace. The analysis highlights ETF capital flows as a direct measure of how quickly advisers, pensions and asset managers can gain exposure to an asset inside familiar regulatory structures. For related coverage of ETF momentum in 2026, see Bitcoin ETFs in 2026 and how inflows have behaved recently.

Key Drivers of Bitcoin ETF Growth

Supporters cited by Bitwise point to several practical factors behind rapid ETF uptake: Bitcoin’s fixed supply, growing global liquidity, continuous settlement and clearer regulatory frameworks that make ETFs usable within existing compliance models. These attributes, the firm argues, help explain why institutional allocators adopted spot Bitcoin ETFs quickly after the January 2024 launch. The discussion centers on how familiar ETF wrappers lowered barriers for large investors to gain exposure without changing their operating frameworks.

Skepticism and Challenges

Despite strong inflows, replies and critics emphasized that Bitcoin remains volatile and that some reports flagged underperformance during 2025, keeping debate open about long-term stability versus assets like gold. Bitwise’s comparison does not erase those concerns but places them alongside evidence of fast institutional adoption. The tension between rapid inflows and shorter-term performance is part of ongoing discussions among allocators.

Bitwise’s Perspective on the Digital Gold Thesis

In its post, Bitwise described the “Digital Gold” thesis as having moved from theory to a proven global standard, framing ETFs as a mechanism that cements Bitcoin’s role in mainstream portfolios. The firm uses the ETF inflow comparison to argue that Bitcoin now operates inside portfolio construction norms rather than only at the periphery. Readers should note that this framing reflects Bitwise’s view as shared on X on Jan. 10, 2026.

Почему это важно

Если вы майните в РФ с 1–1000 устройствами, сама по себе новость об институциональных притоках напрямую не меняет работу ферм или энергоснабжение. При этом рост ETF-инвестиций говорит о большей ликвидности и внимании со стороны крупных игроков, что может сделать рынок для продаж и расчётов более удобным и глубоким.

Также важно понимать, что быстрые притоки не устраняют волатильность: поддерживающие аргументы и критика сосуществуют, поэтому крупные институциональные потоки — это фактор, который стоит учитывать при планировании краткосрочных операций и управлении рисками на вашей площадке.

Что делать?

Оставайтесь в курсе регуляторных новостей и потоков в ETF, но не делайте оперативных решений только на их основе; это в первую очередь институциональный показатель. Контролируйте себестоимость майнинга, оптимизируйте энергопотребление и техобслуживание, чтобы сохранить маржу независимо от внешних притоков или краткосрочной волатильности.

Если вы продаёте часть добытого, планируйте операции с учётом ликвидности и комиссий, фиксируйте записи и отслеживайте объявления крупных участников — они влияют на поток ликвидности, хотя не гарантируют изменение цены в долгосрочной перспективе.

Для дополнительного контекста о сравнении золота и биткоина можно прочитать материал gold vs bitcoin 2025, где обсуждаются результаты и роль ETF в 2025 году.