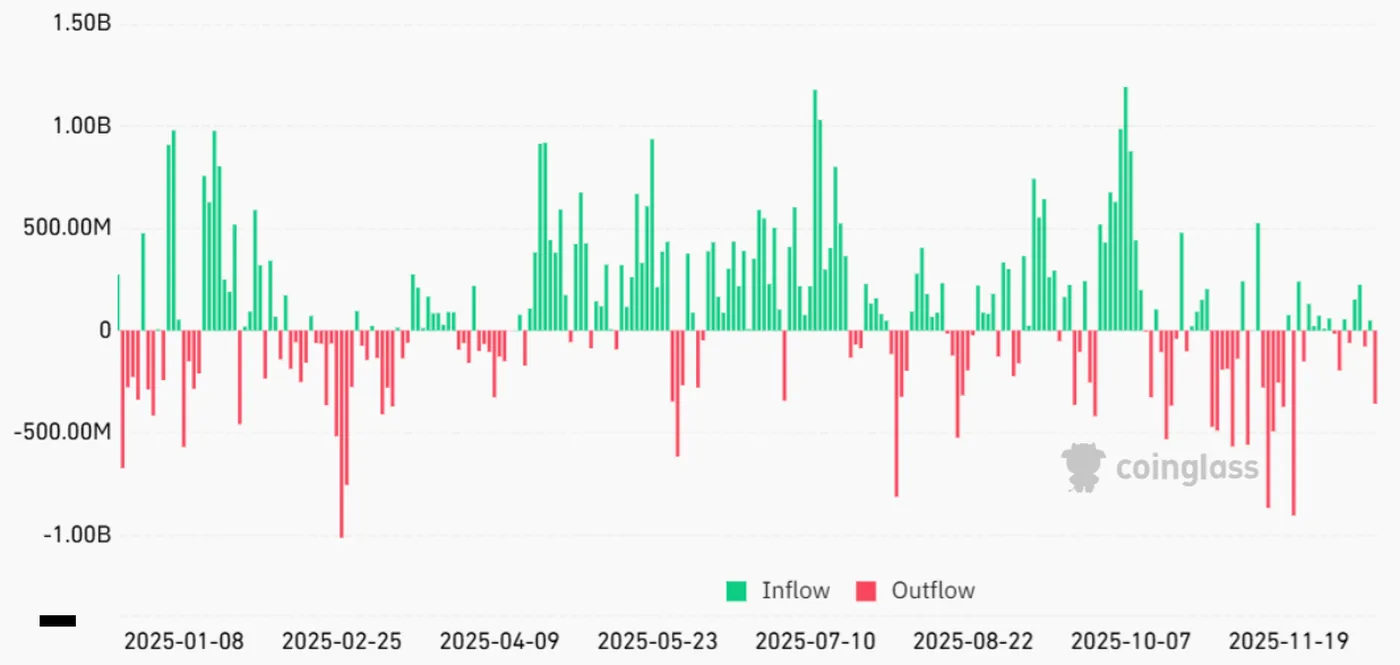

Bitcoin price recently dipped to the $85,000 level but rebounded by 3% the following day, maintaining a position well below its all-time high of $126,219 by 31%. Concurrently, spot Bitcoin exchange-traded funds (ETFs) recorded $358 million in net outflows on Monday, marking the largest withdrawal in over three weeks. This outflow suggests a softening in institutional demand following the breach of the psychological $90,000 support level.

Current State of Bitcoin and Spot Bitcoin ETFs

Despite the recent sell-off, Bitcoin has held above $85,000, demonstrating resilience amid market pressures. The significant $358 million outflow from spot Bitcoin ETFs indicates that institutional investors may be reducing exposure temporarily. However, this withdrawal comes after a period of strong performance, with Bitcoin still trading substantially below its peak but outperforming other assets over the longer term.

Bitcoin’s 31% decline from its all-time high reflects a market correction rather than a definitive trend reversal. The largest daily ETF outflow in weeks highlights caution among institutional players but does not necessarily signal a broader abandonment.

Institutional Investor Behavior and Market Sentiment

The outflows from Bitcoin ETFs suggest some reduction in institutional exposure following the recent price dip below $90,000. Nevertheless, analysis points to no fundamental change in investor sentiment, as the US Federal Reserve has delayed interest rate cuts and continued balance sheet reductions longer than anticipated. These monetary policies influence market dynamics and investor decisions.

Institutional capital has primarily entered the Bitcoin market through ETFs and corporate reserves, with no clear evidence of a shift toward riskier or less liquid assets. The current correction appears to be a short-term adjustment rather than a signal of institutional withdrawal from Bitcoin.

Bitcoin’s Correlation with Gold and Market Metrics

Bitcoin’s relationship with gold, often viewed as a digital alternative store of value, has been inconsistent throughout 2025. The 60-day correlation metric has oscillated between positive and negative since May, indicating fluctuating alignment with gold price movements. Despite a 31% price drop since October, this correlation metric remained unaffected, weakening arguments that institutional investors have shifted their risk perception away from Bitcoin.

Bitcoin has outperformed the S&P 500 index by 7% over the past 18 months, underscoring its competitive position among major assets. This performance, combined with its complex correlation with gold, highlights Bitcoin’s unique role in diversified portfolios.

Volatility and Future Outlook

Bitcoin options implied volatility peaked at 53% in November, a level comparable to that of Tesla, reflecting market anticipation of sharp price swings. Such volatility indicates that traders expect significant movements, which can increase premiums on options but does not necessarily imply bearish sentiment.

There is currently no indication that institutional investors have abandoned expectations for Bitcoin to reach $100,000 in the near term. Correlation and volatility metrics suggest that Bitcoin’s price behavior remains consistent despite recent declines, and the effects of recent liquidity injections from the US Federal Reserve have yet to fully impact the market.

Why This Matters

For miners and investors in Russia operating up to 1,000 devices, understanding these market dynamics is crucial. The $358 million outflow from spot Bitcoin ETFs signals some institutional caution but not a wholesale exit. Bitcoin’s price holding above $85,000 and its steady correlation with gold suggest ongoing interest and potential for recovery.

Volatility levels indicate that price swings are expected, which can affect mining profitability and investment timing. The delayed Fed rate cuts and continued balance sheet reductions mean that macroeconomic factors influencing Bitcoin remain in flux, requiring miners to stay informed and adaptable.

What Should Miners Do?

- Monitor Bitcoin price trends closely, especially support levels around $85,000 and resistance near $90,000.

- Stay updated on institutional flows and ETF activity to gauge market sentiment shifts.

- Consider volatility metrics when planning mining operations and potential asset sales to optimize returns.

- Keep an eye on Federal Reserve policies, as changes can impact liquidity and Bitcoin’s price dynamics.

- Maintain a diversified approach and avoid overreacting to short-term outflows or price corrections.

By staying informed about these factors, miners can better navigate the current market environment and position themselves for potential opportunities as Bitcoin’s price and institutional interest evolve.

For further insights on ETF flows and Bitcoin’s market behavior, see related analyses such as Spot Bitcoin ETFs’ $351.7M Outflow Led by Fidelity and Bitcoin-to-Gold Ratio Halves in 2025 Amid Gold's Rally.