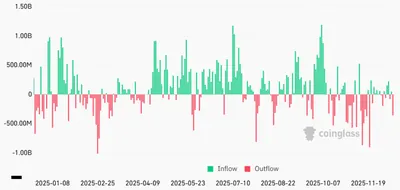

Spot Bitcoin exchange-traded funds registered a sharp swing in early January 2025, with net outflows amounting to $1.13 billion from Monday through Wednesday. That movement almost completely erased the $1.16 billion of net inflows that had accumulated in the first days of the month, cooling the initial optimism that had supported crypto markets.

Significant Outflows from Spot Bitcoin ETFs

Data compiled by Farside Investors and reported by CoinDesk shows the concentrated outflows over those trading days, underscoring how quickly institutional flows can reverse. These flows primarily reflect activity in U.S.-listed spot Bitcoin ETFs, which were launched after receiving approval from the Securities and Exchange Commission in January 2024 and are now used as a transparent route for large investors to gain Bitcoin exposure. In the context of recent moves, readers may find it useful to compare this episode with other short-term redemptions, such as the six-day outflows reported earlier.

Institutional Conviction and Market Dynamics

Market participants interpret the fast reversal as a signal of reduced near-term conviction among some institutional holders, with profit-taking and portfolio rebalancing among the commonly cited explanations. At the same time, broader macro factors are part of the backdrop: the market is awaiting the release of December’s U.S. employment data and a pivotal U.S. Supreme Court ruling on tariff policies, events that could influence risk appetite and asset allocation. These catalysts help explain why flows can swing sharply over a few days rather than reflect a steady trend.

Expert Analysis on ETF Flow Volatility

Observers stress that volatility in ETF flows is a typical feature for a product class still finding its long-term investor base. Short-term outflows, even when sizable, represent data points within a longer adoption curve and do not by themselves determine the product’s ultimate success. At the same time, the episode highlights Bitcoin’s sensitivity to traditional macro forces even when exposure is routed through an ETF structure.

Broader Impact on the Cryptocurrency Market

The immediate effect of concentrated ETF outflows has been tighter market sentiment and price pressure across digital assets, with Bitcoin leading moves that often ripple through altcoins. Traders and investors are monitoring technical support levels and trading volumes for signs of stabilization, while the regulatory conversation around custody, taxation and legislation remains an important long-term factor for institutional strategy. For historical perspective, earlier intramonth redemptions such as the earlier ETF outflow provide additional context for how flows can fluctuate.

Why this matters (for a miner in Russia with 1–1,000 devices)

ETF flows are a barometer of institutional demand, but they do not directly change how your rigs operate or consume electricity. That said, sharp outflows can tighten market sentiment and increase short-term price volatility, which affects the fiat value you receive when you sell mined coins. For small and medium miners, this means being aware of liquidity and price moves that can influence short-term revenues and cashflow planning.

What to do?

Keep actions practical and proportional to your operation size. The list below focuses on immediate, low-cost steps that help manage risk and uptime without relying on market timing.

- Monitor flows and price: Track daily ETF flow reports (for example, from Farside Investors) alongside price moves to understand market momentum and selling pressure.

- Adjust cashflow timing: If you sell mined coins to cover expenses, consider scheduling routine conversions rather than reacting to intraday volatility.

- Optimize costs: Review local electricity tariffs, improve cooling efficiency, and postpone non‑urgent hardware upgrades during volatile price periods.

- Maintain reserves: Keep a small fiat buffer to cover a few weeks of operating costs in case prices dip unexpectedly.

- Stay informed on regulation: Follow major regulatory and macro events cited in market coverage, since they influence institutional flows and broader sentiment.

These measures do not eliminate market risk but help you operate more predictably through short-term episodes of ETF-driven volatility. For miners focused on the long term, the maturation of ETF access to Bitcoin is one of several factors shaping institutional demand rather than a single decisive force.