Bitcoin’s mid‑January advance lost momentum as the market retraced more than 10% from its peak, reflecting a pullback in institutional demand and a shift in ETF flows. According to Bitfinex, the rally failed to hold above the $95,000–$98,000 resistance band, with the highest print at $97,850 before prices slid back into the prior range. That combination of a failed breakout and sustained ETF redemptions pushed the market to reconsider near‑term upside.

Bitcoin's January Rally Loses Momentum

Bitfinex’s latest note points to a fragile equilibrium between buyers and sellers after upside attempts were repeatedly met by distribution from prior‑cycle buyers. The retracement erased year‑to‑date gains and put prices below the yearly open, highlighting how sensitive the market is to institutional flows and distribution dynamics. Without renewed spot demand, those failed breakouts have kept the market from regaining conviction.

ETF Outflows and Market Confidence

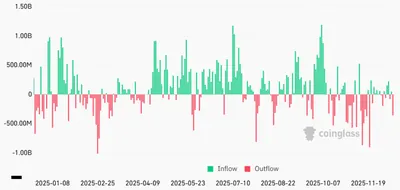

Data compiled by Bitfinex show more than $1.3 billion in cumulative ETF outflows over the past week, including five consecutive days of net redemptions across major providers. The breadth and consistency of those outflows suggest coordinated de‑risking rather than routine rotation, and Bitfinex says upside attempts remain vulnerable in the absence of renewed inflows. Recent coverage has tracked these outflows alongside price action and market sentiment recent coverage, underlining how ETF flows can influence confidence.

Market Structure and Derivatives Positioning

Derivatives activity showed a measured response: open interest in perpetual contracts declined by more than 4%, roughly $1.18 billion in notional terms, a reset that analysts called constructive for market structure even as spot participation cooled. Options markets displayed a front‑end steepening, with one‑week at‑the‑money implied volatility jumping by more than 13 points while three‑month and six‑month volatilities moved only modestly. That pattern points to tactical hedging around near‑term headlines rather than broad, long‑dated fear.

The recent open interest drop fits into this picture: dealers and leveraged participants pared exposure, which tends to reduce the scale of forced moves and can make short‑term ranges more persistent. In this setting, short‑term holders have absorbed much of the downside while prior buyers have limited upside progress.

Macro Conditions and Geopolitical Tensions

Broader macro and geopolitical developments added to market uncertainty, prompting brief risk‑off moves that fed into the retracement. Bitfinex noted that the episode reinforced a wider repricing of risk across equities, bonds and currencies, which can amplify tactical hedging in crypto markets. While these shocks were described as transitory, they contributed to elevated near‑term noise and to selective buying and selling.

Bitcoin's Trading Range and Future Outlook

After the pullback, Bitfinex expects bitcoin to trade in a roughly $85,000–$94,500 range until a clear demand catalyst appears. The report emphasises that stronger spot buying would be required to support a durable breakout above the resistance band that recently contained prices. For now, the market looks set to churn sideways with volatility signalling caution rather than a regime change.

Почему это важно

Если вы майните в РФ, этот откат влияет прежде всего на настроение рынка и краткосрочную ликвидность — продажи из ETF и падение интереса на производных рынках делают крупные движения менее предсказуемыми. При этом снижение цены и рост краткосрочной волатильности означают, что вы можете реже получать высокую прибыль от быстрой реализации добытого биткоина, особенно если у вас ограничённые мощности и доступ к ликвидности. В отсутствии нового спроса с рынка стоимость актива может оставаться в узком диапазоне, что влияет на расчёт срока окупаемости оборудования.

Что делать?

- Пересчитайте рентабельность: при текущей волатильности и возможном боковом движении уточните срок окупаемости и маржинальные доплаты по электроснабжению.

- Планируйте продажи по уровням: если у вас небольшое количество устройств, дробите продажи, чтобы снизить риск реализации по локальному минимуму.

- Следите за потоками ETF и открытым интересом: резкие оттоки и снижение OI могут продлить боковик, поэтому ориентируйтесь на восстановление притока средств перед увеличением экспозиции.

- Используйте хеджирование аккуратно: краткосрочные опционы и простые стоп‑ордера помогут защитить выручку при резких всплесках волатильности, но не применяйте сложные стратегии без понимания издержек.

- Сохраняйте резерв ликвидности: при сетевых и рыночных шоках легче держать оборудование в работе, если есть запас средств на оплату электроэнергии и обслуживание.