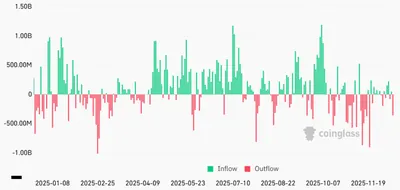

Bitcoin is holding above $92,000 even as market signals show growing caution among traders. Over the weekend BTC saw a 3.4% correction and professional flows pushed Bitcoin spot ETFs to $395 million in net outflows, reducing some of its appeal as a hedge. At the same time, derivatives metrics and network activity point to elevated downside sensitivity, keeping many market participants on edge.

Bitcoin Holds Above $92K Amid Market Turbulence

The $92,000 level has acted as short-term support after a failed breakout attempt higher, but the price environment remains fragile. A retest of this area unexpectedly triggered liquidations, and that dynamic has made traders more defensive about new long positions. Continued ETF outflows and broader risk aversion are the key forces testing whether this support can persist.

Market Reactions and Derivatives Trends

Derivatives data show mixed signals: the BTC futures premium held near 5%, suggesting leverage demand was present despite the failed rally. Still, the weekend pressure forced $215 million in leveraged BTC futures longs to be liquidated, amplifying the correction and prompting traders to seek protection. For additional context on derivatives flows and open interest dynamics, see futures open interest.

Options markets reflected increased demand for downside protection: the BTC delta skew at Deribit rose to 8%, indicating puts traded at a premium. That shift, together with ETF outflows, has reduced some traders’ conviction in a clean bullish breakout in the near term.

Macroeconomic Factors Influencing Bitcoin

Global political tensions and macro headlines weighed on risk appetite, and precious metals saw strong flows as investors sought safety. Gold pushing to record levels was among the reasons cited for ETF outflows from Bitcoin, weakening BTC’s appeal as an alternative hedge. Broader geopolitical and economic developments have therefore become an important backdrop for Bitcoin price action; for more on resistance factors see why BTC struggles.

China’s reported economic slowdown and other macro signals contributed to traders’ cautious stance, reinforcing the view that external shocks can quickly change risk positioning across crypto markets.

Bitcoin Network Activity and Miner Revenue

On-chain activity has softened: daily active Bitcoin addresses fell to 370,800, a decline of 13% from two weeks earlier, which highlights weaker retail or on-chain engagement. Miner revenue remains composed of a fixed block reward plus transaction fees, and lower network activity can pressure fee income and broader mining economics. For related price context and levels, see this price levels summary.

Why this matters

For a miner running between one and a thousand devices in Russia, these developments affect both revenue certainty and short-term price risk. ETF outflows and liquidations can lead to sharp intraday moves that cause stress for operations with tight cash-flow or power commitments, while lower on-chain activity may reduce fee income that sometimes cushions revenue dips.

At the same time, derivatives indicators showing higher demand for downside protection mean larger players may be hedging more aggressively, which can increase volatility around major technical levels even if the spot price remains near $92,000.

What to do?

Actionable steps for small and mid-size miners should focus on preserving liquidity, managing operational risk and preparing for higher volatility. Below are practical measures to consider.

- Review cash buffers and running costs: ensure you can cover fixed power and maintenance for several weeks without relying on spot BTC sales.

- Stagger coin sales: avoid selling all mined BTC at once; use smaller, regular withdrawals to reduce the impact of intraday volatility and liquidation events.

- Monitor derivatives and liquidations: track futures premiums and large liquidation events to anticipate sudden price moves that can affect short-term revenue.

- Optimize operations: check firmware, cooling and power efficiency to reduce costs per BTC and improve resilience to price dips.

- Use basic hedges selectively: if you have exposure you cannot tolerate, consider simple hedging tools or structured off-ramps while avoiding complex positions without experience.