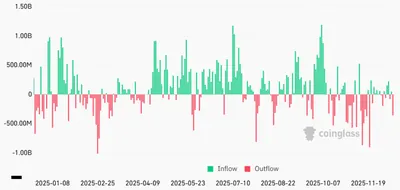

Spot Bitcoin exchange-traded funds (ETFs) reversed their early strength in 2026, posting four straight days of net outflows and shedding a combined $681 million over the first full trading week. The flows outweighed initial inflows earlier in the week, leaving ETFs in net negative territory by the end of the period.

Spot Bitcoin ETFs Experience Significant Outflows in Early 2026

Data from SoSoValue shows spot Bitcoin ETFs recorded four consecutive days of net outflows between Tuesday and Friday, with Wednesday marking the largest single-day redemption at $486 million. Other large redemptions included $398.9 million on Thursday and $249.9 million on Friday, offsetting the prior inflows of $471.1 million on Jan. 2 and $697.2 million on Jan. 5.

The reversal came after the market opened the year with brief inflows; for more on early-week inflow totals, see early 2026 inflows. Historical context on prior multi-week outflows can help frame this swing late‑2025 outflows, which set part of the backdrop for investor positioning.

Macro Uncertainty Drives Risk-Off Shift

Vincent Liu, chief investment officer at Kronos Research, cited macro uncertainty as the main reason for the pullback, noting that shifting expectations around monetary policy and elevated global risks weighed on positioning. He pointed out that investors are watching upcoming US Consumer Price Index data and Federal Reserve guidance for clearer signs on policy direction, and that until those signals arrive, risk appetite has been reduced.

Morgan Stanley Files for Bitcoin and Solana ETFs

Despite the volatile flows, Morgan Stanley filed with the US Securities and Exchange Commission to launch two spot crypto ETFs, one tracking Bitcoin and another tracking Solana (SOL). The filing followed a recent decision at Bank of America to allow advisers in its wealth management businesses to recommend exposure to four Bitcoin ETFs, indicating continued institutional interest in product availability.

Spot Ether ETFs Also See Outflows

Spot Ether ETFs showed a similar pattern on a weekly basis, posting net outflows of approximately $68.6 million and ending the week with total net assets of around $18.7 billion. This movement mirrors the broader risk-off sentiment that affected spot crypto ETF flows during the same period, and related coverage on short multi-day outflow episodes may be useful background stopped outflow series.

Why this matters

For miners, especially those operating in Russia with from a handful to many hundreds of rigs, ETF flows are a barometer of institutional sentiment rather than a direct operational factor. Large outflows can reflect reduced appetite from institutional investors, which may coincide with higher volatility in crypto markets and affect liquidity for large trades.

At the same time, the reported filings and adviser approvals show that product availability and institutional engagement continue alongside bouts of outflows, so the market's structural access points are still evolving. This means miners should watch institutional flow patterns as one of several signals about market conditions, without treating a single week of flows as decisive.

What to do?

Practical steps for miners to consider in light of these flows:

- Monitor liquidity and spreads on the exchanges you use; widen your cash buffer if market volatility increases and you need to convert coin to cover costs.

- Keep operational costs under control — check power contracts, maintenance schedules, and pool fees to preserve margins during short-term volatility.

- Diversify where you sell mined coins: use multiple exchanges or OTC desks to avoid slippage during episodes of reduced institutional demand.

- Follow macro announcements (US CPI and Fed guidance) mentioned by market participants, as these were cited drivers of the recent risk-off move.

- Keep an eye on product availability and institutional developments, such as the Morgan Stanley filing, which can change where big liquidity is routed over time.

These actions aim to help miners manage operational risk and liquidity without making trading calls; they are practical steps to stay resilient while institutional flows and macro signals evolve.