In 2025, the Bitcoin-to-gold ratio experienced a sharp decline, falling from about 40 ounces of gold per Bitcoin at the end of 2024 to roughly 20 ounces by the fourth quarter of 2025. This 50% drop reflects gold's strong performance relative to Bitcoin rather than a collapse in demand for the cryptocurrency. The macroeconomic environment of 2025 played a significant role in shaping this dynamic, with gold emerging as the dominant store-of-value asset during the year.

Overview of the Bitcoin-to-Gold Ratio Decline in 2025

The BTC-to-gold ratio halved over the course of 2025, signaling a notable shift in asset valuations. This change was driven primarily by gold's outperformance amid a unique economic backdrop, rather than a fundamental weakening of Bitcoin demand. Understanding the factors behind gold's rally and Bitcoin's relative underperformance provides insight into this market movement.

Factors Behind Gold’s Strong Performance in 2025

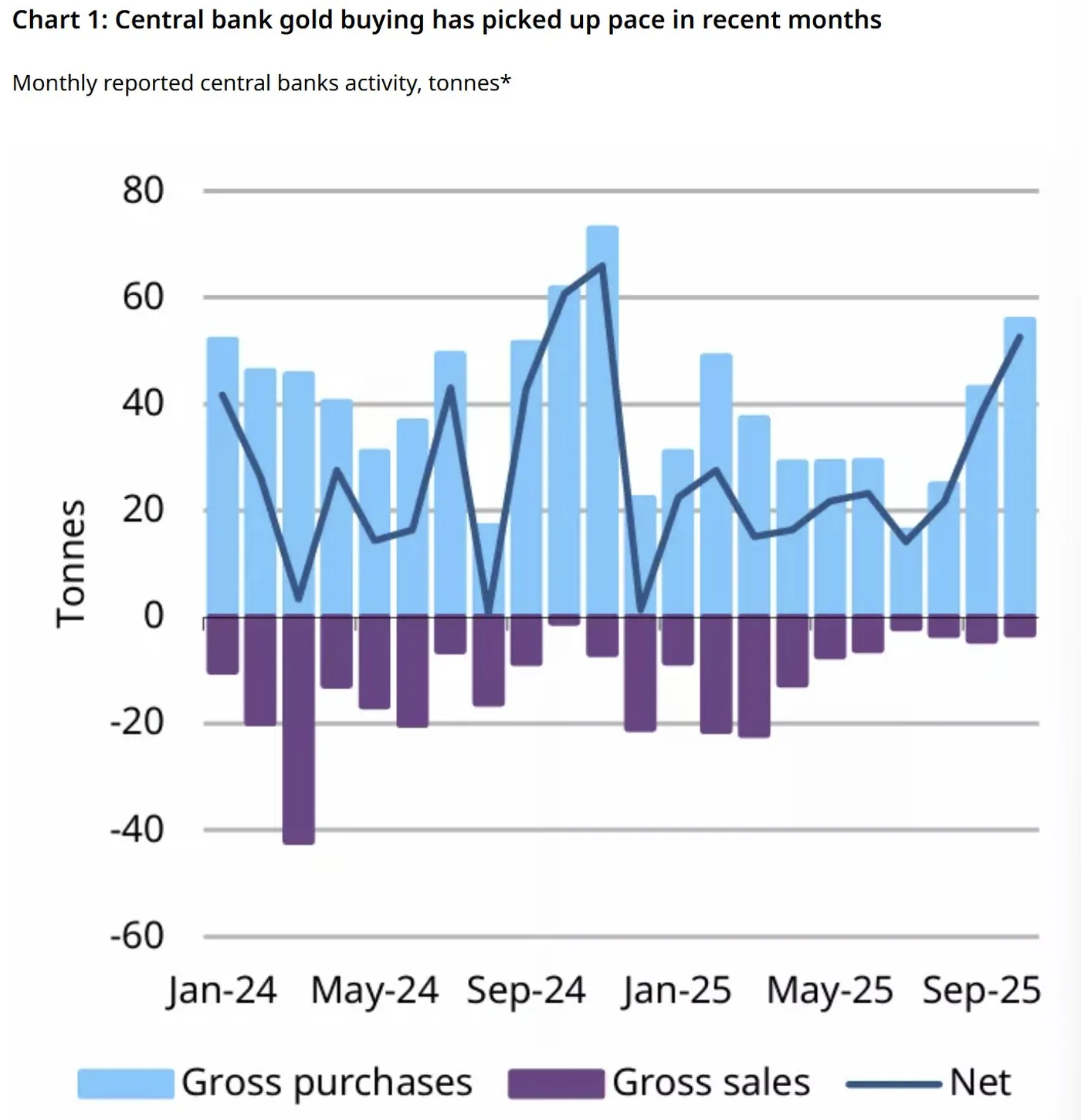

Gold delivered a remarkable year-to-date gain of 63%, surpassing $4,000 per ounce in the final quarter. Central banks played a pivotal role by purchasing a total of 254 tonnes of gold through October, with the National Bank of Poland contributing 83 tonnes. Additionally, global gold exchange-traded funds (ETFs) saw inflows of 397 tonnes in the first half of the year, pushing holdings to a record 3,932 tonnes by November.

This rally occurred despite generally restrictive US interest rates throughout most of 2025, with the Federal Reserve only beginning to ease rates in September. Elevated market volatility, reflected in the VIX rising to an average of 18.2 from 14.3 the previous year, alongside a 34% increase in geopolitical risk indexes, further boosted gold's appeal as a safe-haven asset. Consequently, gold functioned more as broad portfolio insurance than a traditional inflation hedge during this period.

Bitcoin’s Relative Underperformance and Market Dynamics

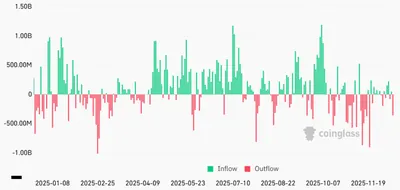

Bitcoin reached six-figure price levels in 2025 and initially benefited from strong demand for spot Bitcoin ETFs. Assets under management (AUM) for these ETFs increased from $120 billion in January to a peak of $152 billion by July. However, the second half of the year saw a decline in AUM to around $112 billion, reflecting net outflows amid price pullbacks and reduced capital inflows.

Onchain data indicated significant selling by long-term Bitcoin holders, who disposed of over 500,000 BTC during the year, including approximately 300,000 BTC worth $33 billion in October alone. This selling reduced long-term holder supply from 14.8 million BTC in mid-July to about 14.3 million BTC by year-end. Elevated real yields throughout most of 2025 increased the opportunity cost of holding Bitcoin, while its correlation with equities remained relatively high, contrasting with gold's safe-haven demand.

Implications and Outlook for 2026

The compression of the BTC-to-gold ratio in 2025 reflects a cyclical repricing between these assets rather than a structural breakdown in Bitcoin's long-term thesis. Gold's role as portfolio insurance amid tight US financial conditions and delayed monetary easing shaped its strong performance. Whether this trend will reverse in Bitcoin's favor in 2026 remains uncertain, as investors continue to weigh macroeconomic factors and market volatility.

Why This Matters for Miners

For miners operating in Russia with up to 1,000 devices, understanding these market shifts is important even if direct impacts seem limited. Gold's outperformance signals increased risk aversion and market uncertainty, which can influence cryptocurrency demand and price volatility. The decline in Bitcoin ETF assets and significant sales by long-term holders may affect liquidity and price stability, potentially impacting mining profitability.

What Miners Should Consider

- Monitor macroeconomic indicators such as US interest rates and geopolitical risks, as they influence Bitcoin and gold dynamics.

- Keep track of Bitcoin ETF trends and long-term holder behavior to anticipate potential price movements.

- Assess mining operations' cost efficiency to withstand periods of increased volatility or price pressure.

- Stay informed on related market analyses, such as forecasts on Bitcoin price trends and holder supply changes, to better navigate 2026.

For further insights on Bitcoin's outlook, miners may find value in analysis of long-term holder supply and price support as well as contrasting perspectives like Luke Gromen's bearish Bitcoin forecast for 2026.