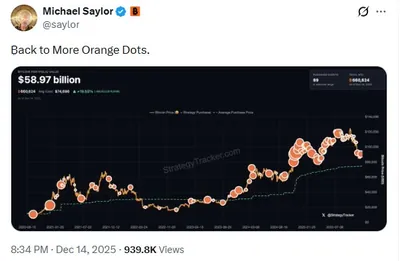

MicroStrategy’s founder posted a new image captioned “₿igger Orange,” a color-coded hint that has in the past preceded large bitcoin purchases. That pattern is notable because one week earlier a similar tease, “₿ig Orange,” was followed immediately by a confirmed acquisition of 13,627 BTC.

MicroStrategy's Latest Bitcoin Purchase Hint

On Sunday Michael Saylor shared the “₿igger Orange” image alongside the company’s purchase tracker, offering only a cryptic nod. Observers point to the prior sequence: a “₿ig Orange” post was followed the next day by a purchase announcement, so market attention has turned to whether the new hint signals another sizable buy. For background on Saylor’s recent social prompts, see Saylor’s earlier hint that preceded prior purchases.

Current Bitcoin Holdings and Valuation

MicroStrategy now reports holding 687,410 BTC, with that treasury valued at just north of $65 billion. The company’s overall spend on bitcoin totals $51.80 billion, producing a dollar-cost average of $75,353 per BTC, while company data shows a market Net Asset Value (mNAV) of 1.07.

Recent Purchase Details

On Jan. 12, 2026 MicroStrategy disclosed it acquired 13,627 BTC for $1.25 billion, paying an average price of $91,519 per coin. That purchase, confirmed publicly the day after a color-coded social post, is the most recent concrete addition to the firm’s bitcoin holdings; readers can review the company’s Jan. 12 update on the 13,627 BTC purchase.

Stock Performance and Market Context

The Nasdaq-listed MSTR has posted a year-to-date gain of 12.37% in 2026, reflecting recent positive price action in the stock. Company commentary and large treasury moves are regularly cited as drivers of investor attention toward MSTR, and MicroStrategy’s balance sheet metrics — including the mNAV — are used by market participants to assess valuation versus the company’s bitcoin holdings.

Approaching the 700,000 BTC Milestone

With the current holdings level, MicroStrategy sits 12,590 BTC short of reaching 700,000 BTC. If the “₿igger Orange” post signals a buy that equals or exceeds the prior 13,627 BTC tranche, the firm would pass the milestone and add to its already substantial treasury.

Why this matters

MicroStrategy’s large, public bitcoin purchases tend to attract media and investor attention, which can influence trading activity and sentiment across crypto markets. For individual miners, that attention can translate into short-term volatility in liquidity and order flow, even when underlying operations remain unchanged.

What to do?

Monitor official MicroStrategy updates and Saylor’s public posts to confirm any new purchases before reacting. Keep routine operational checks up to date: verify mining rigs’ firmware and monitoring, track electricity costs, and ensure payouts and wallets are functioning normally.

For miners in Russia with between one and a thousand devices, staying informed is the practical step: follow the company’s announcements, watch exchange order books if you trade, and avoid making operational changes based solely on social media hints. If you want the immediate context on Saylor’s signals and recent buys, review the linked coverage inside the article.