Corporate giant Strategy completed another Bitcoin acquisition, buying 1,229 BTC for $108.88 million in late December. This transaction increases the company’s on‑balance-sheet Bitcoin holdings and reflects its ongoing allocation to the asset class.

Overview of Strategy's Bitcoin Purchase

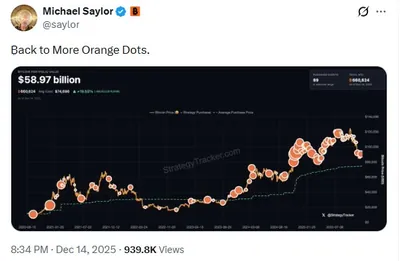

The latest purchase of 1,229 BTC for $108.88 million was finalized in late December and adds to an already large corporate treasury allocation. Following the transaction, Strategy’s total Bitcoin holdings stand at 672,497 BTC, with a reported market value of approximately $50.44 billion as of December 28. The company framed the acquisition as part of its continued commitment to holding Bitcoin as a treasury reserve.

Strategy's Bitcoin Accumulation Strategy

Strategy follows a methodical accumulation policy based on periodic dollar‑cost averaging rather than trying to time market swings. That disciplined approach is paired with a long-term orientation: the firm reports a year‑to‑date return on its Bitcoin investments of 23.2%, which the company cites when explaining its allocation. For custody, Strategy relies on a combination of cold storage and institutional‑grade custodians, details it has disclosed in public filings and earnings calls.

Corporate Bitcoin Holdings Landscape

With 672,497 BTC on its balance sheet, Strategy ranks among the largest corporate Bitcoin holders and serves as a notable example of treasury allocation to digital assets. Large corporate accumulations change how market participants view available supply and liquidity, and they set a precedent other firms may study when considering similar policies. For additional context on corporate buying patterns and other sizeable acquisitions, see MicroStrategy's large purchases and reports of other large purchases.

Expert Analysis on Bitcoin as a Treasury Asset

Observers point to several consistent rationales behind corporate allocations to Bitcoin: treating it as a scarce reserve asset, seeking diversification away from traditional cash holdings, and using disciplined accumulation rather than speculative timing. Improved accounting clarity and institutional custody options are also cited as enablers that reduce operational friction for companies adding Bitcoin to their treasuries. Strategy’s disclosures emphasize custody security and long‑term intent as part of its treasury policy.

Market Impact and Future Implications

A single acquisition of $108.88 million is typically absorbed by deep market liquidity without sharp price disruption, but repeated large purchases by institutional buyers can have cumulative effects on circulating supply and market perception. Strategy’s continued accumulation reinforces Bitcoin’s role in corporate treasury discussions and may influence how other firms evaluate digital assets as part of their balance‑sheet toolkit. The company highlights its 23.2% year‑to‑date return as a historical performance metric, without implying future results.

Почему это важно

Для майнера в РФ это решение компании важно прежде всего с точки зрения восприятия рынка: крупные корпорации, удерживающие большие позиции, меняют структуру доступного предложения, но немедленных изменений в работе майнинг‑фермы это не влечёт. При этом дисциплинированные покупки крупных держателей подтверждают, что спрос со стороны институционалов остаётся одним из факторов, на которые ориентируются участники рынка.

Что делать?

Если у вас от 1 до 1 000 устройств, сконцентрируйтесь на рутине: контролируйте расходы на электроэнергию, следите за безопасностью локального и удалённого доступа к оборудованию и планируйте техобслуживание. Для тех, кто хеширует и одновременно держит часть выручки в Bitcoin, имеет смысл использовать проверенные методы хранения — холодные кошельки или услуги институционального уровня, если доступно. Наконец, сохраняйте дисциплину в управлении рисками: учитывайте волатильность, храните резерв на покрытие расходов и не полагайтесь на отдельные корпоративные покупки как на основание для оперативных решений.