Strategy announced the purchase of 1,229 BTC for $108.8 million, an acquisition Michael Saylor disclosed publicly, with the company paying an average of $88,568 per coin. This buy increases Strategy’s total holdings to 672,497 BTC and adds to a multi‑year accumulation that has cost the company over $50 billion, at an average price of nearly $74,500 per bitcoin.

Strategy’s Latest Bitcoin Purchase

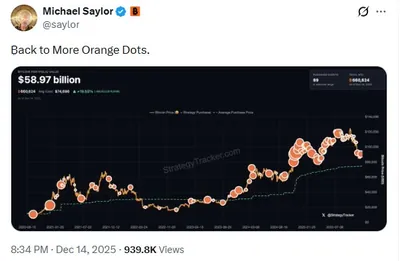

The company returned to the market this week and completed the 1,229 BTC acquisition for $108.8 million, with an average price of $88,568 per coin. Michael Saylor announced the buy on social media and had signalled a shift in tone prior to the transaction; he posted a message that many interpreted as a hint of further purchases, a point discussed in coverage of his recent activity hint of a new purchase.

Strategy’s Bitcoin Holdings Overview

Following this acquisition, Strategy’s vaults now contain 672,497 BTC, reflecting the company’s continued focus on accumulating bitcoin. Over the course of its buying program the firm has spent more than $50 billion to reach that total, and its average cost per coin stands at nearly $74,500. For background on how Strategy’s holdings have evolved, see reporting on the company’s stated positions and totals in related coverage of its current BTC holdings.

Financial Strategy and Criticism

In 2025 Strategy built a roughly $2 billion USD reserve intended to support dividend payments and interest obligations; that reserve was funded through share sales, a financing choice that some critics say diluted shareholders. The decision to use part of those dollar reserves to buy additional bitcoin drew direct criticism from Peter Schiff, who questioned the logic of selling down a treasury reserve to buy more bitcoin while the company’s stock trades at a discount to its bitcoin holdings. At the same time, shares of Strategy (MSTR) have fallen by over 45% year‑to‑date in 2025, a market reaction noted alongside the company’s cash management moves; coverage of the reserve increase provides more detail on that build-up built USD reserve.

Market Performance and Outlook

Strategy’s stock has declined significantly this year, and the firm’s public statements emphasise a long-term bullish view on bitcoin even amid short-term weakness. Michael Saylor has framed the current price environment as a moment to hold and accumulate, language he used when describing the company’s approach during the market downturn. The company’s actions combine continued buying with the establishment of cash buffers, a mix that has prompted both investor concern and commentary from critics.

Why this matters

If you run mining equipment in Russia with between one and a thousand devices, this corporate purchase does not directly change how you operate your rigs or your electricity arrangement. The news is mainly about Strategy’s treasury and financing choices; your day-to-day mining decisions—electricity, cooling, and hardware maintenance—remain unaffected by the company’s buy.

However, if you hold MSTR stock or follow Michael Saylor’s public signals, note that the company has been selling shares to build cash reserves and that MSTR has fallen over 45% YTD. Those developments affect shareholders and traders rather than mining output, but they can influence market sentiment that sometimes spills over into broader bitcoin coverage.

What to do?

- If you own MSTR shares, review your exposure: the company’s stock has been volatile and its financing moves have been criticised.

- Don’t change mining operations based solely on corporate purchases—focus on local costs, hardware efficiency, and regulatory compliance.

- Follow Saylor’s public posts for announcements about Strategy’s buys or reserve moves, since the company communicates updates via social media.

- Keep liquidity planning separate: maintain operational reserves for electricity and repairs rather than relying on market swings in bitcoin or MSTR stock.