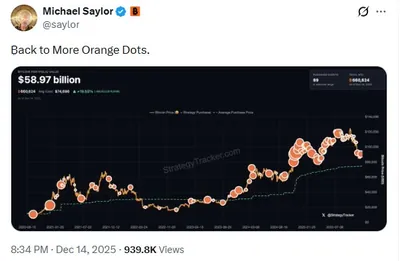

MicroStrategy rebranded to Strategy in early 2025 and repositioned itself around corporate Bitcoin ownership, adopting a Bitcoin-themed marketing approach to reflect that shift. As of Dec. 30, Strategy holds 672,497 BTC, acquired at an average price of $74,997 per coin and valued at nearly $59 billion. The company also said it established a $1.44 billion cash reserve to cover at least 12 months of preferred dividends and debt interest, a move intended to reassure investors about near-term obligations.

MicroStrategy’s Rebranding and Bitcoin Focus

In early 2025 MicroStrategy officially changed its name to Strategy and made Bitcoin central to its public identity. The corporate narrative now emphasizes its role as the world’s largest corporate Bitcoin holder, with the software business playing a much smaller part in valuation. That pivot has turned the company into a leveraged vehicle for BTC exposure rather than a traditional software-focused firm.

Current Bitcoin Holdings and Financial Status

By Dec. 30, Strategy had accumulated 672,497 Bitcoin, a balance purchased at an average cost of $74,997 per coin and valued at nearly $59 billion on the balance sheet. To address fixed cash obligations tied to preferred shares and debt, Strategy announced a $1.44 billion cash reserve on Dec. 1, 2025; the company framed this step as coverage for at least a year of dividend and interest payments, and it was followed by public discussion of its cash reserves. Strategy’s large BTC position remains the dominant factor in how the market values the company, overshadowing its legacy operating revenue and turning equity dynamics into a function of Bitcoin exposure rather than software performance.

Historical Context and Evolution

Strategy began accumulating Bitcoin in August 2020, first buying 21,454 BTC for $250 million as a treasury reserve asset. Since then, the company has financed further purchases through market offerings such as at-the-market equity programs, convertible notes and preferred stock, allowing it to add BTC without selling core holdings. The move to fair-value accounting for Bitcoin has also increased earnings volatility because unrealized gains and losses now flow through reported results each quarter.

Challenges and Risks in 2026

Key risks to Strategy’s model include servicing debt and preferred dividends, dilution from repeated equity issuance, and market volatility that can compress any equity premium the company enjoys. Index-provider consultations — including potential MSCI rule changes that could exclude crypto-heavy treasury companies — create the prospect of passive outflows and reduced demand, an argument explored in recent coverage of Nasdaq 100 risks. Competition from spot Bitcoin ETFs and tighter investor appetite for leveraged corporate BTC exposure are additional pressures that can make new issuance value-destructive.

Expert Opinions on Sustainability

Industry voices are split on durability. Jamie Elkaleh says the model "remains sustainable as long as the crypto market stays constructive," while warning about persistent dilution and sensitivity to interest-rate conditions. Marvin Bertin notes the approach performs well in strong bull markets but becomes strained in flat or choppy markets, and Joel Valenzuela highlighted the possibility of a significant Bitcoin correction that could stress the mechanics of Strategy’s capital structure. Together, these perspectives underline that market direction heavily influences how the company can finance and maintain its BTC position.

Bull vs. Bear Case Scenarios

In a bull scenario, a renewed Bitcoin rally could restore Strategy’s NAV premium and enable accretive equity issuance, improving the company’s ability to retire costly obligations. Conversely, in a bear scenario a persistent NAV discount would make equity raises destructive, increase the burden of preferreds and converts, and potentially force sales or discounted issuance that erode shareholder value. Investors are advised to monitor holdings, leverage ratios and issuance activity as leading indicators of which path Strategy is following.

Why this matters

For a miner in Russia operating from a single consumer rig to a small farm of several hundred devices, Strategy’s situation matters mostly through market channels rather than direct operational effects. If institutional vehicles tied to corporate BTC exposure contract or face forced outflows, liquidity and price dynamics for Bitcoin could shift, affecting miners’ revenue when they sell or convert BTC. At the same time, the company’s large holdings and any resulting market moves are one of many factors that influence price and demand for mined coins, so the impact on an individual miner can be limited but still material during sharp market stress.

What to do?

- Keep a short-term cash buffer to cover operating expenses during price drawdowns, so you do not need to sell mined BTC at low prices.

- Monitor market liquidity and institutional flows — shifts in demand from large holders or index-driven selling can increase volatility.

- Track key signals: BTC holdings, leverage in corporate vehicles, and issuance of preferred or convertible instruments that could pressure markets.

- Consider operational diversification (staggered energy contracts, GPU/ASIC mix) to reduce single-point risks tied to short-term price moves.

- Stay informed via trusted coverage of Strategy’s balance-sheet moves and related market developments, including reports on its Bitcoin holdings.