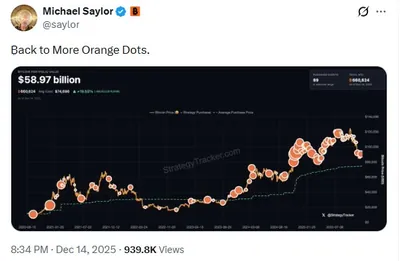

Michael Saylor's company, Strategy, currently holds 671,268 Bitcoin, representing approximately 3.2% of the total 21 million Bitcoin supply. At the time of reporting, these holdings are valued at around $58.61 billion, according to data from Saylor Tracker. This substantial accumulation highlights Strategy's significant presence in the Bitcoin market.

Overview of Strategy's Bitcoin Holdings

Strategy's Bitcoin stash accounts for a notable share of the total supply, with 671,268 BTC under its control. This equates to about 3.2% of all Bitcoin in existence. The current valuation of these assets stands near $58.61 billion, underscoring the scale of Strategy's investment in the cryptocurrency.

Recent Bitcoin Purchases by Strategy

Recently, Strategy acquired an additional 10,645 Bitcoin for $980.3 million, paying an average price of $92,098 per coin. These purchases are conducted through over-the-counter (OTC) desks, a method designed to handle large transactions discreetly and minimize any potential impact on Bitcoin's market price.

Comparison with Other Public Companies

Bitcoin entrepreneur Anthony Pompliano has expressed skepticism about any public company matching Strategy's Bitcoin holdings in the near future. Saylor's initial purchase in 2020 was around $500 million when Bitcoin traded between $9,000 and $10,000 per coin. To rival Strategy's current holdings, a company would need to raise hundreds of billions of dollars, a feat that appears unlikely given current market conditions.

Future Plans and Market Impact

Strategy's CEO, Phong Lee, has indicated that the company probably will not sell any Bitcoin until at least 2065. This long-term holding strategy addresses concerns about the company's potential influence on Bitcoin's price. Additionally, Michael Saylor has publicly stated his commitment to continuously buying Bitcoin, even at market peaks. Strategy's use of OTC desks for purchases further ensures that their acquisitions do not disrupt the market.

Why This Matters

For miners and investors in Russia and beyond, Strategy's massive Bitcoin holdings and long-term approach signal strong institutional confidence in Bitcoin's future. The company's method of buying through OTC desks helps maintain market stability, which is crucial for miners who rely on predictable price dynamics. Understanding Strategy's position can provide insight into broader market trends and potential price support.

What Should Miners Do?

- Monitor Strategy's buying activity as an indicator of institutional demand.

- Consider the stability provided by large holders who plan to retain Bitcoin long-term.

- Stay informed about market mechanisms like OTC desks that affect liquidity and price impact.