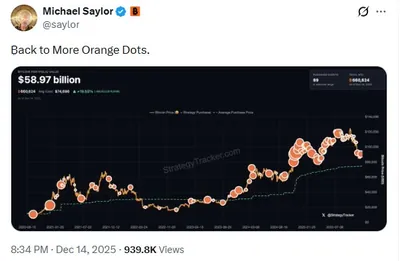

Bitcoin’s recent dip to around $75,500 briefly pushed the market price just below MicroStrategy’s average purchase cost of roughly $76,037 per coin, technically putting the firm ‘underwater’ on its bitcoin holdings. At first glance this sounds alarming, but the company’s position on the balance sheet is not immediately threatened: MicroStrategy currently holds 712,647 bitcoin, and none of these coins are pledged as collateral. That unencumbered status means a price drop alone does not create a forced-sale scenario, though it does reduce the attractiveness of raising new equity to buy more bitcoin.

MicroStrategy's Bitcoin Holdings Dip Below Cost Basis

The brief price move below the $76,037 average affects headline profitability on paper but does not by itself create liquidity pressure for the firm. Because all 712,647 BTC are unencumbered, there is no automatic collateral call tied to the holdings, and the company does not face an immediate balance-sheet-driven need to sell. For background on MicroStrategy’s broader position and historical holdings, see this earlier holdings report that outlines the scale of its bitcoin stack.

Financial Flexibility Amid Market Volatility

MicroStrategy carries $8.2 billion in convertible debt on its books, which is sizeable but structured with flexibility in mind. The company can roll maturities, convert debt into equity when terms allow, or pursue alternative instruments to manage obligations, and the first convertible-note put date isn't until the third quarter of 2027. Other bitcoin treasury firms have used tools like perpetual preferred shares to address similar liabilities, and MicroStrategy has comparable options available if it chooses to employ them.

Stock Performance and Historical Context

Fundraising is where the pressure manifests. MicroStrategy has traditionally used at-the-market (ATM) equity offerings to fund bitcoin purchases, a method that works best when the stock trades at a premium to its net asset value (mNAV). Last Friday, when bitcoin was in the roughly $89,000–$90,000 range, the company’s multiple was about 1.15x mNAV, indicating a premium to the value of its bitcoin holdings; the recent slide has flipped that premium to a discount below 1, which makes issuing new shares less attractive.

When shares trade below the bitcoin holding value, the company’s ability to add to its bitcoin stack slows: in 2022, while the stock spent much of the year under the holding value, MicroStrategy added only about 10,000 bitcoin. For coverage of the company’s recent balance-sheet moves and cash position, see the piece on its increased reserves.

Why it matters

For individual miners, including small operators in Russia running from one to a thousand devices, this development mostly affects market sentiment rather than immediate mining economics. MicroStrategy’s paper losses do not force the company to liquidate bitcoin holdings, so electricity costs, hardware operation, and local regulatory conditions remain the main drivers of a miner’s profitability. However, a sustained bitcoin price at or below MicroStrategy’s cost could weigh on equity markets and investor appetite for related instruments, indirectly influencing broader liquidity in crypto markets.

What to do?

- Keep operating decisions tied to your own cost structure: monitor electricity, cooling, and hardware efficiency rather than headline portfolio moves by large holders.

- Maintain a cash buffer to cover short-term expenses if price volatility affects revenue; large corporate moves rarely force immediate changes at the miner level.

- Follow funding and market-depth signals—if major holders slow buying because of an mNAV discount, expect slower inflows to the spot market, which can influence liquidity and spreads.

- Stay informed via reliable reports on the company’s convertible debt and maturity schedule, since those are the specific levers that could change corporate behaviour.

In short, the brief dip below MicroStrategy’s average cost is notable but not an immediate crisis: the firm’s 712,647 bitcoin are unencumbered, convertible debt maturities provide runway (with the first put date in Q3 2027), and past behavior shows buying can slow rather than stop when shares trade at a discount. Disclaimer: the analyst who wrote the original report discloses ownership of MSTR shares.