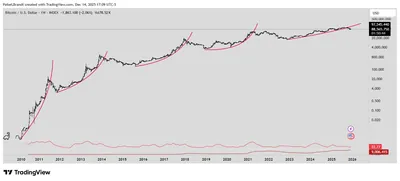

Cryptoquant's latest report describes a modest recovery in Bitcoin's price that nevertheless leaves the broader downtrend intact. The firm notes Bitcoin has climbed roughly 21% since Nov. 21, 2025, after a prior 19% drop that confirmed a bear market when the price fell below its 365-day moving average. While the recent rally resembles past bear-market bounces, Cryptoquant emphasizes the move has not yet produced a decisive regime change.

Bitcoin's Recent Price Rebound

Cryptoquant frames the current rise as a rebound typical of bear-market rallies rather than a confirmed uptrend. The report highlights that this recovery closely mirrors a similar pattern from 2022, when rallies also failed near the same technical threshold. The firm therefore treats the recent advance with caution rather than interpreting it as a clear breakout.

365-Day Moving Average as a Key Indicator

The 365-day moving average remains a central reference point in Cryptoquant's analysis, with Bitcoin approaching—but not reclaiming—that level, which is currently near $101,000. The analytics team describes this moving average as a long-standing regime boundary where past bear cycles saw price rejection before renewed downside. As such, the vicinity of the 365-day average is considered a meaningful technical zone rather than a simple moving target.

Demand Conditions and ETF Behavior

Onchain data show demand conditions have improved only slightly and remain weak overall, according to Cryptoquant. The Coinbase Premium Index briefly turned positive, indicating marginal improvement in U.S.-based buying interest, though these episodes were short-lived. Spot bitcoin ETFs tracked by the firm paused net selling after offloading roughly 54,000 BTC in November, but Cryptoquant says this pause is not yet evidence of sustained accumulation; see related analysis on slowing demand for more on demand dynamics.

Spot Demand and ETF Inflows

Cryptoquant reports that apparent spot demand has contracted by approximately 67,000 BTC over the past 30 days and has remained negative since late November. At the same time, ETF inflows in early 2026 totaled about 3,800 BTC, a figure Cryptoquant notes is nearly unchanged from the same period last year. Taken together, these measures suggest that ETF activity has not yet shifted into persistent net accumulation consistent with past recoveries.

Rising Exchange Inflows as a Risk Factor

Another concern highlighted in the report is growing exchange inflows: Bitcoin transfers to exchanges reached a seven-day average of roughly 39,000 BTC, the highest level recorded since late November. Cryptoquant links elevated exchange inflows historically with increased sell-side pressure, which the firm views as a material risk for sustaining the rally. This pattern reinforces the view that the market structure remains vulnerable until demand dynamics change materially.

Conclusion: Bear Market Still Intact

Cryptoquant concludes that both onchain and market indicators continue to support a bear-market framework rather than a confirmed trend reversal. The firm adds that the current trajectory does not have to repeat prior cycles exactly, but available data do not yet justify declaring the bear market over. For additional perspective on the 21% rebound and related risks, see the linked analysis on the recent price move 21% price rebound.

Why this matters

For a miner operating in Russia with anywhere from one to a thousand devices, these findings clarify market conditions that affect liquidity and exit pressure. Slight improvement in demand does not eliminate the increased exchange inflows and negative spot-demand readings that raise the chance of further selling pressure. Understanding that the 365-day moving average acts as a significant technical boundary helps place price action into a broader risk context for operational planning.

What to do?

- Monitor exchange inflows and spot demand metrics closely; sustained rises in transfers to exchanges can precede larger sell-offs.

- Keep an eye on the 365-day moving average near $101,000 as a reference for risk management rather than a guaranteed breakout level.

- Treat ETF activity as supportive but not definitive—current ETF inflows are modest and paused net selling after large November outflows.

- Adjust short-term cash management and power usage plans assuming market vulnerability, especially if you rely on spot market liquidity to liquidate mined coins.