Bitcoin rose above $90,000, but the price move has not translated into broad trader confidence. Options data and futures indicators show professional participants are still paying for downside protection and avoiding additional leveraged bullish exposure. At the same time, spot ETF outflows and a subdued futures basis point to limited conviction behind the rebound.

Bitcoin Reaches $90K: Market Reaction and Sentiment

The breakout above $90,000 prompted questions about whether sufficient momentum exists to push prices higher, yet derivatives market behaviour suggests caution. Put options traded at a premium on Saturday, meaning traders were willing to pay more for downside protection rather than chase upside exposure. Bitcoin’s price has also remained confined to a relatively tight 6% range over the past 20 days, which highlights the market’s reluctance to commit to a sustained trend.

Economic Uncertainty and Market Indicators

Broader market conditions have not provided a clear tailwind for crypto. The S&P 500 traded roughly 1.3% below its all-time high as investors expressed concerns about worsening economic conditions, a dynamic that can limit risk appetite across asset classes. In the same vein, Tesla reported weaker vehicle deliveries and its shares fell, while Chinese tech news offered some positive spillover; these mixed signals contributed to a cautious environment for risk assets.

Bitcoin Derivatives and Leverage Demand

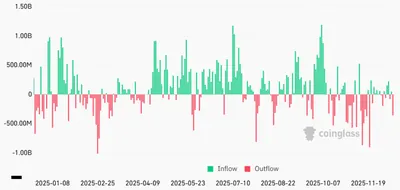

Demand for leveraged bullish Bitcoin positions stayed flat even as the price climbed, indicating traders were reluctant to add directional risk. The Bitcoin futures basis rate stood below the neutral threshold on Friday, which is another sign that bulls are not fully confident about further gains. At the same time, spot Bitcoin ETFs recorded more than $900 million in net outflows since Dec. 15, a factor that can sap immediate buying pressure.

Market Skepticism and Future Outlook

Options and derivatives point to lingering skepticism around the $90,000 level, though there are no signs of market panic. The continued premium on put options and a futures basis under the neutral mark show professionals prefer protection over leverage, and bond futures markets price only a modest probability of an early rate cut, which feeds into cautious positioning. Overall, confidence appears to be rebuilding slowly after a month-long consolidation near the current price band.

Related reading

For context on market structure and positioning, see the note on how Bitcoin has been stuck at $90,000 and analyses of open interest movements such as the open interest drop. If you want more detail on barriers around the $90K level, read why BTC can’t overcome $90K.

Почему это важно

Для майнера в РФ текущее состояние рынка означает, что крупные участники пока не готовы массово наращивать ставки на рост. Премии по пут‑опционам и оттоки из спотовых ETF говорят о том, что в краткосрочной перспективе ликвидность для резкого ценового подъёма ограничена. При этом отсутствие паники означает, что внезапных обвалов рынка тоже не наблюдается, но волатильность остаётся фактором риска для доходности майнинга.

Что делать?

Короткие практические шаги, которые полезно рассмотреть майнеру с 1–1000 устройствами:

- Проверить маржинальную устойчивость — избегайте использования кредитного плеча или дополнительного залога при высокой волатильности.

- Оптимизировать энергопотребление и расписание работы оборудования, чтобы снизить затраты в периоды низкой доходности.

- Мониторить ключевые индикаторы: движение ETF‑потоков и опционные премии, они подсказывают изменение настроений крупных игроков.

- Подготовить план действий на случай сильного ценового сдвига: своевременно резервировать средства на обслуживание и перенос нагрузки.