A coalition of Republican lawmakers in the U.S. House of Representatives is pushing to repeal the IRS rule that treats crypto staking rewards as taxable income at the moment they are received. Their stated goal is to have the rule withdrawn before it fully applies for the 2026 tax year. While the political effort proceeds, investors must still follow the current Treasury rules when reporting income.

What Is the Current Crypto Staking Tax Rule?

In 2023 the Internal Revenue Service introduced a rule changing how staking rewards are taxed: rewards earned from staking are considered taxable income at the moment they are received. The taxable amount is the fair market value of the tokens on the day they are credited to your account, even if you do not sell them. For example, receiving 1 ETH as a staking reward when ETH is worth $3,000 means you must report $3,000 as additional income for that year.

Why Are Lawmakers Demanding a Repeal?

Lawmakers advocating repeal argue that staking rewards are newly created property rather than traditional income, and that the current framework misclassifies them. That disagreement underpins the legislative push, which emphasizes withdrawing the rule before it applies to the 2026 tax year. Proponents of repeal say the rule should be revisited to better reflect how proof-of-stake networks create and distribute new tokens.

Practical Challenges for Investors

The IRS rule introduces several operational problems for people who receive staking rewards, from individuals to larger participants. These issues affect liquidity, accounting and overall costs of participation in staking networks.

- Liquidity pressure: You can owe tax on rewards you haven’t converted to cash, which may force sales of other assets to cover the tax bill.

- Recordkeeping complexity: Tracking the exact fair market value of frequent, small staking rewards across multiple protocols creates administrative burden.

- Higher compliance costs: The added time and resources needed to log and report each reward increase costs for individual participants and operators.

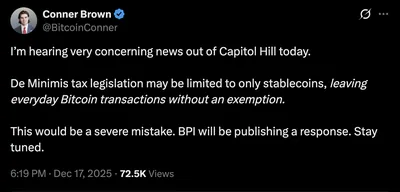

Impact on the Future of Crypto in America

The legislative fight could shape how institutions and retail investors view proof-of-stake networks in the U.S. Supporters say a repeal would be a significant win for the digital asset sector and could encourage greater participation in networks such as Ethereum, Cardano and Solana. Conversely, if the rule remains, it may push development and investment to jurisdictions with more favorable tax treatments, a point raised by repeal proponents.

Почему это важно

Если вы майните в России и владеете от одного до тысячи устройств, прямая юридическая сила этого решения относится к налогоплательщикам в США, но практические последствия всё равно важны. Для майнеров это означает повышенное внимание к учёту вознаграждений, возможную потребность в ликвидности для уплаты налогов и рост операционных расходов на ведение отчётности. Кроме того, обсуждение в США может повлиять на рыночную инфраструктуру и доступность сервисов, хотя это не меняет ваши местные налоговые правила автоматически.

Что делать?

Действия перечислены просто и по существу — они применимы для майнера с любой парой устройств, от одного до тысячи. Во-первых, ведите подробный учёт всех полученных стейкинг-вознаграждений и их стоимости на момент зачисления; это прямо предписано действующим правилом и поможет при подготовке отчётности. Во-вторых, проконсультируйтесь с налоговым специалистом, который разбирается в криптовалютах и может подсказать, как документировать и сохранять данные для возможных перекрёстных проверок.

Наконец, следите за законодательной динамикой и нормативными инициативами в США и за их обсуждением в отрасли, поскольку изменения в правилах могут повлиять на сервисы и условия работы — например, на предложения по federal tax changes и на конкретные налоговые инициативы как Digital Asset PARITY Act.

FAQ

Q: What exactly is being taxed under the current IRS rule?

A: The IRS taxes the fair market value of crypto tokens you receive as staking rewards at the exact moment they are added to your wallet; that value is treated as ordinary income.

Q: When are lawmakers urging repeal?

A: Republican lawmakers are urging that the IRS staking tax rules be repealed before they take full effect for the 2026 tax year.

Q: How is the taxable amount calculated?

A: Taxable income is the fair market value of the reward on the day it is credited to you; the rule treats that value as part of your annual income even if you don’t sell the tokens.

Q: Does this federal rule apply regardless of state residence?

A: Yes. The IRS rule is federal and applies irrespective of the state in which a U.S. taxpayer resides.

Q: What should I do right now as an investor?

A: Maintain meticulous records of all staking rewards and their values at receipt, and consult a tax professional familiar with cryptocurrency until and unless the rule is repealed.