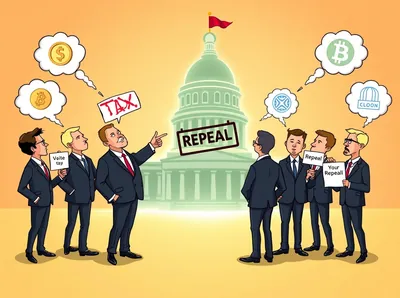

The proposal for a de minimis exemption on crypto transactions in the US has reignited public discussion about which assets will qualify for the relief. Representatives from the Bitcoin Policy Institute (BPI) warn that lawmakers are currently considering exemptions only for dollar-pegged stablecoins and excluding Bitcoin, which Conner Brown, BPI's Head of Strategy, calls a "serious mistake." Senator Cynthia Lummis's bill also specifies concrete limits and additional provisions for donations and income from mining or staking.

What is the de minimis tax exemption?

The de minimis exemption is a rule that exempts small transactions below a set threshold from taxation to reduce administrative and calculation burdens. In the context of cryptocurrencies, such rules allow small transfers or sales to be excluded from the tax base when their amounts are negligible compared to accounting costs. The main idea is to simplify tax calculations and make everyday payments more convenient for users and merchants.

Bitcoin Policy Institute's position on tax exemption

The Bitcoin Policy Institute is a nonprofit organization advocating for Bitcoin's interests in policy and regulation, with its representatives actively commenting on current initiatives. Conner Brown, leading BPI's strategy, stated that lawmakers are currently considering de minimis exemptions only for stablecoins and called Bitcoin's exclusion a "serious mistake." BPI emphasizes that the lack of relief for BTC hinders its use as a medium of exchange rather than just a long-term store of value.

Senator Cynthia Lummis's bill: details and implications

The core of Senator Cynthia Lummis's proposed bill is to set a de minimis threshold of $300 per transaction and a total annual limit of $5,000 for tax exemptions on transactions and sales. The bill's text also includes tax benefits for digital assets used for charitable donations and tax deferral for cryptocurrencies earned through proof-of-work mining or staking. These provisions affect which transactions and asset categories can expect a simplified tax regime.

Criticism of the exemption idea for stablecoins

One major criticism of limiting de minimis only to stablecoins is a logical contradiction: stablecoins are designed to maintain stable value, so the need to exempt small exchanges of them from taxes raises questions. "Why even have de minimis for stablecoins?" wrote Marty Bent, founder of the media company Truth for The Commoner (TFTC). "They don't change in value. It's pointless," he added. Critics' positions highlight the fundamental difference between stablecoins and Bitcoin, which is important to consider when discussing exemptions.

Bitcoin as a payment method: current challenges

In the whitepaper authored under the pseudonym Satoshi Nakamoto, Bitcoin was described as a "peer-to-peer electronic cash system." In practice, using BTC as a payment method is limited by relatively high fees and an average block confirmation time of about 10 minutes, making small everyday transactions inconvenient. In this context, secondary solutions like the Lightning Network aim to speed up and reduce the cost of payments by conducting many transactions off-chain with subsequent settlement on the blockchain.

Why this matters

For a miner with 1–1000 devices in Russia, the US de minimis discussion does not directly change Russian regulations but remains a useful indicator of international trends in crypto regulation. An important point for miners is that Lummis's proposal includes a tax deferral clause for crypto earned through mining or staking, showing legislative attention to mining income. However, excluding BTC from small payment exemptions leaves out the ecosystem segment many miners are interested in as a payment method.

What to do?

Brief practical recommendations for miners in Russia: first, continue keeping accurate records of mined and sold coins, including dates and transaction amounts, to provide data to regulators if needed. Second, monitor bill texts and comments from relevant organizations—for example, there is a detailed analysis on stablecoin tax benefits in the article tax benefits for stablecoins, and on general initiatives and Bitcoin projects in the article Tax Benefits Bill. Finally, if you use BTC for internal payments, consider possible adoption of the Lightning Network, which makes micropayments faster and cheaper, and keep track of international regulatory changes, such as federal rule changes.

In brief

Currently, the US de minimis discussion focuses on stablecoins, and Lummis's proposed scheme includes thresholds and benefits that may affect mining income. Miners in Russia should maintain records and monitor developments to respond quickly to changes in international practice.