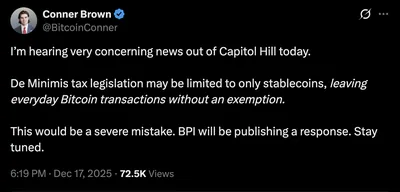

A bill has been introduced in the US Congress proposing to ease tax requirements related to cryptocurrency payments and operations. The initiative covers stablecoin transactions as well as taxation of profits from staking and mining, and was prepared by Ohio Congressman Max Miller together with Nevada Representative Steven Horsford.

Goals and Sponsors of the Bill

The authors of the document stated the goal of adapting the Tax Code to the practice of using cryptocurrencies as a payment method and reducing tax barriers for retail transactions. Max Miller and Steven Horsford propose to account for minor price fluctuations so that they do not generate taxable income.

Tax Relief for Stablecoin Transactions

The key provision of the bill is a tax exemption for all stablecoin transactions up to $200. The relief applies only to regulated coins pegged to the US dollar and requires issuers to be authorized to operate under the GENIUS Act.

- Tax exemption up to $200 for stablecoin transactions.

- Applies only to regulated USD-pegged coins.

- Issuers must be authorized under the GENIUS Act.

- Relief does not apply to brokers and dealers.

The document also specifies that the relief is void if the stablecoin’s price deviates significantly from its nominal value. As part of control measures, lawmakers proposed a set of rules aimed at preventing abuse and inconsistencies in reporting.

Regulation of Staking and Mining

A separate section of the bill addresses taxation of profits from staking and mining. The authors propose temporarily exempting such profits from tax for five years to avoid situations where tax must be paid immediately upon income recognition.

At the same time, the bill preserves regulators’ ability to impose additional control and reporting requirements to reduce risks of rule circumvention through unregulated schemes.

Additional Measures and Oversight

The document includes provisions to counteract abuse and clarifies conditions for applying relief when stablecoin prices deviate significantly. These provisions aim to reduce fraud opportunities and maintain transaction transparency.

Alongside the initiative, the bill text outlines the role of the US Treasury in potentially introducing further control and reporting requirements, implying stricter procedures for market participants.

Why This Matters

For a miner or small farm operator in Russia, the direct financial benefit of such relief may be indirect but significant: simplifying rules for retail transactions could increase the convenience of using stablecoins in payment scenarios. The bill itself does not eliminate obligations for sellers and platforms but sets the framework in which transactions can become less tax burdensome.

Moreover, increased control and reporting requirements may lead services working with cryptocurrencies to change their user cooperation rules. Therefore, these changes are important not only for stablecoin users but also for the infrastructure around them.

What to Do?

If you mine in Russia and use or plan to use stablecoins in transactions, it is useful to prepare in advance for possible changes in rules and reporting requirements. Below are practical steps that do not require new legal interpretations but help minimize risks and maintain order in accounting.

- Monitor changes in US legislation and statements from authorized bodies to understand which issuers are considered regulated.

- Document operations: keep statements and internal records of transactions, especially during stablecoin conversions and transfers.

- Check the stablecoin issuer’s status regarding GENIUS Act requirements before accepting coins for transactions.

- Keep in mind that relief does not apply to brokers and dealers — clarify tax and reporting obligations when working through such services.

- Consult a tax specialist if necessary to correctly reflect staking and mining income in accounting.

For understanding related topics, it is helpful to review materials on compliance with anti-money laundering requirements and on implementing stablecoin support in payment infrastructure. For example, see the article on the anti-money laundering law and the material about stablecoin support in top-up services.