The Digital Asset PARITY Act is a bipartisan bill aimed at aligning the taxation of digital assets with principles already applied to stocks and commodity markets. It was introduced by Representatives Steven Horsford and Max Miller on December 20, 2024, and proposes comprehensive amendments to the U.S. tax code focusing on clarity and comparability of rules.

What is the Digital Asset PARITY Act?

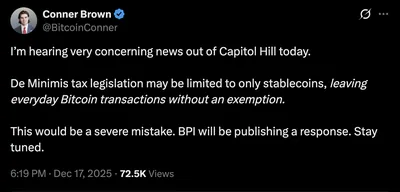

The bill’s goal is to eliminate excessive compliance requirements and close major loopholes for abuse, while aligning digital asset taxation with long-standing tax principles. Key provisions include establishing de minimis and deemed-basis frameworks for regulated, dollar-pegged payment stablecoins, bringing these digital “dollars” closer to cash treatment in routine transactions and reducing mandatory reporting burdens.

The initiative also includes provisions clarifying source-of-income rules for nonresidents and other areas of digital asset tax regulation, aiming to make rules more practical and understandable. This is part of a broader agenda to revise crypto taxation; see the article on current urgent federal rule changes.

New Rules for Miners and Stakers

One central change addresses so-called “phantom income.” The bill creates a voluntary scheme allowing miners and stakers to defer income recognition from digital rewards until a clearly defined point, after which such income is recognized as ordinary income and establishes the basis for future capital gains calculation.

This change formally gives taxpayers a choice—to recognize income immediately or use the deferral option set forth in the bill. It is important to maintain thorough documentation of received rewards and the chosen accounting policy, as this determines the timing of taxation and basis calculation.

Changes for Traders and Investors

For professional traders and dealers, the bill permits the use of mark-to-market accounting, putting them in a position similar to participants in securities markets and allowing different recognition of trading results. Simultaneously, the bill includes provisions aimed at preventing profit deferral through offsetting positions.

The bill also introduces approaches to stablecoin treatment, viewing regulated dollar-pegged payment stablecoins more as a payment method in routine operations. In practical terms, this aligns with initiatives to simplify crypto transaction accounting in business tools; see the article on simplifying crypto taxation.

Impact on Foreign Investors and Charitable Contributions

The bill clarifies source-of-income rules for nonresidents, affecting tax consequences of digital asset transactions on U.S. platforms. It also proposes amendments simplifying the approach to charitable donations in cryptocurrency by distinguishing highly liquid assets from less liquid or speculative tokens.

These clarifications aim to make tax rules less arbitrary and more administrable, especially where clear criteria for liquidity and income source assessment were previously lacking.

Why It Matters

Whether you mine in Russia on one or a thousand devices, the key effect is the change in the timing of income recognition. The ability to defer reward recognition means tax accounting and reporting may require new records and procedures to track basis upon subsequent asset sales.

Additionally, stablecoin rules and mark-to-market accounting for professionals change interaction practices with foreign platforms and calculation services. Even if you don’t work directly with U.S. platforms, changes in international practice may affect service conditions and third-party reporting.

What to Do?

- Monitor the bill’s text and progress, especially if you use foreign exchanges or payment services.

- Keep detailed records of mining and staking rewards: record receipt time, amounts, addresses, and subsequent transactions.

- If you trade professionally or plan to use mark-to-market accounting, consult a tax advisor familiar with U.S. rules.

- Review contracts and service terms with payment providers and platforms, especially when using stablecoins for payments.

- Assess whether additional internal procedures are needed to track basis and reporting if you choose to defer income recognition.