The author argues stablecoin issuers should consider giving up interest programs to win clear, regulated rails for digital dollars. This is framed as a strategic trade-off: sacrifice yield that banks can easily replicate in exchange for settlement, interoperability and regulatory legitimacy that banks cannot reproduce. The piece insists the industry should shift the fight from interest-rate dynamics to utility and access.

Key takeaway

Concede on yield to remove a major policy obstacle and prioritize stablecoins’ core strengths: settlement, permissionless transfer and interoperability. According to the author, doing so could clear the way for the CLARITY Act to advance early next year and unlock partnerships with banking infrastructure.

What U.S. banks are demanding

A coalition of U.S. banks is urging lawmakers to rewrite the GENIUS Act to target reward structures offered by non-bank stablecoin issuers. They describe the ability for crypto platforms to offer yield on digital dollars as a “loophole” and warn it could siphon deposits away, citing the potential for $6 trillion in portable deposits to leave their balance sheets. This push frames yield as a risk to traditional deposit models and a regulatory priority for banks.

Why the author supports conceding yield

The author’s central claim is that "The revolution of stablecoins has never been about interest rates." Stablecoins, he writes, are valuable because they enable 24/7 settlement, programmable finance and non-custodial digital sovereignty, not because they offer savings returns. If users want yield, "they have a dozen DeFi protocols or traditional treasury bills to choose from," making yield a secondary and replicable feature.

Implications for stablecoin issuers and users

Conceding yield could reduce regulatory friction and facilitate stablecoin access to banking infrastructure, partnerships and regulated rails that have been stalled by compliance uncertainty. The author argues this preserves features banks cannot easily copy—permissionless transfer and interoperability—while moving the policy debate away from capital and interest-rate arguments. For users and issuers, the trade-off is framed as giving up a contest over APY to gain long-term integration and legitimacy.

What to watch next (policy and market signals)

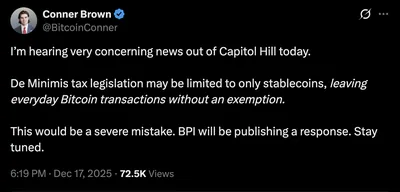

Key indicators include progress on the CLARITY Act after yield debates are removed, legislative changes to the GENIUS Act, and new partnerships between stablecoin issuers and banking or payment rails. Watch for formal rule proposals and industry announcements that signal greater access to regulated banking infrastructure; related coverage includes reporting on FDIC GENIUS rules and regulatory roundtables such as the SEC privacy roundtable that shape supervisory expectations.

Why this matters

For operators and users, regulatory clarity determines how easily stablecoins plug into banks, on-ramps and off-ramps. Clear rules can lower compliance uncertainty that has blocked deeper banking partnerships, while keeping settlement and interoperability intact. The author also contends that the argument banning yield hurts the unbanked is weak, because underbanked users adopt stablecoins for broken payment rails and failing local currencies rather than for APY.

What to do?

If you run mining or node operations (from a single device to a small farm), prioritize practical steps that reduce operational risk and preserve access to value rails. First, monitor policy developments around the GENIUS and CLARITY Acts so you can anticipate changes to on-ramps and banking relationships. Second, maintain diversified liquidity and custody arrangements that keep your holdings usable for settlement even if yield programs change.

- Keep funds in trusted custody or non-custodial wallets to preserve interoperable settlement capabilities.

- Explore alternative sources of yield if needed, remembering that "a dozen DeFi protocols or traditional treasury bills" exist outside stablecoin reward programs.

- Track announcements on issuer–bank partnerships and regulatory guidance that affect on-ramps and compliance requirements.

About the author

Adrian Wall is Senior Director of U.S. Policy at TRON DAO and Managing Director of the Digital Sovereignty Alliance (DSA). He directs DSA’s Learning Team, developing blockchain education programs for policymakers, universities, and financial institutions, and has advised on bipartisan legislative efforts including the GENIUS Act and the Clarity Act. He is a frequent speaker at forums such as the United Nations, CoinDesk, Nacha, and the DCBlockchainSummit.

In his conclusion the author states: "Let the banks keep their yield. We will take the future of money."