Bitcoin failed to hold $97,000 as the market’s momentum weakened and retail traders largely stayed on the sidelines. The perpetual futures funding rate stalled at 4%, suggesting limited demand for leveraged bullish positions. After an 8%, three-day rebound that wiped out $465 million in short BTC futures, BTC’s price stabilized near $95,500.

Bitcoin Rally Collapses at $97K

The recent pullback erased gains above $97,000 and left investor sentiment fragile. The perpetual funding rate stood at 4% on Thursday, a level that points to muted appetite for long leverage among traders. Despite the retracement, the three-day upswing removed a large amount of short exposure, after which the price settled around $95,500.

Retail Traders' Skepticism

Retail traders have remained largely sidelined even as BTC bounced, with derivatives and web-search metrics showing limited participation. Google Trends records global search interest for “crypto” at 27 on a 0–100 scale, a figure not far from the 12-month low of 22, which underscores softer public attention. Concerns about socio-political risks and questions around the Federal Reserve’s independence also contribute to cautious retail behavior.

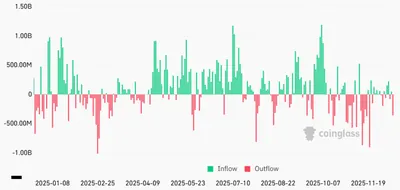

Institutional Investors' Role

Institutional buying of spot Bitcoin ETFs continues to feature in the background and may provide demand support. The Bitcoin spot ETF industry has surpassed $120 billion in assets, while public companies have accumulated more than $105 billion in Bitcoin across their treasuries. That steady institutional interest is cited as a potential counterbalance to weak retail flows.

Market and Political Uncertainty

Broader uncertainties are part of the market picture and affect sentiment across investor types. Fed Chair Jerome Powell’s term ending in April has traders anticipating changes to policy later in the year, and political tensions—such as threats by Trump to retaliate against Iran—have added to the risk backdrop. These factors help explain why some participants prefer to wait on the sidelines rather than push for fresh leveraged longs.

Why it matters for a miner in Russia

If you run one device or a small farm, muted retail demand and a stalled funding rate mean liquidity and short-term trading activity may stay low, which can keep intra-day volatility reduced. Institutional flows and large corporate treasuries provide a possible floor under prices, but they do not change your operational costs or local electricity needs. At the same time, macro and geopolitical uncertainty can affect market sentiment quickly, so staying aware of funding-rate moves and ETF flows helps you read short-term market behavior.

What to do?

- Monitor funding rates and price levels: track the 4% perpetual funding rate and spot price near $95,500 to understand demand for leveraged longs.

- Keep operational costs under control: audit power usage and prioritize uptime during profitable hours to protect margins regardless of short-term price swings.

- Plan position decisions: avoid reactive selling on brief pullbacks if your horizon is long-term, and consider small, staged actions if you need liquidity.

- Follow institutional flows: watch spot ETF asset levels and corporate BTC purchases as indicators of larger, non-retail demand that can affect broader trends.

For more context on derivatives and retail participation, see reporting on the open interest drop. For a broader perspective on where BTC has been trading over recent months, read our piece about the price stuck at $90K.