Bitcoin briefly jumped above $92,000 on Monday after US federal prosecutors opened a criminal investigation into Federal Reserve Chair Jerome Powell. The price move was short-lived and occurred alongside notable institutional flows and mixed derivatives signals. Traders and analysts pointed to ETF outflows and muted demand for bullish leveraged positions as reasons for skepticism about a sustained rally.

Bitcoin Price Surge Amid Fed Chair Investigation

The immediate market reaction to news of a DOJ inquiry into the Fed chair pushed BTC above $92,000 but did not trigger broad conviction among traders. Political and regulatory developments can spark volatility, yet in this case the rally coincided with other indicators that limited upside follow-through. For deeper background on the probe and its market implications, see Powell investigation.

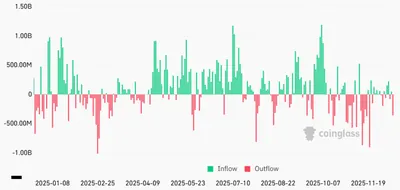

Institutional Outflows and Market Sentiment

Institutional selling was measurable: Bitcoin spot ETFs recorded $1.38 billion in net outflows across four trading sessions. At the same time, BTC futures showed a neutral annualized premium — a 5% basis rate — which is well below the roughly 10% premium often associated with strong bullish momentum. These two facts together help explain why traders remained cautious despite the intraday price spike.

MicroStrategy’s $1.25 Billion Bitcoin Purchase

Corporate demand presented a counterpoint: MicroStrategy added $1.25 billion worth of Bitcoin in January 2026, marking its largest purchase since July 2025. That buying pressure coexisted with ETF outflows, creating conflicting signals for price direction. The divergence between concentrated corporate accumulation and broad institutional redemptions contributed to mixed market sentiment; for more on persistent resistance near $90K see why BTC can't pass $90K.

Macroeconomic Factors Affecting Bitcoin

Macro news also shaped traders' mindset. Goldman Sachs no longer expects an interest rate cut in March 2026, which removes one potential tailwind for risk assets. The US Dollar Strength Index rebounded to 99 from a 96.7 low in late November 2025, underscoring that a broad weakening of the dollar has not materialized despite fiscal concerns. Powell’s term as Fed chair ends in April 2026, a development noted by market participants when assessing future monetary-policy direction.

Bitcoin vs. Traditional Safe Havens in 2026

Despite the recent rebound, Bitcoin is still down 23% since October 2025 while gold and silver reached all-time highs in 2026. That divergence has led some traders to question the strength of Bitcoin’s store-of-value narrative in the current environment. Combined with ETF outflows and muted futures premiums, the data suggest limited odds of an immediate, sustained breakout above recent highs.

Почему это важно

Если вы майните в РФ, эта новость показывает, что даже крупные политические события дают лишь краткосрочную волатильность для BTC, а не гарантию продолжительного роста. При этом институциональные оттоки и нейтральный фьючерсный базис означают, что спрос со стороны крупных игроков остаётся слабым, что может ограничивать периоды устойчивого повышения цен.

Что делать?

Для майнера с 1–1000 устройств полезны простые, практические шаги, которые не зависят от предположений о крупном тренде.

- Мониторьте потоки ETF и фьючерсный базис: следите за изменениями $1.38B оттока и 5% базиса — они отражают институциональный спрос.

- Оценивайте рентабельность майнинга регулярно: пересчитайте себестоимость с учётом текущих цен и тарифов, чтобы решить, стоит ли временно снижать нагрузку на оборудование.

- Диверсифицируйте риски: держите резервы в валюте, которую вы используете для операционных расходов, и по возможности избегайте перекрытия долговыми обязательствами, завязанными на цене BTC.

- Не реагируйте на одиночные рыночные всплески: краткосрочные движения после новостей могут быстро разворачиваться, поэтому принимайте решения на основе нескольких индикаторов.