Bitcoin lost momentum at the end of January 2026, sliding 8.3% in 24 hours and 13.6% over the prior week. The market hit an intraday low of $75,555 on Bitstamp, and the broader crypto economy shrank to roughly $2.6 trillion as month-end liquidity thinned.

Bitcoin Price Collapse in Late January 2026

The final trading days of January pushed bitcoin notably lower, with the intraday trough recorded at $75,555 on Bitstamp. That sharp move came on top of a weekly decline of 13.6%, leaving markets strained as buyers stepped back amid thinner weekend conditions. For additional context on month-end levels, see the discussion of the monthly close level.

Institutional and Miner Selloff

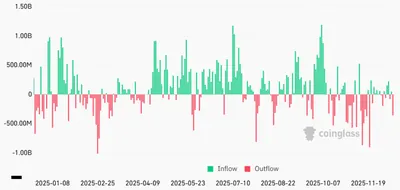

Institutional flows and miner distributions were a major drag on price: spot crypto ETF investors pulled nearly $1 billion in a single day on Jan. 30, including $528.3 million from bitcoin funds alone. This wave of ETF outflows reduced demand and helped amplify downward pressure.

At the same time, on-chain analytics showed miner activity that added to supply on exchanges. Glassnode reported miners are "consistently sending BTC to exchanges," a pattern the firm described as creating structural sell pressure and contributing to ongoing price weakness.

Geopolitical Tensions Drive Risk-Off Sentiment

Escalating U.S.-Iran tensions in late January 2026 pushed markets toward risk-off behavior, reducing demand for assets viewed as risk-on. Bitcoin fell below $80,000 to the $75,555 intraday low as reports of strikes and explosions in the region coincided with already thin liquidity. The sell-off was not isolated to crypto: precious metals also experienced downward pressure during the same period.

Regulatory Uncertainty from CLARITY Act Delay

The prospect of a U.S. government shutdown as of Jan. 31, 2026, effectively stalled the Digital Asset Market Clarity Act (CLARITY Act), removing near-term momentum for clearer rules on digital assets. The shutdown threat also constrained SEC operations, shrinking staff capacity and freezing approvals, which market participants cited as a drag on ETF adoption and capital flows into the sector.

Why this matters

For miners, the recent moves mean lower USD proceeds when selling mined BTC and potentially thinner liquidity when exiting large positions. Institutional outflows and miner distributions can push prices down quickly, so even small operations may see balance-sheet volatility if they sell into these conditions.

Regulatory pauses and geopolitical risk primarily affect demand and market sentiment rather than mining fundamentals such as hash rate or hardware performance. Still, weaker prices and tighter liquidity can make operations that rely on frequent coin sales or leverage more vulnerable until conditions stabilize.

What to do?

- Review your cash flow: map expected expenses and how long current BTC reserves need to cover them before selling.

- Stagger sales: if you must sell, spread orders over time to avoid executing large trades into thin markets.

- Prioritize security: move long-term reserves to cold storage and keep operational funds separate to reduce exposure.

- Monitor on-chain and ETF flows: watch miner distributions and ETF flows as indicators of supply pressure and liquidity.

- Optimize costs: check power and maintenance schedules to lower short-term outlays and extend runway during weak price periods.