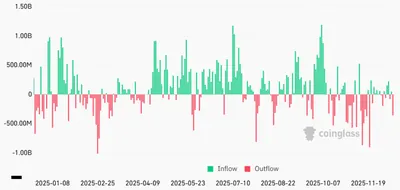

The compression of Bitcoin futures spreads has sharply reduced the profitability of the classic cash-and-carry arbitrage that once attracted large institutional capital. Data show one-month annualized Bitcoin basis yields have fallen to around 5%, down from roughly 17% a year ago, narrowing the premium available to large players. At the same time, open interest dynamics on major venues are shifting the market structure and the ways institutions trade.

Decline in Bitcoin Arbitrage Yields

The cash-and-carry trade — buying spot Bitcoin and selling futures to capture the basis — has become much less lucrative as spreads tightened. With one-month annualized basis yields near 5% and one-year U.S. Treasuries yielding about 3.5%, the excess return that used to cover financing and execution costs has largely evaporated. That move from roughly 17% to near 5% a year later is the core reason many large accounts are reassessing the strategy.

Shift in Bitcoin Futures Market

Open interest in Bitcoin futures on the Chicago Mercantile Exchange (CME) has dropped below $10 billion after peaking above $21 billion, and for the first time since 2023 now trails Binance’s futures interest. Binance’s open interest has held steady near $11 billion, reflecting the growing role of perpetual contracts that dominate crypto volumes. This change in venue mix and liquidity affects how easily large arbitrage positions can be put on and hedged; for additional context on market flows see the open interest fall report.

Institutional Pullback and Strategy Changes

Market participants report a pullback from hedge funds and large U.S. accounts in traditional basis trades rather than an outright exit from crypto exposure. CME noted that 2025 marked a turning point, with improved regulatory clarity encouraging institutions to expand beyond Bitcoin into assets such as ether, XRP and solana. Average daily open interest in ether futures rose from roughly $1 billion in 2024 to nearly $5 billion in 2025, and traders are increasingly allocating to options, hedging and more complex positioning; see related coverage on derivatives positioning for more detail.

Why this matters

For miners and small operators, the direct impact may be limited, but the market shift changes the broader liquidity and derivative risk premia that can influence spot-price behaviour and financing costs. Tighter basis yields mean fewer large players are using futures-backed financing strategies that used to provide a steady demand channel into spot markets, which can affect intraday liquidity and spreads on major venues. Even if you run a handful of rigs, these structural moves change the environment in which you sell mined coins or hedge production.

What to do?

If you mine in Russia with between 1 and 1,000 devices, focus first on the basics: track your all-in costs and compare them to realized spot prices after fees and transfers. Recalculate any decisions that relied on high basis yields — strategies that assumed a multi‑percent premium over Treasuries may no longer be profitable once execution and funding are considered.

- Monitor key indicators: one-month basis yields and futures open interest on major exchanges to see if spreads widen or tighten further.

- Reduce reliance on leveraged or execution-heavy arbitrage unless you can cover tight margins; prioritize simple, low-cost settlements.

- Consider basic hedging steps if you sell mined coins regularly, such as using shorter-dated futures or limiting exposure during volatile periods.

- Stay informed about liquidity and product changes — as institutions shift strategies, market depth and fees can change quickly.

FAQ

What exactly fell to 5%? One-month annualized Bitcoin basis yields — the annualized return from buying spot and selling one-month futures — have fallen to around 5% from roughly 17% a year earlier, reducing the attractiveness of the cash-and-carry trade.

How has futures open interest changed? Open interest in CME Bitcoin futures has dropped below $10 billion from a peak above $21 billion, while Binance’s open interest has remained near $11 billion, shifting the venue mix in derivatives trading.

Are institutions leaving crypto? The reporting indicates a pullback from specific arbitrage trades rather than an exit: institutions are reallocating into options, hedging and other assets like ether, XRP and solana, and exchanges reported higher ether futures activity in 2025.

Where can I read more on related topics? For deeper data and analysis on futures interest and derivative positioning, see articles on bitcoin options impact and futures open interest.