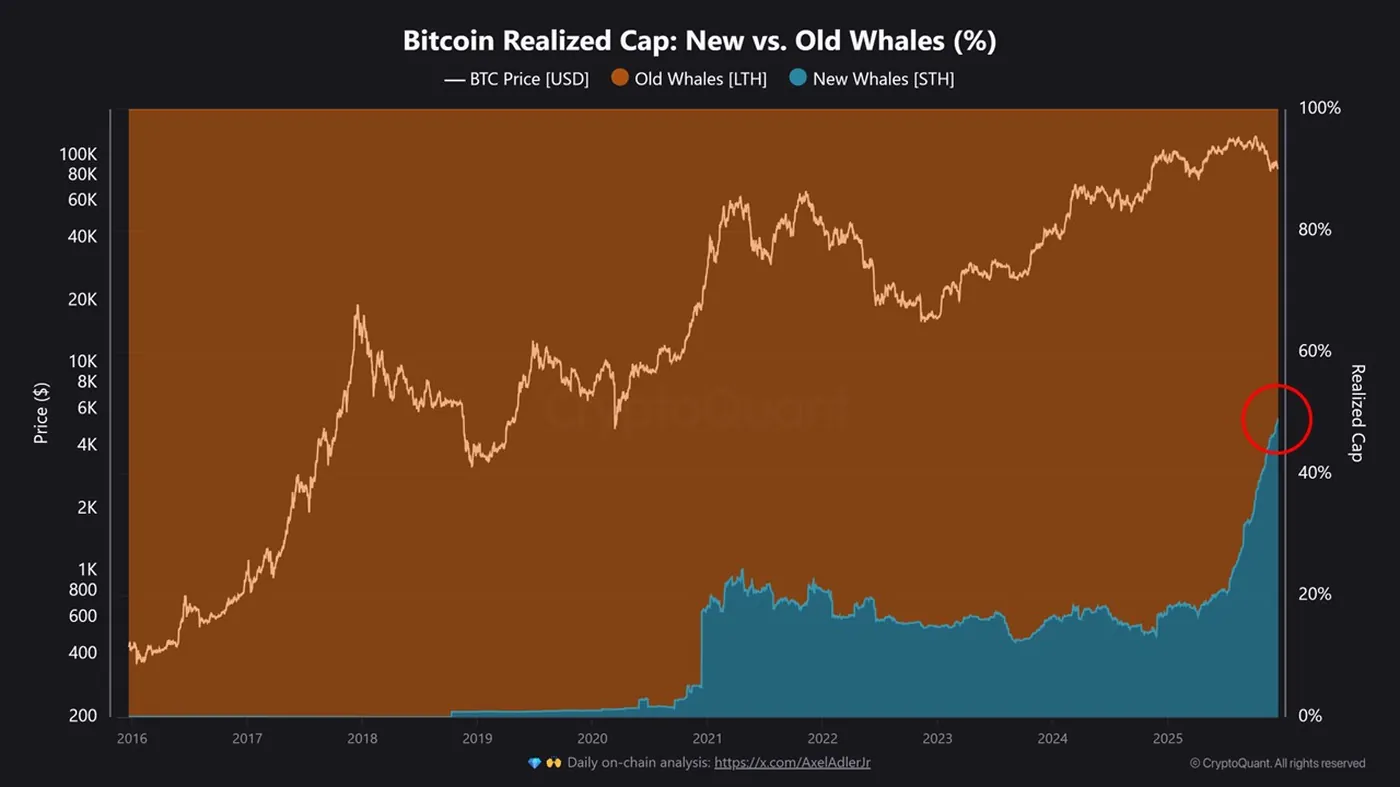

On-chain data reveals a significant shift in capital distribution: addresses classified as "new whales" now make up nearly 50% of Bitcoin's realized cap. Previously, their share did not exceed 22%, so this change is viewed as a restructuring of the network's fundamental value rather than just a cyclical spike in activity. Additionally, over the past 30 days, short-term holders (STH) increased their holdings by approximately 100,000 BTC — a figure indicating strong demand intensity.

New Whales Are Changing Bitcoin Market Structure

Realized cap reflects the value of coins at the price of their last movement, showing where capital entered the network rather than just current ownership. The sharp rise in new whales' share to ~50% means a significant portion of Bitcoin's value is now "anchored" in relatively recent positions. For more details on the significance of realized cap growth, see our related note realized cap share growth, which explains why this affects network valuation.

Rising Demand from Short-Term Investors

The metric tracking short-term holders' position changes over 30 days showed an increase of nearly 100,000 BTC — a record level according to the publication. This influx of STH was accompanied by active buying on pullbacks, including operations around $85,000, confirming concentrated demand among new participants. Meanwhile, coins older than 155 days remained mostly inactive, meaning long-term holders were not the primary sellers during this phase.

Whale Activity on Binance Exchange

Flow data to Binance shows that about 37% of BTC sent there came from wallets holding 1,000–10,000 BTC, i.e., whales. These movements indicate that large capital sought liquidity and participated in trading on the exchange during volatility. Hyblock's cumulative volume delta (CVD) analysis further shows that wallets with amounts from $100,000 to $10 million demonstrated a positive delta volume of $135 million this week, while retail and mid-level traders showed negative deltas.

Why This Matters

For miners in Russia, these changes primarily signal a shift in demand and liquidity structure rather than direct guidance. If large capital effectively forms the majority of realized cap, it changes the "anchor" value levels of the network and influences the nature of sell-offs and purchases by market participants. At the same time, short-term holder activity and exchange flows reveal who is providing current liquidity and where price pressure may arise.

It is important to understand that the data does not indicate mining will become more or less profitable directly, but it helps better assess the market environment: who is buying, who is selling, and where volumes come from. This information is useful for planning cash flows, managing reserves, and evaluating risks when selling mined coins.

What to Do?

- Monitor on-chain metrics: regularly check realized cap and STH holdings changes to see how network value evolves.

- Track exchange flows: consider the share of large wallet inflows to Binance — an indicator of where major players seek liquidity.

- Manage reserves: maintain operational reserves to cover electricity and equipment maintenance costs amid market volatility.

- Make cautious selling decisions: plan mined BTC sales considering large holders' market activity and liquidity flows.

- Study additional materials: for deeper analysis of on-chain narratives, see on-chain analysis, which explores thematic shifts in participant behavior.