In December 2025, institutional demand for Bitcoin has overtaken the amount of newly mined BTC for the first time since early November. Institutions are currently purchasing 13% more Bitcoin daily than miners are producing, signaling a notable shift in market dynamics. This renewed corporate demand coincides with Bitcoin's price seeking a bottom more than 30% below its October all-time highs.

Overview of Institutional Bitcoin Demand in December 2025

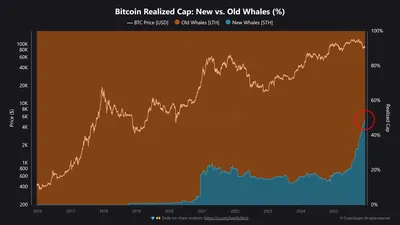

Recent data from Capriole Investments reveals that institutional buyers have flipped the daily supply balance by acquiring more Bitcoin than miners add to the market. This development marks the first time in six weeks that corporate demand alone has caused a net reduction in Bitcoin supply. While the scale of buying remains modest compared to the bull market peak two months prior, the trend highlights growing institutional interest amid current price levels.

Market Context and Price Movements

Bitcoin's price has experienced significant volatility, moving from highs around $126,000 to lows near $80,500. Despite this stress, the market is showing signs of bottoming out. Notably, no new corporate treasury companies were formed last month, and some existing treasuries have begun selling Bitcoin. This environment reflects a complex balance between market pressures and strategic positioning by institutional players.

Role of Major Corporate Treasuries

The company Strategy, known for holding the world's largest Bitcoin treasury, continues to add to its BTC holdings despite declining prices and stock performance. Capriole Investments' founder Charles Edwards has described a "broken corporate flywheel," characterized by record discounts to net asset value among treasury companies and increasing leverage. These factors may complicate Bitcoin's price recovery path, even as network fundamentals suggest the asset remains attractive.

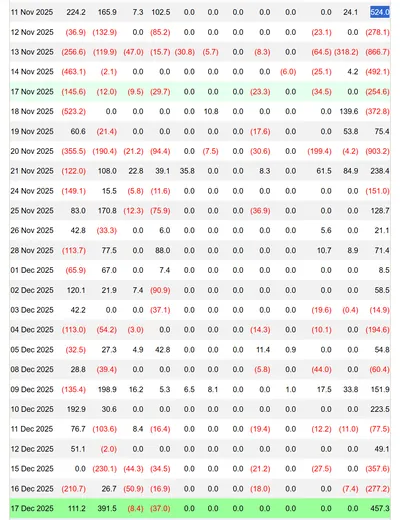

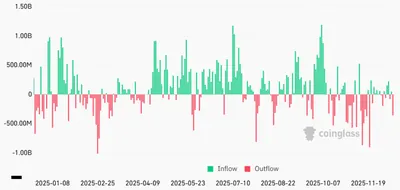

Bitcoin ETF Outflows and Market Implications

ETF outflows have exceeded $600 million within just two days this week, with data from Farside Investors reporting net outflows of $635 million since Monday. Onchain analytics platform CryptoQuant describes the market as transitioning, where short-term pessimism coexists with strategic accumulation. This divergence between institutional outflows and the conviction of major players illustrates Bitcoin's oscillation between immediate market stress and long-term appreciation expectations.

Analysis and Future Outlook

Despite significant ETF outflows, network fundamentals continue to support institutional market entries. The current divergence between capital leaving investment vehicles and major players increasing their holdings suggests a complex market environment. Bitcoin is navigating between short-term challenges and the anticipation of long-term value growth, underscoring the nuanced outlook for miners and investors alike.

Why This Matters

For miners operating in Russia with up to 1,000 devices, the fact that institutional demand now surpasses new Bitcoin supply indicates a potential shift in market liquidity and price support. Even though ETF outflows reflect some short-term selling pressure, the strategic accumulation by large corporate treasuries and institutions could stabilize or eventually boost Bitcoin's price. Understanding these dynamics helps miners anticipate market conditions that affect profitability and planning.

What Should Miners Do?

- Monitor institutional buying trends and ETF flows to gauge market sentiment and potential price movements.

- Consider the implications of corporate treasury activities, especially from major holders like Strategy, on Bitcoin's supply and demand balance.

- Stay informed about network fundamentals and market stress indicators to optimize mining operations and risk management.