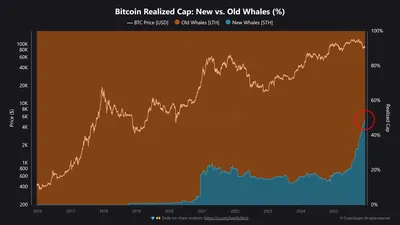

What does the rise of the Realized Cap share among new whales to 50% mean? This is a key question for understanding the current structure of the Bitcoin market. The Realized Cap share attributed to so-called "new whales" has approached 50%, reflecting a shift in capital distribution within the network rather than just a price increase. Let's explore what the Realized Cap metric is, who these new large holders are, and what practical conclusions market participants can draw from this.

Brief Overview of the Realized Cap Metric

Realized Cap is calculated based on the price of the last on-chain movement of each coin rather than the current market price, thus showing the prices at which capital was actually formed in the network. Unlike standard market capitalization, which multiplies the current price by the total number of coins, Realized Cap accounts for the "entry price" of each unit and provides insight into the cost basis. Changes in the Realized Cap share among different holder groups are important because they reflect which portion of capital has entered recently and at what average prices that capital was accumulated.

What Recent Data Shows: Growth in Share Among New Whales

Available data indicates that the Realized Cap share attributed to the so-called "new whales" has approached 50%. This does not mean ownership of half of all BTC, but rather that about 50% of the total capital invested in the network was formed at relatively recent prices. This shift means a significant portion of value is now "tied" to recent purchases, not just early accumulations.

Who Are the "New Whales" and How Do They Differ from Previous Holders?

Early large holders in previous cycles typically accumulated Bitcoin at low prices and gradually distributed their positions as prices rose. The key difference in the current situation lies in the profile of new whales: today, corporate entities and institutional investors dominate, entering the market with large capital volumes and a higher average purchase price. Their behavior differs in scale, average entry price, and the fact that they act systematically and long-term rather than for quick speculation, which affects the nature of demand; for more on institutional demand pressure, see the institutional demand overview.

The Role of Digital Treasuries and Spot ETFs

In the current cycle, the main sources of such demand have been companies with digital treasuries and institutional participants via spot ETFs. These players bring significant capital inflows and create demand at higher prices than in previous cycles, changing the accumulation profile within the network. Since they operate systematically and long-term, their presence influences demand structure beyond short-term activity spikes.

Impact on Market Cycles and Bitcoin Behavior

The increase in new holders' share indicates that a significant portion of capital entered the market at higher price levels, and even during correction phases, the Realized Cap share of new whales continued to grow—something rarely observed before. "From an on-chain perspective, this means Bitcoin behaves less like a purely cyclical speculative asset. A new market structure is forming where steady institutional demand gradually replaces the model of sharp accumulation and distribution phases. This calls into question the applicability of classic four-year cycles based on past retail investor behavior," experts stated. While the changing demand structure makes it impossible to definitively say that classic cycles have lost all relevance, their applicability is certainly being reconsidered; for an example of correction and recovery impact, see the recovery after correction article.

Conclusions and Possible Development Scenarios

In short: the market is currently shaped largely by the inflow of more expensive capital from corporate and institutional players, changing the owner profile and Realized Cap distribution. Future scenarios include the consolidation of institutional demand with a gradual shift in accumulation and distribution models or a partial return to a more cyclical model if large holders' behavior changes. For various participants, this means considering not only price but also demand profile when making decisions.

Why This Matters

For a miner in Russia operating 1–1000 devices, this news is important because the mechanism of price formation and the network's cost basis are changing—this can affect demand stability and the nature of long-term movements. Even if there is no immediate effect on daily mining profitability, understanding that most capital was formed at recent prices helps assess potential correction depths and recovery speed. Additionally, the systemic nature of institutional demand means less frequent sharp redistributions, which is important to consider when planning sales and equipment investments.

What to Do?

- Review your sales plan: align BTC sales schedules with mining costs and current cash needs to avoid selling during temporary dips.

- Optimize expenses: review electricity contracts and opportunities to improve energy efficiency, as market structure changes do not reduce mining cost importance.

- Monitor institutional flows: track data on spot ETFs and digital treasury purchases to understand major demand trends.

- Maintain reserves: if you operate a small farm, it's wise to have a financial cushion for strong but short-term liquidity fluctuations.