MetaPlanet, a Japanese-listed company, has set a long-term target to acquire 210,000 Bitcoin (BTC) by 2027. This amount equals exactly 1% of Bitcoin’s total finite supply and reflects a deliberate shift toward holding Bitcoin on the corporate balance sheet. To enable the plan, shareholders recently approved a reorganization of the company’s capital structure that the firm says will support large-scale capital raising for Bitcoin purchases.

MetaPlanet's Ambitious Bitcoin Goal

The headline objective — 210,000 BTC by 2027 — is presented as a strategic treasury decision rather than a short-term trade. MetaPlanet frames the goal as a permanent allocation on its balance sheet, made possible by corporate-level changes to how it raises capital. The company describes the target as a precise share of Bitcoin’s fixed supply, underscoring the long-term nature of the commitment.

Strategy for Bitcoin Acquisition

MetaPlanet plans to fund purchases through newly designed financial instruments and by directing proceeds from those issuances into Bitcoin. The capital structure overhaul approved by shareholders is central to this approach, allowing the company to use equity-linked or other products to gather funds at scale. According to the announcement, this is intended as a sustained acquisition program rather than a single market entry.

In support of this capital-raising strategy, MetaPlanet has recently moved on corporate financing options aimed at institutional investors. For context on related corporate moves, see the company’s update on dividend preferred shares, which illustrates one type of instrument the firm has discussed with investors.

Corporate Bitcoin Treasury Landscape

In the current corporate landscape, MicroStrategy is reported as the largest corporate holder, with 671,268 BTC as of December 2024. By comparison, MetaPlanet’s 210,000 BTC target would place it among the largest corporate treasuries if fully acquired. That shift would change the ranking of public companies by Bitcoin holdings and highlight a different model of corporate reserve management.

Market Impact and Strategic Implications

The company and observers cited in the source note that sustained, large-scale buying from a single corporate issuer has the potential to affect market dynamics, given the finite supply of Bitcoin. The plan’s market effect will depend on how purchases are phased, the liquidity available at the time of buying, and the success of the capital-raising instruments. At the same time, the firm emphasizes that execution and timing are key to managing costs and risks tied to acquiring large amounts of BTC.

Regulatory and Operational Considerations

As a Japanese-listed entity, MetaPlanet operates under local regulatory rules that the source describes as providing a framework for corporate crypto activity. The company must address operational challenges such as custody, security, and the logistics of storing a sizable Bitcoin treasury. These practical issues are an explicit part of the plan the firm outlined alongside its financing proposal.

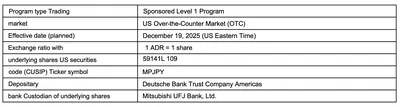

For additional context on MetaPlanet’s market and listing moves, the company also announced an OTC ADR initiative; see the note on ADR MPJPY on OTC which relates to how the firm engages with international investors.

Why this matters (short, for miners in Russia)

For a miner running from 1 to 1,000 devices in Russia, MetaPlanet’s announcement is primarily a demand-side event: a large corporate buyer planning systematic purchases increases another source of non-mining Bitcoin demand. That does not change your day‑to‑day mining setup, power costs, or hardware needs, but it can influence secondary market liquidity and where institutional buying pressure appears.

In practical terms, the move is one more signal that corporations are treating Bitcoin as a reserve asset. For small miners this mainly affects broader market conditions — not immediate mining operations — so keep watching how the company executes rather than the announcement alone.

What to do?

- Monitor liquidity and sell strategies: track how large buyers enter the market and avoid selling during concentrated purchase windows.

- Mind custody and security: ensure your mined BTC are secured with reliable wallet and custody practices to prevent operational loss.

- Keep records for taxes and compliance: maintain clear documentation of mined coins and sales to simplify reporting under Russian rules.

- Follow execution updates: watch MetaPlanet’s financing and purchase cadence to understand potential shifts in market depth and volatility.

Bottom line

MetaPlanet’s stated intent to acquire 210,000 BTC by 2027, backed by a shareholder-approved capital reorganization and the use of new financial products, is a notable corporate experiment in building a Bitcoin treasury at scale. The plan preserves the company’s stated long-term orientation toward Bitcoin, while its real-world implications will depend on financing execution, purchase timing, and operational safeguards.