Metaplanet’s shareholders approved a package of changes that lets the company issue dividend-paying preferred shares targeted at institutional investors. The measures, passed as five proposals, expand the company’s ability to create preferred equity, alter dividend mechanics and open participation to overseas institutions. Company officials framed the move as a shift toward income-focused institutional capital while keeping a Bitcoin-heavy balance sheet.

Metaplanet's Capital Structure Overhaul

The approved proposals reclassify capital reserves to allow dividends on preferred shares and potential buybacks, and they double the authorized number of Class A and Class B preferred shares. Together the changes give Metaplanet more flexibility to package exposure to its corporate Bitcoin holdings in forms familiar to institutional investors. By explicitly enabling overseas institutional participation, the company is signaling an intent to reach global capital pools without requiring those investors to hold spot Bitcoin directly.

Details of Preferred Shares

Metaplanet amended dividend structures and investor protections across its preferred-share classes to create clearer income features for buyers. The design differentiates products by payout timing and downside protections so institutions can choose structures that match their cash-flow needs and risk tolerance.

Class A: Monthly, floating-rate dividends

The company amended Class A preferred shares to adopt a monthly, floating-rate dividend known as the "Metaplanet Adjustable Rate Security." This structure is intended to deliver regular income that moves with the agreed rate mechanics, aligning with institutional demand for periodic cash flows. The monthly, adjustable design contrasts with fixed, growth-through-dilution approaches.

Class B: Quarterly payouts and investor protections

Class B preferred shares were changed to pay quarterly dividends and include a 10-year issuer call at 130% of face value, plus an investor put option if the company does not complete an initial public offering within a year. These features let Metaplanet repurchase shares at a premium after a set term while giving investors an exit route under the stated IPO condition. The arrangement mirrors protections common in private credit and structured equity.

Metaplanet's Bitcoin Holdings

Metaplanet held about 30,823 Bitcoin (BTC) at press time, worth $2.75 billion, according to Bitcoin Treasuries. That holding makes the company the biggest corporate Bitcoin holder in Asia and the fourth-biggest in the world. The preferred-share route is presented as a way to translate that corporate Bitcoin exposure into income-style instruments for institutional buyers; for context on corporate holdings, see corporate Bitcoin holdings.

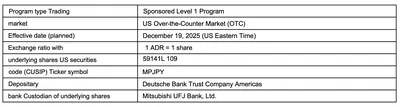

Global Expansion and US Trading

Alongside the capital-structure changes, Metaplanet announced plans to begin trading in the US on the over-the-counter market via American Depositary Receipts. The company had previously established a subsidiary in Miami months before the US-trading announcement, underscoring its push to attract overseas institutional capital. For more on Metaplanet’s ADR plans, see ADR on OTC.

Why this matters

For miners and small operators in Russia, the decision does not change Metaplanet’s Bitcoin holdings but signals growing institutional interest in non-spot ways to access corporate Bitcoin exposure. That matters because it shows a path institutions may prefer—income-producing securities tied to corporate treasuries rather than direct spot holdings. Even if you run a handful of rigs, watching how institutions package Bitcoin exposure helps anticipate shifts in demand and liquidity in broader markets.

What to do?

If you manage from one device up to a thousand, keep actions simple and practical. First, monitor Metaplanet’s investor notices and trading updates so you know whether new securities or ADRs affect market flows. Second, assess your own exposure to Bitcoin price moves and evaluate whether institutional products change the availability of indirect Bitcoin investment in your region. Third, stay informed through reliable industry sources and link updates; consider following developments around institutional issuance and ADR listings.

- Track official Metaplanet filings and company statements for exact terms and timelines.

- Compare any institutional product’s payout rhythm (monthly vs quarterly) with your cash-flow needs.

- Keep an eye on OTC/ADR trading announcements if you trade or follow corporate Bitcoin equities.