Metaplanet announced it will begin US trading via American Depositary Receipts (ADRs), with its ADRs expected to trade on the over-the-counter market in US dollars under the ticker MPJPY. The company said the move is intended to broaden access for US investors while not raising new capital. Metaplanet’s CEO Simon Gerovich wrote: “This directly reflects feedback from US retail and institutional investors seeking easier access to our equity.”

What Metaplanet announced

The core announcement is that Metaplanet will debut US trading via ADRs listed in US dollars on the OTC market under the ticker symbol MPJPY, and that trading is expected to start on Friday. The company framed the step as a way to make its equity easier to buy for US retail and institutional investors, rather than a capital raise. Metaplanet also pointed to its recent corporate moves, including establishing a US subsidiary in Miami with initial capital of $15 million to grow Bitcoin income.

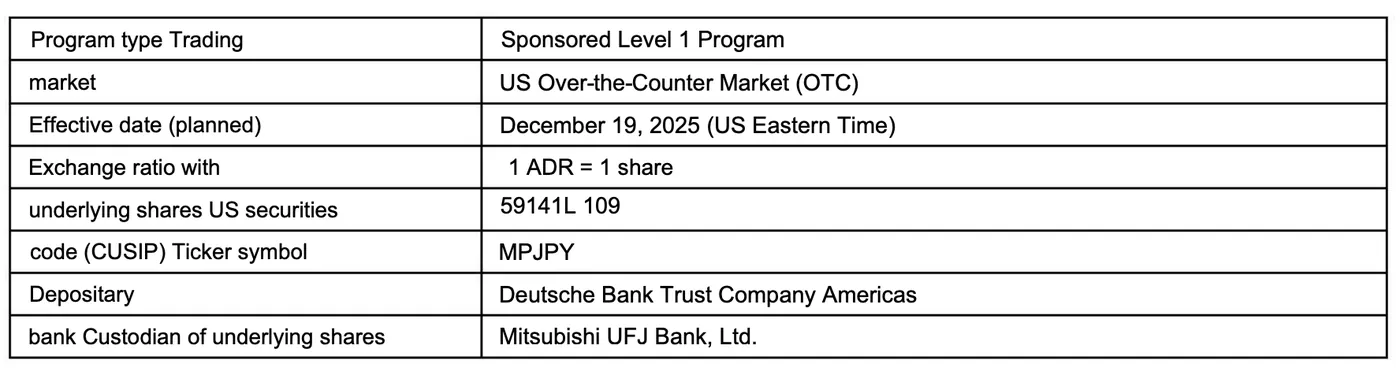

Structure and partners of the ADR program

Metaplanet launched the ADR program through a sponsored level trust agreement with Deutsche Bank Trust Company Americas acting as depositary and MUFG Bank as custodian in Japan. The company explained the commercial intent in clear terms: "The ADRs are not intended to raise funds, but to fund the issuance of common shares and preferred shares by the company." This means the sponsored trust structure is used to represent existing or newly issued Metaplanet shares to US investors via ADRs.

How this differs from MTPLF and previous listings

The ADR program is distinct from Metaplanet’s MTPLF listing, which began trading on the OTC Markets Group’s OTCQX market in December 2024. The company emphasised that "It [MTPLF] is not based on a sponsored ADR program," underscoring that MTPLF and the new MPJPY ADRs are separate mechanisms for US market access. Investors comparing the two should note that sponsored ADRs involve a depositary bank and custodian relationship, while MTPLF was listed on OTCQX under a different arrangement.

Metaplanet’s Bitcoin buying and treasury position

Metaplanet acquired around 29,000 BTC in 2025 but halted purchases in September, with its most recent acquisition dated Sept. 29 according to Bitbo data. Since launching its Bitcoin acquisition strategy in April 2024, the company has accumulated a total of 30,823 BTC, making it one of the larger corporate Bitcoin treasuries. The buying halt came after Metaplanet’s enterprise value fell below the value of its Bitcoin holdings in mid-October; by publishing time the company reported its market to Bitcoin NAV (mNAV) had recovered above 1, standing at 1.12.

Market context and investor implications

The announcement arrives against a backdrop where several DAT companies saw sharp share price declines after a strong rally in July 2025, a reminder that equity prices in this sector can be volatile. For US investors and traders, an ADR listing on the OTC market means Metaplanet shares will be easier to buy without using a foreign exchange, but the liquidity and trading environment on OTC can differ from major exchanges. If you follow corporate Bitcoin holdings and comparisons across issuers, our coverage of corporate bitcoin holdings may help place Metaplanet’s treasury in context, while developments in broader listings are discussed in NYSE listing changes.

Почему это важно

Для майнера в России прямая торговля метапланет через ADR на OTC в США вряд ли изменит условия майнинга, но это делает акции компании более доступными для иностранного капитала. Проще говоря, если вы отслеживаете крупные держатели биткоина и влияния их действий на рынок, появление MPJPY на OTC упрощает наблюдение за корпоративной активностью компании из США. Также это может повлиять на ликвидность акций Metaplanet, что важно тем, кто следит за ценой компаний с большой экспозицией в BTC.

Что делать?

- Проверьте, удобен ли вам OTC-рынок: убедитесь, что ваш брокер даёт доступ к OTC и может исполнить сделки по MPJPY.

- Если вы держите позицию в биткоине или акциях компаний с BTC, следите за обновлениями по покупке/остановке покупок — Metaplanet остановила покупки в сентябре, последняя покупка датирована Sept. 29.

- Учтите, что ADRs «are not intended to raise funds, but to fund the issuance of common shares and preferred shares by the company», поэтому это не классическое размещение для привлечения капитала.

- Если нужно — используйте материалы по сравнению корпоративных BTC-холдингов, чтобы оценивать риски и динамику цены.